GST E way Bill Rules

GST E way Bill Rules (Rules 138 to 138D of CGST Rules ) notified vide Notification No 27 /2017 Central Tax Dated 30th August, 2017 by Central Goods and Services Tax (Sixth Amendment) Rules 2017.

Key Points about E way Bill

Who has to file GST E Way Bill

Where the goods are transported by the registered person as a consignor or the recipient of supply as the consignee,

- whether in his own conveyance or

- a hired one or by railways or

- by air or by vessel,

- the said person or the recipient may generate the e-way bill in FORM GST EWB-01

- electronically on the common portal (www.gst.gov.in )

- after furnishing information in Part B of FORM GST EWB-01.

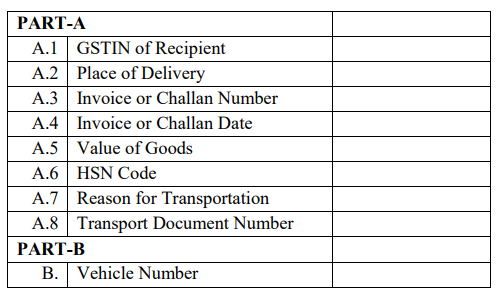

GST E way Bill Format

How to Fill GST E way Bill :-

1. Place of Delivery shall indicate the PIN Code of place of delivery.

2. HSN Code in column A.6 shall be indicated :-

a) at minimum 2 digit level for taxpayers having annual turnover upto Rs 5 crore in the preceding financial year and

b) at 4 digit level for taxpayers having annual turnover above Rs 5 crore rupees in the preceding financial year.

3. Transport Document number indicates Goods Receipt Number or Railway Receipt Number or Airway Bill Number or Bill of Lading Number.

4. Reason for Transportation shall be chosen from one of the following:

Code Description

1 Supply

2 Export or Import

3 Job Work

4 SKD or CKD – completely knocked down

5 Recipient not known

6 Line Sales

7 Sales Return

8 Exhibition or fairs

9 For own use

0 Others

Value for which GST E Way Bill needs to be filed and Place where it has to be filed : –

Every registered person who causes movement of goods of consignment value exceeding Rs

50,000/-

(i) in relation to a supply; or

(ii) for reasons other than supply; or

(iii) due to inward supply from an unregistered person,

shall, before commencement of such movement, furnish information relating to the said goods in Part A of FORM GST EWB-01, electronically, on the common portal ( www.gst.gov.in).

- GST E Way Bill if Value Less than Rs 50000/- :-

Provided that the registered person or, as the case may be, the transporter may, at his option, generate and carry the e-way bill even if the value of the consignment is less than 50000 /-:

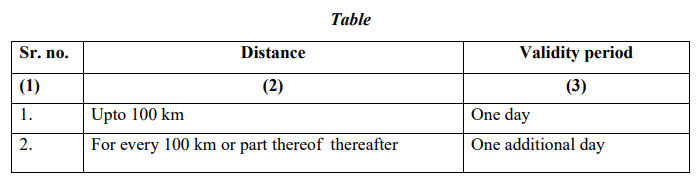

Validity Period of E way Bill

An e-way bill or a consolidated e-way bill generated under this rule shall be valid for the period as mentioned in column (3) of the Table below from the relevant date, for the distance the goods have to be transported, as mentioned in column (2) of the said Table:

Relevant date” shall mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as twenty-four hours.

Relevant date” shall mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as twenty-four hours.

where, under circumstances of an exceptional nature, the goods cannot be transported within the validity period of the e-way bill, the transporter may generate another e-way bill after updating the details in Part B of FORM GST EWB-01.

