Carry forward of ITC under GST by Dealer paying Tax at Fixed rate under Existing Law

As per Section 140(6) of the CGST Act

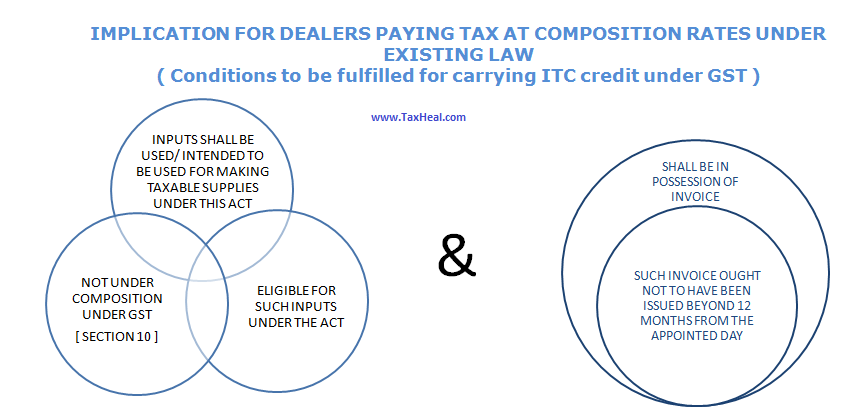

A registered person, who was either paying tax at a fixed rate or paying a fixed amount in lieu of the tax payable under the existing law shall be entitled to take, in his electronic credit ledger, credit of eligible duties in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the appointed day subject to the following conditions, namely:—

(i) such inputs or goods are used or intended to be used for making taxable supplies under this Act;

(ii) the said registered person is not paying tax under section 10;

(iii) the said registered person is eligible for input tax credit on such inputs under this Act;

(iv) the said registered person is in possession of invoice or other prescribed documents evidencing payment of duty under the existing law in respect of inputs; and

(v) such invoices or other prescribed documents were issued not earlier than 12 months immediately preceding the appointed day.

As per Rule 1(2)(b) of GST Transition Rules

In the case of a claim under Section 140(6) , registered dealer shall specify separately the details of stock held on the appointed day and submit a declaration electronically in FORM GST TRAN- 1, duly signed, on the Common Portal

The registered person availing of this scheme and having furnished the details of stock held by him in shall also submits a statement in FORM GST TRAN 2 at the end of each of the six tax periods during which the scheme is in operation indicating therein the details of supplies of such goods effected during the tax period.