DIR 3 KYC

DIR 3 KYC is Application for KYC of Directors .DIR 3 KYC is available on MCA21 Company Forms Download page for filing purposes.

How to Download DIR 3 KYC

Application for KYC of Directors

| Form DIR-3 KYC [zip] (806 KB) | Form DIR-3 KYC [zip] (226 KB) | 04-August-2018 |

what is E-Form DIR 3- KYC

Ministry of Corporate Affairs (MCA) vide Notification dated 5thJuly, 2018 has amended Companies (Appointment and Qualification of Directors) Rules, 2014 by inserting Rule 12A and made Directors KYC mandatory which is effective from 10th July 2018.

Directors KYC will be made by filing e- Form DIR-3 KYC, which is one step forward towards MCA’s effort to systematically weed out fake Companies and its Directors.

eForm DIR-3 KYC is required to be filed pursuant to Rule 12A and Rule 11(2) and (3) of The Cmpanies (Appointment and Qualification of Directors) Rules, 2014 as amended by Companies (Appointment and Qualification of Directors) fourth Amendment Rules, 2018 which is reproduced for your reference.

Rule 12A:

Every individual who has been allotted a Director Identification Number (DIN) as on 31st march of a financial year as per these rules shall, submit e-form DIR-3-KYC to the Central Government on or before 30th April of immediate next financial year.

Provided that every individual who has already been allotted a Director Identification Number (DIN) as at 31st March, 2018, shall submit eform DIR-3 KYC on or before 31st August, 2018.”

Rule 11(2):

The Central Government or Regional Director (Northern Region), or any officer authorised by the Central Government or Regional Director (Northern Region) shall, deactivate the Director Identification Number (DIN), of an individual who does not intimate his particulars in e-form DIR-3-KYC within stipulated time in accordance with rule 12A.

Rule 11(3):

The de-activated DIN shall be re-activated only after e-form DIR-3-KYC is filed along with fee as prescribed under Companies (Registration Offices and Fees) Rules, 2014.

In India approx. 50Lac individuals have been allotted Directors Identification Number (DIN) and all of them (including Disqualified Directors) are required to file e-Form DIR 3 KYC by 31st August, 2018 without any fees and after 31St August 2018 the same can be filed with a fee of Rs. 5000/-.

(MCA website is showing additional precaution by mentioning that after 31st August 2018 e-Form DIR 3 KYC may be filed with fees as may be prescribed and without prejudice to any other action that may be taken, which is not mentioned in the Notification dated 5th July 2018)

e-Form DIR-3 KYC will be made available on website of MCA with effect from July 14, 2018.

