Input Tax Credit Mismatch under GST of India

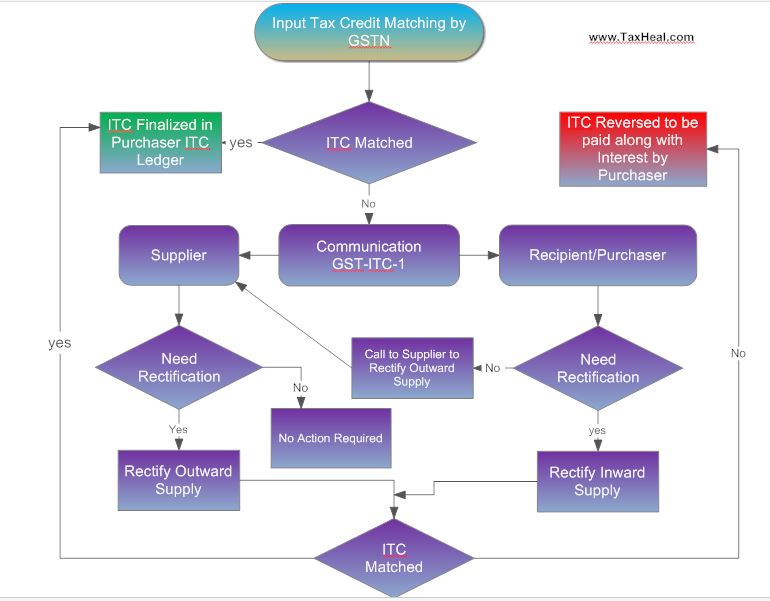

Flow Chart of Input Tax Credit Mismatch under GST

Process of Intimation of Input Tax Credit Mismatch under GST

- Any discrepancy in the claim of input tax credit in respect of any tax period, shall be made available to the registered taxable person making such claim and the supplier electronically in FORM GST ITC-1 through the Common Portal on or before the last date of the month in which the matching has been carried out.

- A supplier to whom any discrepancy is made available may make suitable rectifications in the statement of outward supplies to be furnished for the month in which the discrepancy is made available

- A recipient to whom any discrepancy is made available may make suitable rectifications in the statement of inward supplies to be furnished for the month in which the discrepancy is made available.

- Where the discrepancy is not rectified an amount to the extent of discrepancy shall be added to the output tax liability of the recipient in his return in FORM GSTR-3 for the month succeeding the month in which the discrepancy is made available

Read FAQ’s :-

- Input Tax Credit under Goods & Service Tax (GST)

- Concept of Input Service Distributor in Goods & Service Tax (GST)

Free Education Guide on Goods & Service Tax (GST)