Commissioner may, by notification, extend the validity period of eway bill for certain categories of goods as may be specified therein:

Goods given to Transporter without E Way Bill :-

i) Where the e-way bill is not generated and the goods are handed over to a transporter for transportation by road, the registered person shall furnish the information relating to the transporter in Part B of FORM GST EWB-01 on the common portal (www.GST.Gov.in ) and the e-way bill shall be generated by the transporter on the said portal (www.GST.Gov.in ) on the basis of the information furnished by the registered person in Part A of FORM GST EWB-01:

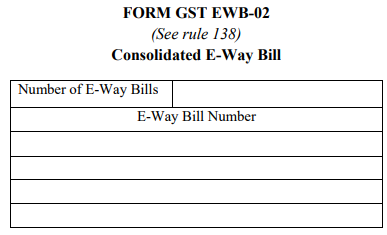

ii) Where the consignor or the consignee has not generated FORM GST EWB-01 and the value of goods carried in the conveyance is more than Rs 50000/- , the transporter shall generate FORM GST EWB-01 on the basis of invoice or bill of supply or delivery challan, as the case may be, and may also generate a consolidated e-way bill in FORM GST EWB-02 on the common portal prior to the movement of goods.

Validity of E way Bill in Other states / UT of India

:-The e-way bill generated under rule 138 of CGST act or under rule 138 of the Goods and Services Tax Rules of any State shall be valid in every State and Union territory.

GST E Way Bill if Goods sent by Railway , Air or Vessel

The information in Part A of FORM GST EWB-01 shall be furnished by the consignor or the recipient of the supply as consignee where the goods are transported

i) by railways or

ii) by air or

iii) by vessel.

GST E Way Bill if purchases from unregistered person

where the movement is caused by an unregistered person either

i. in his own conveyance or

ii . a hired one or through a transporter,

he or the transporter may, at their option, generate the e-way bill in FORM GST EWB-01 on the common portal (www.gst.gov.in) :

where the goods are supplied by an unregistered supplier to a recipient who is registered, the movement shall be said to be caused by such recipient if the recipient is known at the time of commencement of the movement of goods

GST E way Bill if distance less than 10 Kilometers

where the goods are transported for a distance of less than 10 kilometres within the State or Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01.

GST E way bill number

Upon generation of the e-way bill on the common portal (www.gst.gov.in ) , a unique e-way bill number (EBN) shall be made available to the

i. supplier,

ii. Recipient and

iii. Transporter

on the common portal (www.gst.gov.in )

Supply of GST E way Bill Information

The information furnished in Part A of FORM GST EWB-01 shall be made available to the registered supplier on the common portal (www.gst.gov.in ) who may utilize the same for furnishing details in FORM GSTR-1:

However when the information has been furnished by an unregistered supplier in FORM GST EWB-01, he shall be informed electronically, if the mobile number or the email is available

The facility of generation and cancellation of e-way bill may also be made available through SMS.

Communication of E way Bill Acceptance / Rejection

:The details of e-way bill generated shall be made available to the recipient, if registered, on the common portal, who shall communicate his

- acceptance or

- Rejection

of the consignment covered by the e-way bill. [ Rule 138(11) ]

Where the recipient referred to in sub-rule (11) does not communicate his acceptance or rejection within 72 hours of the details being made available to him on the common portal (www.gst.gov.in ), , it shall be deemed that he has accepted the said details. [ Rule 138(12) ]

GST E way bill if Goods Transported from One Conveyance to another during Transit

Any transporter transferring goods from one conveyance to another in the course of

transit shall, before such transfer and further movement of goods, update the details of

conveyance in the e-way bill on the common portal (www.gst.gov.in ) in FORM GST EWB-01:

where the goods are transported for a distance of less than 10 kilometres within the State or Union territory from the place of business of the transporter finally to the place of business of the consignee, the details of conveyance may not be updated in the e-way bill.

E Way Bill if multiple consignments are intended to be transported in one conveyance

After e-way bill has been generated and where multiple consignments are intended to be transported in one conveyance, the transporter may indicate the serial number of e-way bills generated in respect of each such consignment electronically on the common portal (www.gst.gov.in ) and a consolidated e-way bill in FORM GST EWB-02 maybe generated by him on the said common portal (www.gst.gov.in ) prior to the movement of goods.

Cancellation of GST E Way Bill :–

Where an e-way bill has been generated under this rule, but goods are either

i ) not transported or

ii) are not transported as per the details furnished in the e-way bill,

the e-way bill may be cancelled electronically on the common portal (www.gst.gov.in ), either

- directly or

- through a Facilitation Centre notified by the Commissioner,

within 24 hours of generation of the e-way bill:

However an e-way bill cannot be cancelled if it has been verified in transit in accordance with the provisions of rule 138B.

The facility of generation and cancellation of e-way bill may also be made available through SMS.

Documents and devices to be carried by a person-in-charge of conveyance.-

(1) The person in charge of a conveyance shall carry—

(a) the invoice or bill of supply or delivery challan, as the case may be; and

(b) a copy of the e-way bill or the e-way bill number, either physically or mapped

to a Radio Frequency Identification Device embedded on to the conveyance in such

manner as may be notified by the Commissioner.

(2) A registered person may obtain an Invoice Reference Number from the common

portal by uploading, on the said portal, a tax invoice issued by him in FORM GST INV-1

and produce the same for verification by the proper officer in lieu of the tax invoice and such

number shall be valid for a period of thirty days from the date of uploading.

(3) Where the registered person uploads the invoice under sub-rule (2) of Rule 138, the information in Part A of FORM GST EWB-01 shall be auto-populated by the common portal on the basis of the information furnished in FORM GST INV-1.

(4) The Commissioner may, by notification, require a class of transporters to obtain a

unique Radio Frequency Identification Device and get the said device embedded on to the

conveyance and map the e-way bill to the Radio Frequency Identification Device prior to the

movement of goods.

(5) where circumstances so warrant, the Commissioner may, by notification, require the person-in-charge of the conveyance to carry the following documents instead of the e-way bill-

(a) tax invoice or bill of supply or bill of entry; or

(b) a delivery challan, where the goods are transported for reasons other than by

way of supply.

Verification of documents and conveyances carrying GST E way Bill

(1) The Commissioner or an officer empowered by him in this behalf may authorise the proper officer to intercept any conveyance to verify the e-way bill or the e-way bill number in physical form for all inter-State and intraState movement of goods.

(2) The Commissioner shall get Radio Frequency Identification Device readers installed

at places where the verification of movement of goods is required to be carried out and

verification of movement of vehicles shall be done through such device readers where the eway

bill has been mapped with the said device.

(3) The physical verification of conveyances shall be carried out by the proper officer as

authorised by the Commissioner or an officer empowered by him in this behalf:

However on receipt of specific information on evasion of tax, physical

verification of a specific conveyance can also be carried out by any officer after obtaining

necessary approval of the Commissioner or an officer authorised by him in this behalf

Inspection and verification of goods .

(1) A summary report of every inspection of goods in transit shall be recorded online by the proper officer in Part A of FORM GST EWB-03 within twenty four hours of inspection and the final report in Part B of FORM GST EWB-03 shall be recorded within three days of such inspection.

(2) Where the physical verification of goods being transported on any conveyance has

been done during transit at one place within the State or in any other State, no further

physical verification of the said conveyance shall be carried out again in the State, unless a

specific information relating to evasion of tax is made available subsequently.

Facility for uploading information regarding detention of vehicle.-

Where a vehicle has been intercepted and detained for a period exceeding thirty minutes, the

transporter may upload the said information in FORM GST EWB-04 on the common

portal.

