E-Way Bill System

Forthcoming changes/improvements in E-Way Bill System

Explained in Hindi by CA Satbir Singh

After studying the suggestions and feedbacks of the stakeholders of the e-way bill system, it has been decided to add the following changes/improvements in the e-way bill system to help the tax payers in complying with the GST processes and rules. Most of them are validations to the existing fields so as to assist the users in proper entry of the values. These changes are proposed to be rolled out in phased manner in the coming weeks. The tax payers and

transporters can go through these forthcoming changes/improvements, understand and prepare themselves to use them.

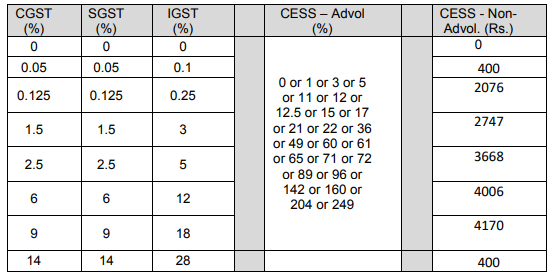

1. Validating the rates of tax while generating the e-way bills

The system is being enabled to check the rates of tax entered by the user. Here, the system will enable the tax payer to enter the standard rate of tax as finalised by the GST Council. This will avoid in making the data entry mistake by the tax payers. However, the entry of the rate of tax is optional. If it is entered, it will be validated. The following list of rates of tax will be validated.

2. Validating the State based on the PIN Code

The system is being enabled with auto populating the state name based on the entry of PIN code. If the same PIN code belongs to the addresses in the couple of states, then the user will be enabled to select the appropriate state.

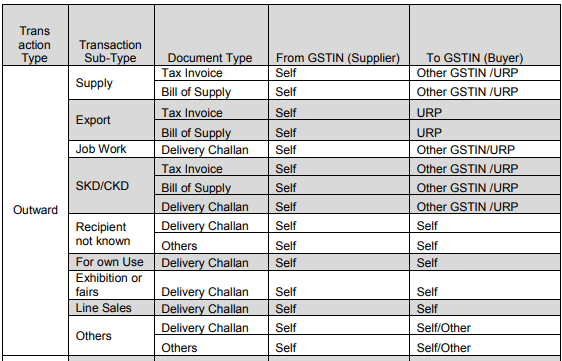

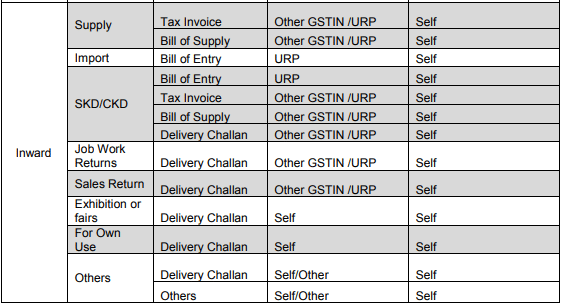

3. Validating the Supply Type with Document Type

To help the tax payer to follow the usage of proper document type for different types of supply of goods, the system is being enabled with the selection of the document type based on the supply type. Please see the table below for the details of supply types and accordingly the document types mapped to it. The system also defines the type of suppliers and buyers involved in this supply types.

These validations are done, if the supplier is generating the e-way bills. In case, the transporters or consignees are generating the e-way bills, then columns related to ‘From GSTIN (Supplier)’ and ‘To GSTIN (Buyer)’ validations will change accordingly.

4. Blocking of generation of multiple e-way bills based on same Invoice Number

As per the feedback received from some of the tax payers, the system is being enabled to block the generation of multiple e-way bills based on the same invoice number by the consignor, if it has been generated previously by him for the same invoice number. That is, the system will allow to generate one e–way bill for one invoice number for the consignor.

However, If the multiple e-way bills are being generated on the same invoice by the transporter or consignee, the system will alert him and allow continuing the generation of e-way bill, if required. This facility is being provided to ensure that if the original invoice with correct number is available with transporter, he can continue with the e-way bill generation and move the goods so that it will not hamper in his/her logistic activities.

5. ‘Bill To – Ship To’ Transactions

The system is being facilitated to capture the details of the ‘Bill to – Ship to’ transactions. The following details are being requested by the system.

1. Category: Regular OR Bill to – Ship To OR Bill From – Dispatch From OR Both

2. GSTIN and Name of Dispatching Party, if category is ‘Bill From – Dispatch From’ or ‘Both’

3. GSTIN and Name of Shipping Party, if category is ‘Bill to – Ship to’ or ‘Both’

However, the parameters of serial number 2 and 3 are optional.

6. Movement to Transporter’s place

Presently, when the supplier is moving consignment to the place of transporter, he can prepare the e-way bill with Part-A and can move the goods without entering any details in Part-B.

In the next version, it is being enabled in the generation of the e-way bill to enter the first leg of movement to the place of transporter. Based on this, without the Part-B entry also, the eway bill is generated indicating the movement to the transporter place and legalising its usage and movement.

7. Making GSTR-1 data mandatory for users of API and Offline (Excel) tool

The users of API and Offline tool are being enabled to pass the information related to Form GSTR-1 (that is, rates of tax and tax values) data compulsorily with e-way bill basic data, before generating the e-way bills.

8. Auto populating distance between ‘From PIN Code’ and ‘To PIN Code’

As per the feedback of the most of the stake holders, the system is being enabled to display and limit the distance (in KMs) between source PIN code and destination PIN Code. The eway bill system is having the distance between all the PIN codes of the country and the distance (in KMs) will be auto populated on entry of source PIN code and destination PIN code. This will simplify the job of calculating and entering the distance between the locations

of the consignor and consignee by the users.

Also Refer Eway bill Portal Click here