GST Payment Formats

Final GST Payment Formats GST PMT 1 to GST PMT 7 to as per Final GST Payment of Tax Rules approved by GST Council 18.05.2017

Download Final GST Payment Formats

| Sr No | Form No | Title of the Form |

| 1 | GST PMT 1 | Electronic Liability Register of registered person (Part–I: Return related liabilities Electronic Liability Register of taxable person (Part–II: Other than return related liabilities) |

| 2 | GST PMT 2 | Electronic Credit Ledger |

| 3 | GST PMT 3 | Order for re-credit of the amount to cash or credit ledger on rejection of refund claim |

| 4 | GST PMT 4 | Application for intimation of discrepancy in Electronic Credit Ledger/Cash Ledger/Liability Register |

| 5 | GST PMT 5 | Electronic Cash Ledger |

| 6 | GST PMT 6 | Challan For Deposit of Goods and Services Tax |

| 7 | GST PMT 7 | Application for intimating discrepancy in making payment |

Download old / Draft GST Payment Formats in March 2017

GST PMT 1, GST PMT 2, GST PMT 3, GST PMT 4, GST PMT 5, GST PMT 6, Electronic Credit Ledger, Electronic Cash Ledger, Electronic Tax Liability Register

| Sr No. | Form No. | Title of the Form |

| 1. | Form GST PMT 1 | Electronic Tax Liability Register of Taxpayer (Part–I: Return related liabilities) Electronic Tax Liability Register of Taxpayer (Part–II: Other than return related liabilities) |

| 2. | Form GST PMT 2 | Electronic Credit Ledger |

| 3. | Form GST PMT 2A | Order for re-credit of the amount to cash or credit ledger |

| 4. | Form GST PMT 3 | Electronic Cash Ledger |

| 5. | Form GST PMT 4 | Challan For Deposit of Goods and Services Tax |

| 6. | Form GST PMT 5 | Payment Register of Temporary IDs/Un-registered Taxpayers |

| 7. | Form GST PMT 6 | Application For Credit of Missing Payment (CIN not generated) |

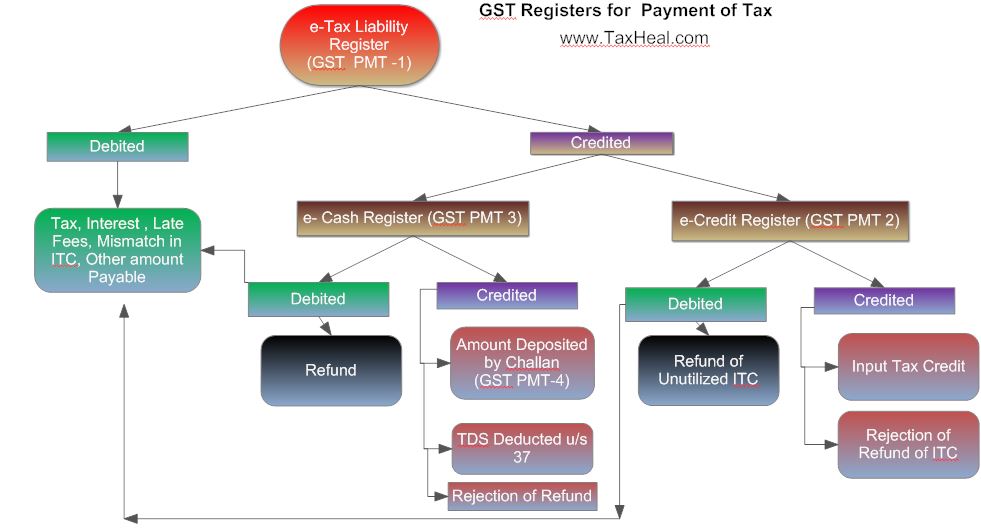

Flow chart GST

e-Registers, e-Tax liability, e-Cash Ledger,e-Credit Register

What are E-Ledgers under GST?

Ans. Electronic Ledgers or E-Ledgers are statements of cash and input tax credit in respect of each registered taxpayer. In addition, each taxpayer shall also have an electronic tax liability register. Once a taxpayer is registered on Common Portal (GSTN), 2 e-ledgers (Cash & Input Tax Credit) and an electronic tax liability register will be automatically opened and displayed on his dashboard at all times.

What is a tax liability register under GST?

Ans. Tax Liability Register will reflect the total tax liability of a taxpayer (after netting) for the particular month.

Download GST PMT 1 Electronic Tax Liability Register

What is a Cash Ledger under GST?

Ans. The cash ledger will reflect all deposits made in cash, and TDS/TCS made on account of the taxpayer. The information will be reflected on real time basis. This ledger can be used for making any payment on account of GST.

Download GST PMT 5 Electronic Cash Ledger

What is an ITC Ledger/e-Credit Register under GST?

Ans. Input Tax Credit as self-assessed in monthly returns will be reflected in the ITC Ledger. The credit in this ledger can be used to make payment of TAX ONLY and not other amounts such as interest, penalty, fees etc.

Download GST PMT 2 Electronic Credit Ledger

Download GST Draft Payment Rules Released by CBEC

Download GST Draft Payment formats Released by CBEC

Free Education Guide on Goods & Service Tax (GST)