Seeks to levy definitive countervailing duty on import of Castings for wind operated electricity generators whether or not machined, in raw, finished or sub-assembled form, or as a part of a sub-assembly, or as a part of an equipment/ component meant for wind-operated electricity generators originating in, or exported from the People’s Republic of China for a period of five years

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

New Delhi, the 19th January, 2016

Notification

No. 1/2016-Customs(CVD)

G.S.R. (E).- Whereas, in the matter of ‘Castings for wind-operated electricity generators whether or not machined, in raw, finished or sub-assembled form, or as a part of a subassembly, or as a part of an equipment/ component meant for wind-operated electricity generators’ (hereinafter referred to as the subject goods) falling under tariff items 8483 40 00, 8503 00 10 or 8503 00 90 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), hereinafter referred to as the Customs Tariff Act, originating in or exported from, People’s Republic of China (hereinafter referred to as the subject country), and imported into India, the designated authority in its final findings, published in the Gazette of India, Extraordinary, Part I, Section 1, vide notification No. 17/6/2013-DGAD, dated the 27th November, 2015 has come to the conclusion that-

(i) the subject goods have been exported to India from subject country at subsidized value, thus resulting in subsidization of the product;

(ii) the domestic industry has suffered material injury due to subsidization of the subject goods;

(iii) the material injury has been caused by the subsidized imports of the subject goods originating in or exported from the subject country;

and has recommended the imposition of definitive countervailing duty on imports of the subject goods originating in, or exported, from the subject country

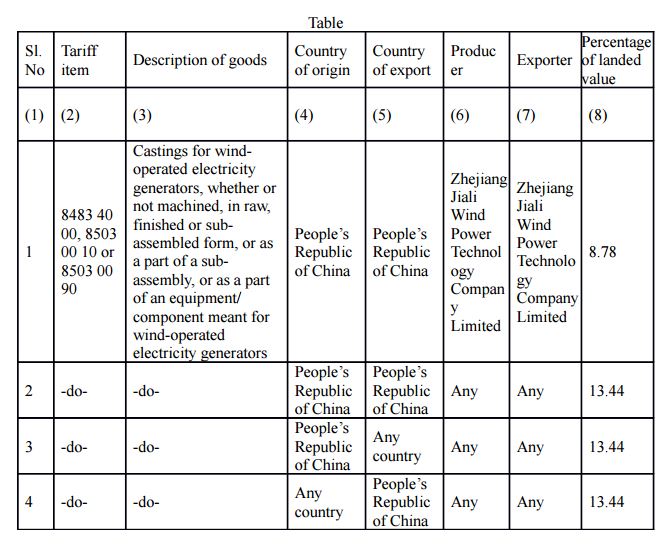

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (6) of section 9 of the Customs Tariff Act, read with rules 20 and 22 of the Customs Tariff (Identification, Assessment and Collection of Countervailing Duty on Subsidized Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the designated authority, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under tariff items of the First Schedule to the Customs Tariff Act as specified in the corresponding entry in column (2), originating in the countries as specified in the corresponding entry in column (4), exported from the countries as specified in the corresponding entry in column (5), produced by the producers as specified in the corresponding entry in column (6), exported by the exporters as specified in the corresponding entry in column (7), and imported into India, countervailing duty at the rate to be worked out as percentage of the landed value of imports of the subject goods as specified in the corresponding entry in column (8) of the said Table, namely:-

2. The countervailing duty imposed under this notification shall be levied for a period of five years (unless revoked, superseded or amended earlier) from the date of publication of this notification in the Official Gazette and shall be payable in Indian currency.

Explanation.- For the purposes of this notification, “landed value” shall be the assessable value as determined under the Customs Act 1962, (52 of 1962) and all duties of customs except duties levied under sections 3, 3A, 8B, 9 and 9A of the Customs Tariff Act.

[F. No. 354/84/2015-TRU]

(K.KALIMUTHU)

Under Secretary to the Government of India