Father’s name non-mandatory in PAN application form; CBDT issues final notification

The CBDT has issued final notification proposing amendments in Rule 14 of Income-tax Rules, 1962 and PAN application Forms, i.e., 49A & 49AA. Now, the Father’s name shall not be mandatory in PAN application forms where mother is single parent.

Further, 31st May of next FY shall be last day to apply for PAN in case of non-individual resident persons entering into a financial transaction of Rs. 2.50 lakhs or more in a financial year.

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 19th November, 2018

G.S.R. 1128(E).—In exercise of the powers conferred by section 139A read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:—

1. Short, title and commencement.__(1) These rules may be called the Income–tax (Twelfth Amendment) Rules, 2018.

(2) They shall come into force from the 5thday of December, 2018.

2. In the Income-tax Rules, 1962, __

(I) in rule 114,__

(A) in sub-rule (3), after clause (iv), the following clauses shall be inserted, namely:__

“(v) in the case of a person, being a resident, other than an individual, which enters into a financial transaction of an amount aggregating to two lakh fifty thousand rupees or more in a financial year and which has not been allotted any permanent account number, on or before the 31st day of May immediately following such financial year;

(vi) in the case of a person, who is the managing director, director, partner, trustee, author, founder, karta, chief executive officer, principal officer or office bearer of the person referred to in clause (v) or any person competent to act on behalf of the person referred to in clause (v) and who has not been allotted any permanent account number, on or before the 31st day of May immediately following the financial year in which the person referred to in clause (v) enters into financial transaction specified therein.”;

(B) in sub-rule (6),__

“(i) for the words, brackets and figures “under sub-rule (4) or intimation of Aadhaar number in subrule (5)”, the words, brackets and figures “under sub-rule (4), intimation of Aadhaar number in subrule (5) and issue of permanent account number” shall be substituted;

(ii) for the words “number and intimation of Aadhaar number”, the words “number, intimation of Aadhaar number and issue of permanent account number” shall be substituted.”;

(II) in Appendix II, in Form number 49A and Form number 49AA, for serial number 6 and entries relating

thereto, the following serial number and entries thereto shall be substituted, namely:—

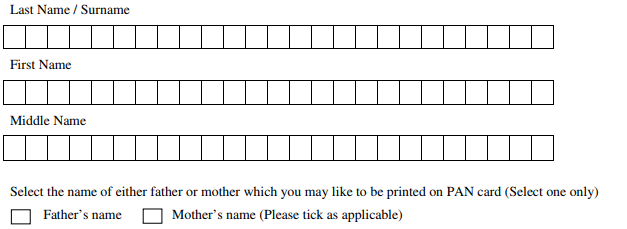

“6.Details of Parents (applicable only for individual applicants)

Whether mother is a single parent and you wish to apply for PAN by furnishing the name of your mother

only?

Yes No (please tick as applicable)

If yes, please fill in mother’s name in the appropriate space provide below.

Father’s Name (Mandatory except where mother is a single parent and PAN is applied by furnishing the name of mother only)

Mother’s Name (optional except where mother is a single parent and PAN is applied by furnishing the

name of mother only)

(In case no option is provided then PAN card will be issued with father’s name except where mother is a

single parent and you wish to apply for PAN by furnishing name of the mother only)’.

[Notification No. 82/2018/F.No. 370142/40/2016-TPL (Part-I)]

Dr. T. S. MAPWAL, Under Secy.

Note : The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3,

Sub-section (ii) vide notification number S.O. 969(E), dated the 26thMarch, 1962 and last amended

vide notification number G.S.R. 1068(E), dated the 25th October, 2018.