e Proceeding User Manual

we are giving e proceeding uer manual for filing reply to Income Tax Notices

Abbreviations

Following abbreviations are used in following e-Proceeding /E Assessment user manual

ITD : Income Tax Department

PAN :Permanent Account Number

AO : Assessing Officer

Introduction

Presently, notice u/s 143(2) is generated by CASS in ITBA. Also, AO issues the statutory notice including notice u/s 142(1) with Questionnaire of the IT Act 1961 from the ITBA assessment module to the assessee’s designated email ID. Similarly, there are many proceedings of the Income Tax Act which require notice or correspondence between the Department and taxpayer and vice-versa including proceedings for appeal, exemption, rectification etc.

This functionality has been designed to enable the assesse to view the e-mail communication issued by AO and to submit response to different Notices or correspondence issued by Assessing Officers or any Income tax Authority.

Refer Income Tax Notice u/s 142 in New Format

e-Proceeding

Step 1: Login to e-filing portal at https://incometaxindiaefiling.gov.in. If you are not registered with the e-filing portal, use the ‘Register Yourself’ link to register.

Step 2: A link e-Assessment/Proceedings is provided under e-Proceeding tab.

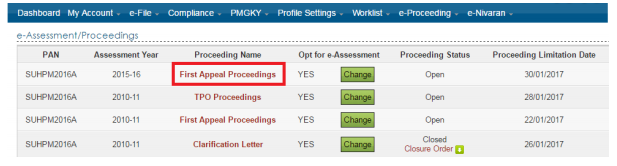

Step 3: On clicking the link the users can view the Proceeding details.

Step 4: The user can opt out/opt for e-assessment anytime. By default option for “Opt for e-Assessment” is selected as Yes. In order to Opt out of e-Assessment click on the “Change” button available. When user clicks on the change button the below popup is displayed to the users.

User needs to click on the Confirm button to opt for e-Assessment.

Note: The users will not be allowed to submit response if “No” is selected for above question. But can view the proceeding details for both the options.

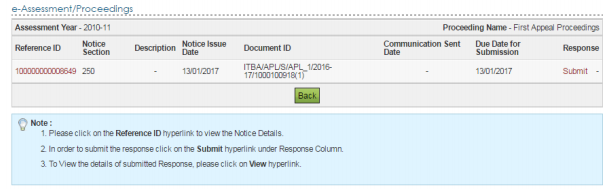

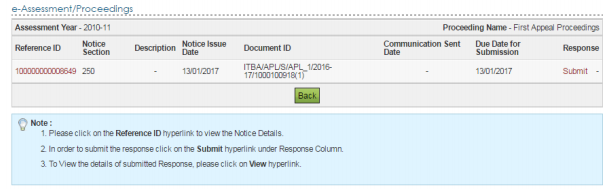

Step 5: Click on Proceeding Name hyperlink. All proceeding details will be displayed.

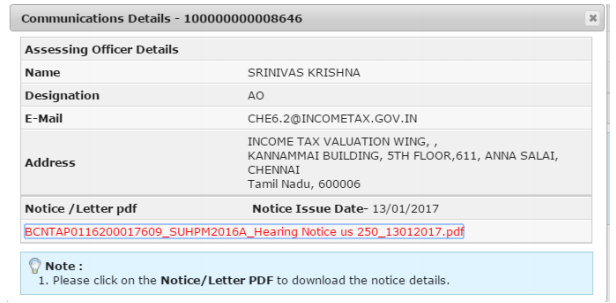

Step 6: In order to see the notice details Click on Reference ID hyperlink.

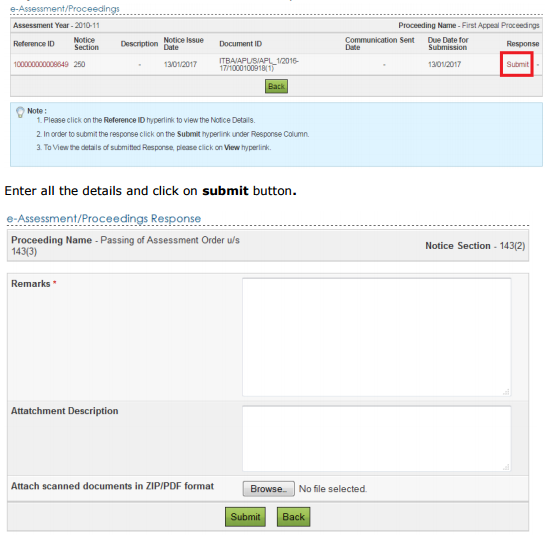

Step 7: Click on Submit link to submit the response.

Enter all the details and click on submit button.

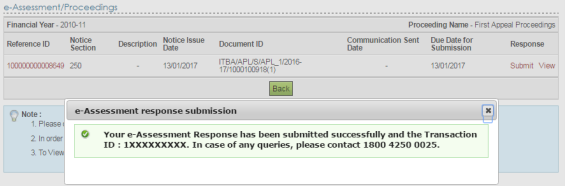

Step 8: On Successful Submission success message along with the Transaction ID is displayed on the screen. In case you make a mistake in submission of response, you may further revise it by login to e-filing portal.

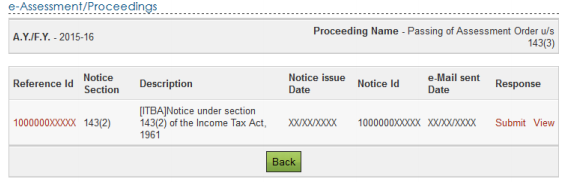

Step 9: Submitted online response can be viewed by clicking on the View.

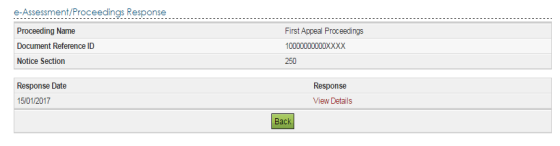

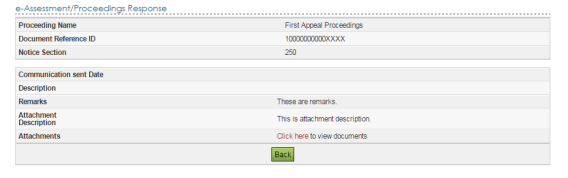

Step 9: For viewing the response details click on View Details. The responses will be sorted as latest first.

Step 10: All response details will be displayed. The User can download the attachments submitted at time of response.

Income Tax Assessment

Assessments under Income Tax Act : Detailed Analysis

Related Post Income Tax E-Assessment / E -proceedings

How to opt and Submit response for e-Proceeding on IncomeTaxIndiaEfiling

Instruction No 01/2018 Dated 1202.2018 : CBDT : E Assessment

Do e Assessment in time barring scrutiny cases : CBDT clarify

Budget 2018-19 : New scheme for Income Tax assessment in electronic mode

10 Things to Know about Income Tax e-Assessments

CBDT asked report of Paperless / e- Assessment of Income tax Return

Migration from e-mail based communication to E-Proceeding : Format

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal