Expense wise reconciliation required in GSTR 9C (GST Audit)

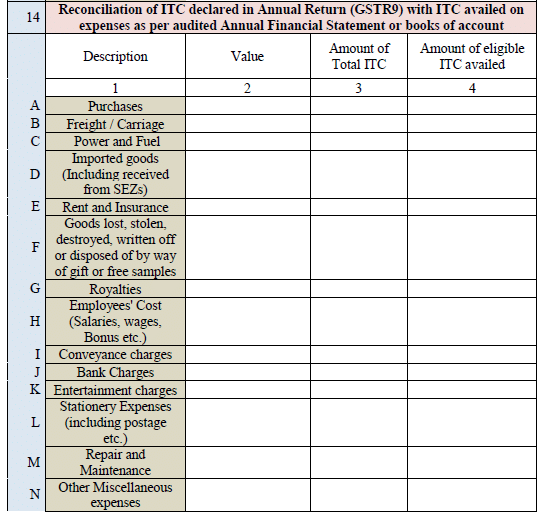

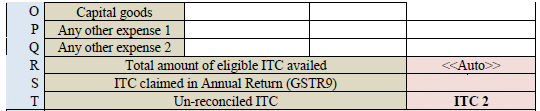

Table 14 of GSTR-9C (Reconciliation Statement if turnover Exceeds Rs 2 Crore ) requires expense-wise reporting of ITC available and availed

Issue:

1. Table 14 of GSTR-9C requires expense-wise reporting of ITC available and availed whereas it is not feasible for auditors to verify expense wise ITC.

2. Table 14 of GSTR 9C require reporting of total ITC and eligible ITC separately which is also the requirement in form GSTR 3B but some assesses have reported only the net amount of ITC eligible while filing GSTR 3B. In such cases, it will become difficult to identify these figures separately as assessees would have expensed such ineligible ITC in the respective head of expense at the time of booking.

One must appreciate the fact that the relevant Form GSTR 9C was notified after the end of the financial year. Units have not maintained this data to be able to furnish the same accurately.

Suggestion:

It is suggested to give relaxation in furnishing such breakup, to the extent maintained.