FAQs On DIR 3 KYC

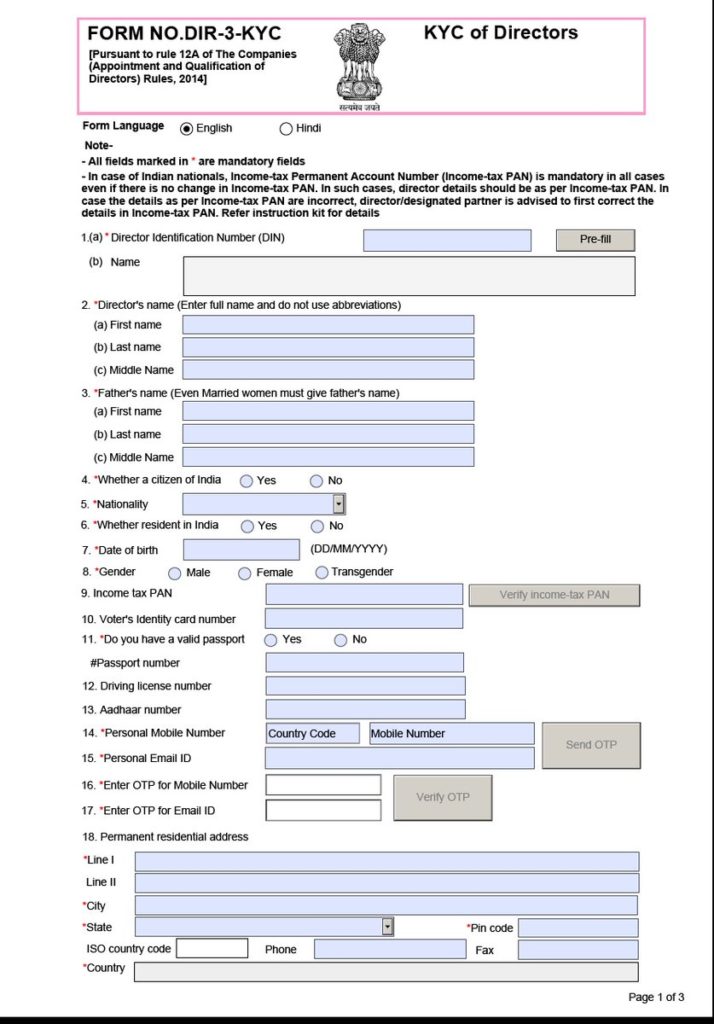

Format of DIR -3 KYC

what is the Purpose of the eForm DIR-3 KYC

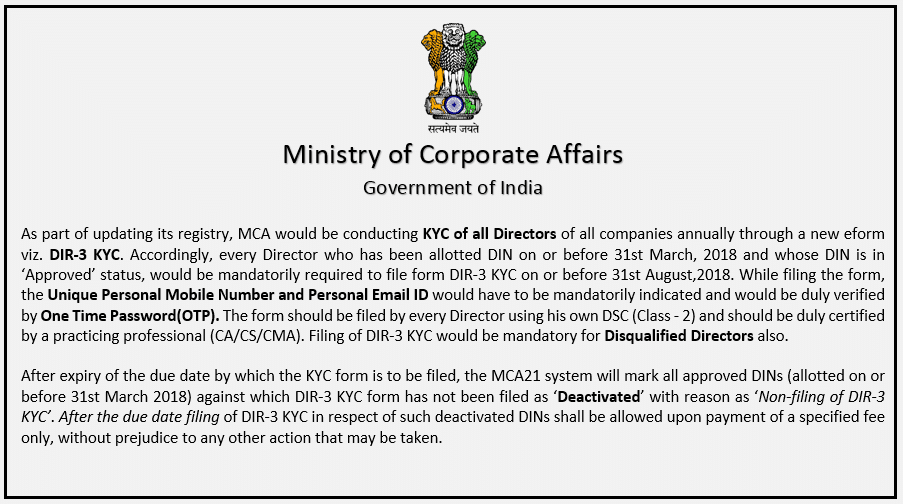

As part of updating its registry, MCA would be conducting KYC of all Directors of all companies annually through the eform DIR-3 KYC. Accordingly, every Director who has been allotted DIN on or before 31st March, 2018 and whose DIN is in ‘Approved’ status, would be mandatorily required to file form DIR-3 KYC on or before 31st August,2018.

What is the Due Date Of Filing E-Form DIR 3- KYC:

According to the aforesaid Notification,every individual who has been allotted Director Identification Number (“DIN):

(i) as at 31st March 2018 is required to submit Form DIR-3 KYC on or before 31stAugust, 2018 and ;

(ii) as on 31St March of a financial year after 31st March , 2018, is required to submit e-Form DIR-3 KYC on or before 30th April of immediate next financial year.

What is the Specific Instructions to fill the eForm DIR-3 KYC at Field Level ?

Instructions to fill the eForm are tabulated below at field level. Only important fields that require detailed instructions to be filled in eForm are explained. Self-explanatory fields are not discussed.

| Sr. No. | Section Name | Field Name | Instructions |

| 1 | (a) | Director Identification Number (DIN) | Should be an ‘Approved’ DIN.In case of Deactivated DINs, DINs with status ‘De-activated’ due to reason ‘Non-filing of KYC in DIR-3-KYC’ shall be allowed after 31st August 2018. |

| 2 | (a) | First Name | Single alphabet shall not be allowed. Either of applicant’s First name or Last name shall be mandatory to enter. The name should be entered as mentioned in PAN since the same shall be verified with PAN database. |

| (b) | Last name | Single alphabet shall not be allowed. Either of applicant’s First name or Surname shall be mandatory to enter. The name should be entered as mentioned in PAN since the same shall be verified with PAN database. | |

