Form 1 for Income declaration scheme

Introduction

As per Income Declaration Scheme, 2016, the declaration of undisclosed income is to be filed using Form for Income Disclosure – Form 1.

As per Notification No. 33/2016, the other Forms accompanying Form for Income Disclosure – Form 1 are Form 2, Form 3 and Form 4.

Form 2 is an acknowledgement issued to the declarant by the jurisdictional Principal Commissioner or Commissioner.

Form 3 shall be furnished by the declarant to the jurisdictional Principal Commissioner or Commissioner for the proof of payment of tax, surcharge and penalty made after receiving Form-2.

Form 4 is a certificate granted by the jurisdictional Principal Commissioner or Commissioner after submission of Form 3.

Note: In e-Filing portal, only Form for Income Disclosure – Form 1 is available for e-Filing.

Pre-Requisites for Uploading Form for Income Disclosure – Form 1

To upload Form for Income Disclosure – Form 1, user should have a valid PAN and should be registered in e-Filing portal (http://incometaxindiaefiling.gov.in/)

A valid XML file should be generated using the JAVA Utility available under downloads. The JAVA utility of Form 1 can be downloaded from the path Downloads Forms (Other than ITR) Form 1.

A valid XML can be generated by following the process, Extract the JAVA Utility of Form 1 Right click and Open the JAR file of Form for Income Disclosure – Form 1 Fill all the Mandatory fields Click on “Generate XML”.

Valid DSC should be registered in e-Filing portal for uploading Form 1.

Upload Form for Income Disclosure – Form 1

To Upload Form 1, the steps are as below:

Step 1: In e-Filing Homepage of http://incometaxindiaefiling.gov.in/, Click on “Login Here”

Step 2: Enter User ID (PAN), Password, DOB/DOI and Captcha. Click Login

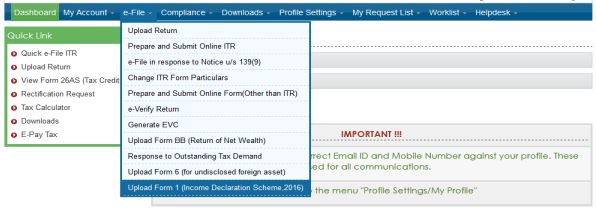

Step 3: Post login, go to e-File Upload Form 1 (Income Declaration Scheme, 2016).

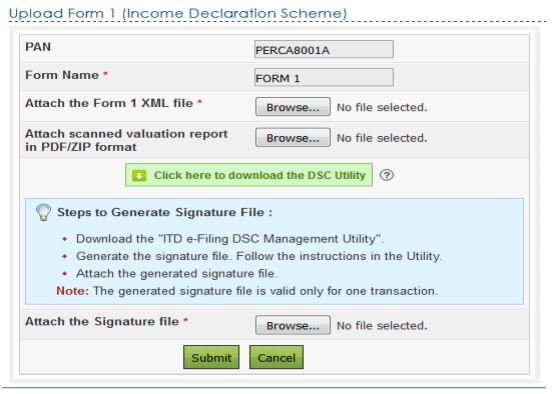

Step 4: “Upload XML file”: In the upload page, attach a valid XML file generated using the JAVA utility of Form 1.

Step 5: “Attach the Valuation Report”: Valuation Report, if any, can be attached. This is not mandatory.

Step 6: “Attach the Signature file”: Upload the signature file generated using DSC Management Utility for the uploaded XML file. For further details on generating Signature file click here. Navigate to Step by Step Guide for Uploading XML.

Step 7: Click on “Submit” button.

Note: The facility to upload Form 1 using DSC is now available on e-Filing portal.

Upload of Form 1 using EVC will be available shortly.

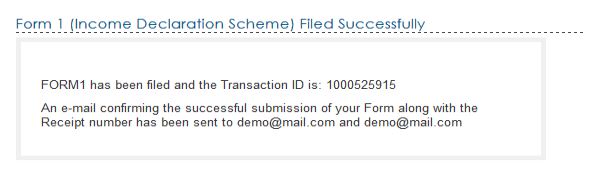

Once the Form 1 is uploaded, success message will be displayed on the screen. A confirmation mail is sent to the registered email id.

View e-Filed Form for Income Disclosure – Form 1

To View the e-Filed Form 1, the steps are as below:

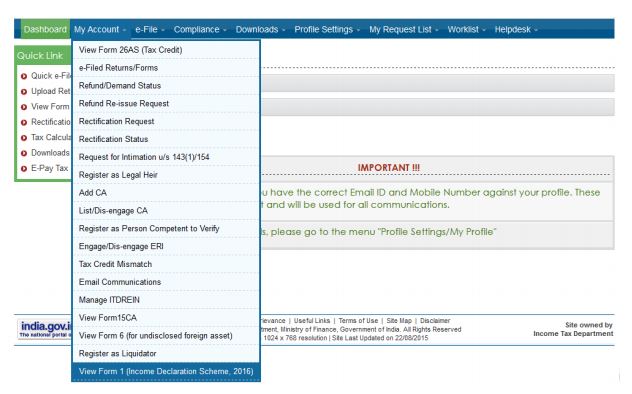

Step 1: Login to e-Filing, Go to My Account View Form 1 (Income Declaration Scheme, 2016).

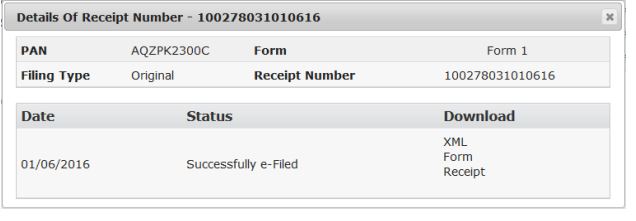

Step 2: The uploaded Form for Income Disclosure – Form 1 details are displayed under “View Form 1”. Click on the “Receipt No.” to see the details of Form 1 uploaded for future reference.

Step 3: The Filing Type of the uploaded Form 1 can be viewed. And the uploaded XML file, PDF and Receipt can be downloaded.

Related Post

- Form for Declaration under Income Declaration Scheme 2016

- FAQ’s on Income Declaration Scheme 2016

- Jurisdiction for making declaration under Income Declaration Scheme 2016

- Income Declaration Scheme Rules 2016

- Income Declaration Scheme 2016 Explanatory notes

- Income Declaration 2016 , Declaration & Tax Payment Date Notified

- THE INCOME DECLARATION SCHEME 2016

- Income Declaration Scheme 2016 to open from 1st June 2016

- CBDT asks issues from public on Income Declaration Scheme 2016 & Direct Tax Dispute Resolution Scheme 2016

- THE DIRECT TAX DISPUTE RESOLUTION SCHEME 2016

- Govt proposed scheme to declare undisclosed income by paying 45% tax