| (c) | Middle Name | Name should be as per PAN database. | |

| 3 | (a) | First name | Single alphabet shall not be allowed. Either of father’s First name or Last name shall be mandatory to enter.The name should be entered as mentioned in PAN since the same shall be verified with PAN database. |

| (b) | Last name | Single alphabet shall not be allowed. Either of Father’s First name or Surname shall be mandatory to enter.The name should be entered as mentioned in PAN since the same shall be verified with PAN database. | |

| (c) | Middle Name | Name should be as per PAN database. | |

| 5 | Nationality | Foreign nationals shall select the nationality as declared in the passport. | |

| 7 | Date of Birth | Enter date in DD/MM/YYYY format. Person should be minimum 18 years of age while filling this application. | |

| 9 | Income-tax PAN | Enter your Income tax permanent account number (Income tax PAN).Income tax PAN is mandatory for Indian Citizens. | |

| Verify income-tax PAN | If Income tax PAN is entered, it is mandatory to click on ‘Verify income-tax PAN’ button. System shall verify the details based on PAN.Ensure that the name (first, middle and last name), father’s name (first, middle and last name) and date of birth is as per the income-tax PAN details. | ||

| 11 | Do You have a valid passport | Mandatory to select ‘Yes’ in case ‘No’ selected in field “Whether Citizen of India” | |

| Passport number | Mandatory to enter if ‘Yes’ is selected above in field 11 | ||

| 13 | Aadhaar Number | Mandatory to enter in case ‘Yes’ selected in field “Whether Citizen of India”. | |

| 14 | Personal Mobile Number | Enter your personal mobile number. Please note that the same will be verified by OTP. Country Code other than +91/91/0 shall be allowed only in case Whether resident in India is selected as ‘No’. | |

| 15 | Personal Email ID | Enter your personal email ID.Please note that the same will be verified by OTP. | |

| Send OTP | This button will be enabled only after successful Pre-scrutiny of the form. Click on this button to send OTP to your mobile number and email ID.Please note that separate OTPs will be sent to mobile number and email ID. Further, please note that OTP can be successfully sent to the mobile number and email ID against one form, for a maximum of 10 times in one day and twice in a span of 30 minutes. For further chances, you may download a fresh form on the same day or try next day. |

what is the Fee for Filing and delay in filing of eForm DIR-3 KYC

| S. No | Purpose of the form | Normal Fee | Additional Fee (Delay Fee) |

| 1. | KYC filed before 31st August by applicant who has been allotted DIN on or before 31st March, 2018 and whose DIN is in ‘Approved’ status | Zero | #N/A |

| 2. | KYC filed after 31st August 2018 by applicant whose DIN status is ‘deactivated’ and the reason for deactivation is ‘Non- filing of KYC in DIR-3 KYC’. | Rs. 5,000 | #N/A |

Fees payable is subject to changes in pursuance of the Act or any rule or regulation made or notification issued thereunder.

what is the Processing Type of eForm DIR-3 KYC

The form will be processed in STP mode. On successful submission of the eForm DIR-3 KYC, SRN will be generated and shown to the user which will be used for future correspondence with MCA. Approval mail shall be sent to the email ID of the applicant and to the user who has filed the eForm.

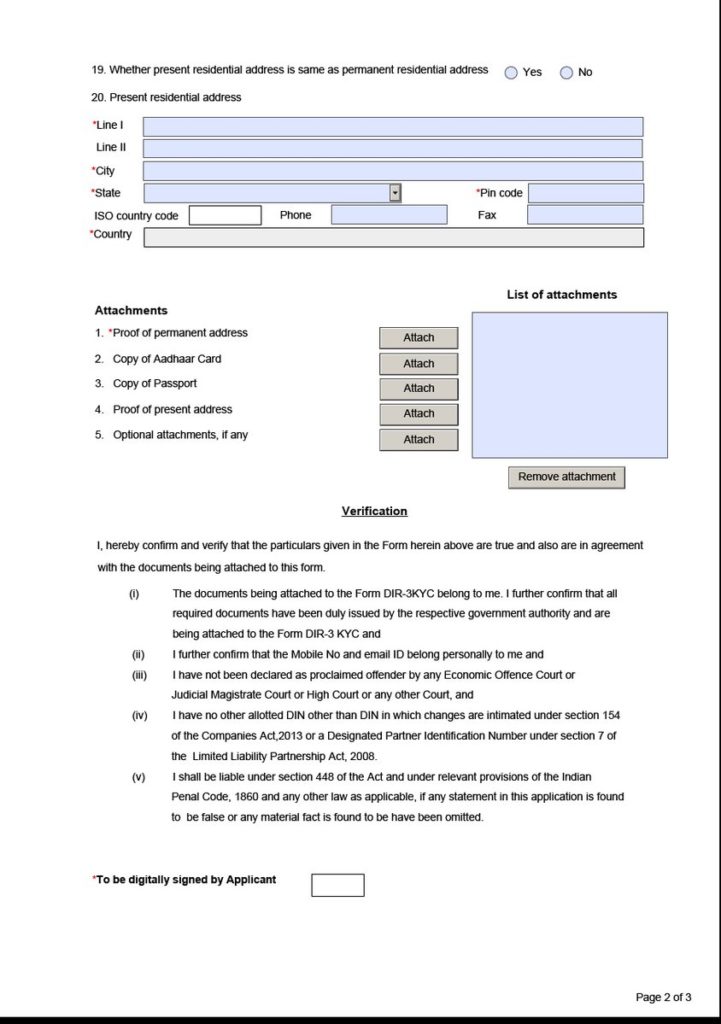

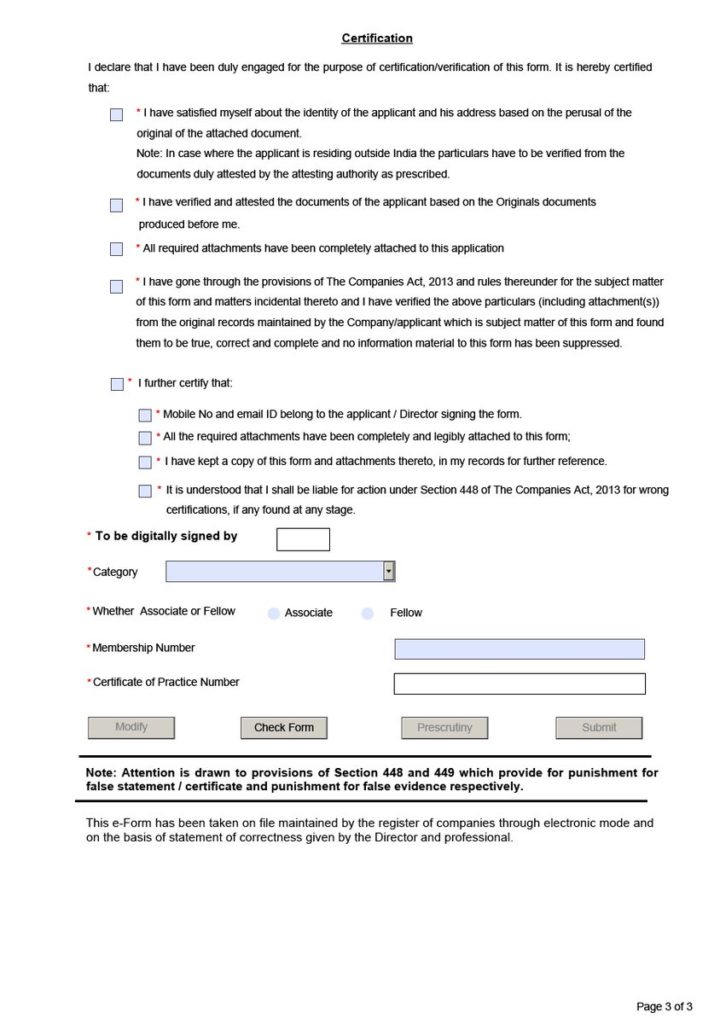

Who needs to Certify E-Form DIR 3 KYC By Professional

e-Form DIR 3 KYC is required to be signed digitally by the applicant director and the same is required to be certified and verified by practicing Chartered Accountant or Company Secretary or Cost and Management Accountant. Professional is required to declare that he has been duly engaged for the purpose of certification/verification of the form and he is certifying the followings:

(a) That he has satisfied himself about the identity of the applicant and his address based on the perusal of the original of the attached document and in case, where the applicant is residing outside India the particulars have to be verified from the documents duly attested by the attesting authority as prescribed.

(b) That he has verified and attested the documents of the applicant based on the Originals documents produced before me.

(c) That he has gone through the provisions of the Companies Act, 2013 and rules made thereunder for the subject matter of this form and matters incidental thereto and he has verified the particulars mentioned in the form (including attachment(s)) from the original records maintained by the Company/applicant which is subject matter of this form and found them to be true, correct and complete and no information material to this form has been suppressed.

(d) That Mobile Number and Email ID of the applicant belong to the applicant who is signing the form.

(e) That all the required attachments have been completely and legibly attached to this form;

(f) That he has kept a copy of this form and attachments thereto, in his records for further reference.

(g) That he is understood that he shall be liable for action under section 448 of the Companies Act, 2013 for wrong certifications, if any found at any stage.

What will happen of DIR KYC 3 is not filed ?

Deactivation and Re-Activation of DIN

In case of non-filing of e-Form DIR-3 KYC by any individual as per dates mentioned above , his/ her DIN will be De-activated by the Central Government or Regional Director (Northern Region) or any officer authorised by the Central Government for this purpose.

The de-activated DIN shall be re-activated only after e-form DIR-3 KYC is filed with additional fees.

What is information to be given in DIR 3 KYC ?

Mandatory Information/ Details for Filing Form DIR-3 KYC

1. Director Identification Number (DIN)

2. Full Name of the Director

3. Fathers Name of the Director Other

4. Whether a citizen of India or not

5. Nationality

6. Whether resident in India or not

7. PAN

8. Date of Birth

9. Gender

10. Aadhar Card Number

11. Passport Number (Mandatory in case of Foreign National)

12. Personal Mobile and Personal Email Id of the Director

13. Permanent Residential address&Present Residential address

What is to be enclosed with DIR 3 KYC ?

Mandatory Attachments to E-Form DIR -3 KYC

Proof of Identity and Proof of Address of individual

What is the Precaution to be taken by professional before Certification Of E-Form DIR 3 KYC ?

Precaution For Any Professional Before Certification Of E-Form DIR 3 KYC

A word of caution to professional before he certifye-Form DIR-3 KYC :

- To obtain Engagement Letter from the applicant confirming his engagement for the purpose ;

- To obtain declaration from applicant confirming (a) his Mobile Number with a copy of mobile bill , (b) Email- ID belongs to him only and (c) he is qualified or disqualified to be Director by MCA ;

- To verify / attest all documents after review of Originals only and

- To keep a copy of e-Form DIR 3 KYC with all attachments attached thereto for his records

How to sign E form DIR KYC 3 ?

Filing Of E-Form DIR 3 KYC With Own Digital Signature:

Since every individual is required to file e-Form DIR-3 KYC with his / her own Digital Signature (DSC), he/ she need to have DSC , for which following documents and details are required to obtain DSC.

| Sr. No | Documents required for getting Digital Signature Certificate |

| 1 | Photograph in JPEG format |

| 2 | Self certified Proof of identity : (Any one of the following) |

| (i) PAN Card (Mandatory for Indian National) (ii) Passport (Mandatory for foreign National) (iii) Voter Identity Card (iv) Driving License (v) Passport (vi) Aadhar Card | |

| 3 | Self certified Proof of residence (Any one of the following): |

| (i) Voter Identity Card (For Resident Only) (ii) Driving License (iii) Passport (iv) Aadhar Card (For Resident Only) (v) Electricity Bill not older than 1 month (vi) Telephone Bill not older than 1 month (vii)Utility Bill for Gas or Water not older than 1 month | |

| 4 | Email ID for video verification |

| 5 | Mobile number for verification (in case Foreign Director – Indian Mobile number for verification) |

| Note: | If Director is residing outside India: |

| Supporting documents should be apostilled/ attested by the Consulate of the Indian Embassy or Foreign Notary Public . |

Pingback: How to Apply DIN (Director Identification Number) - Tax Heal