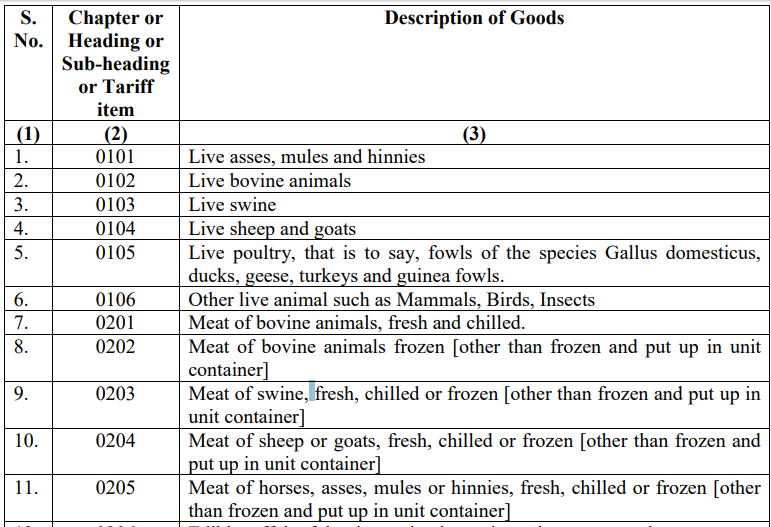

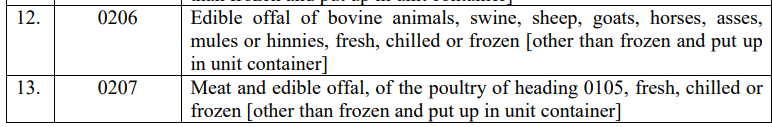

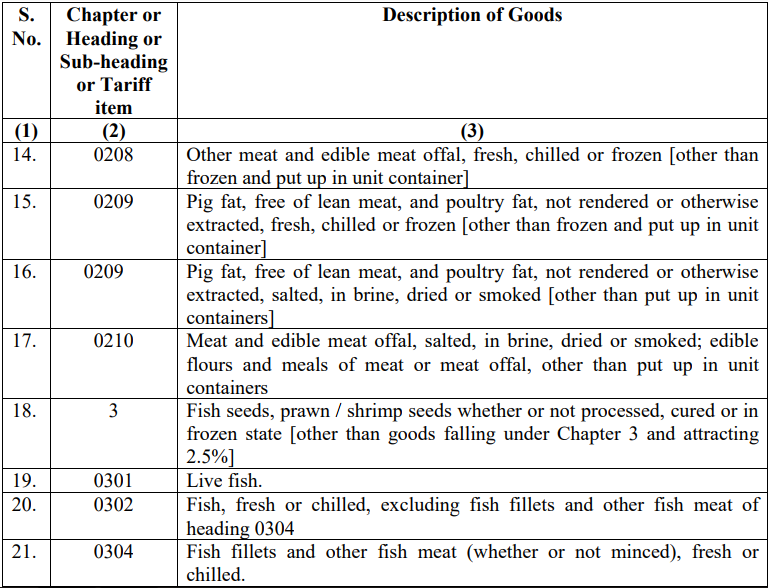

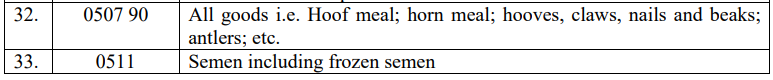

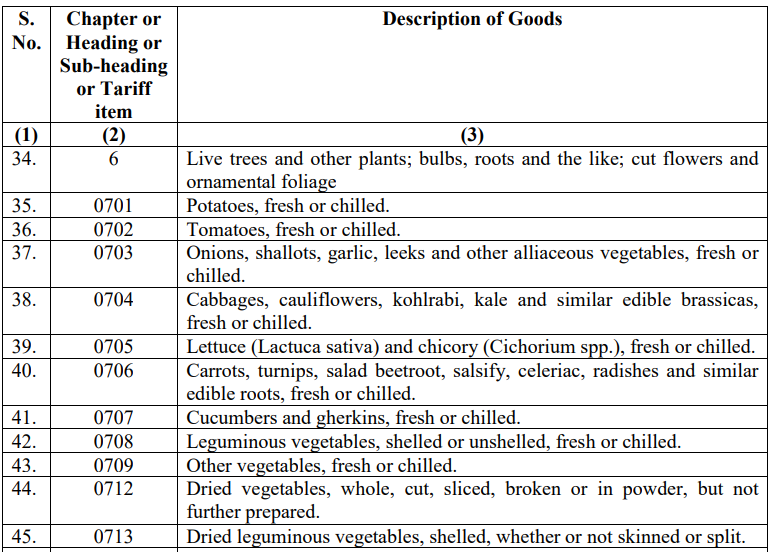

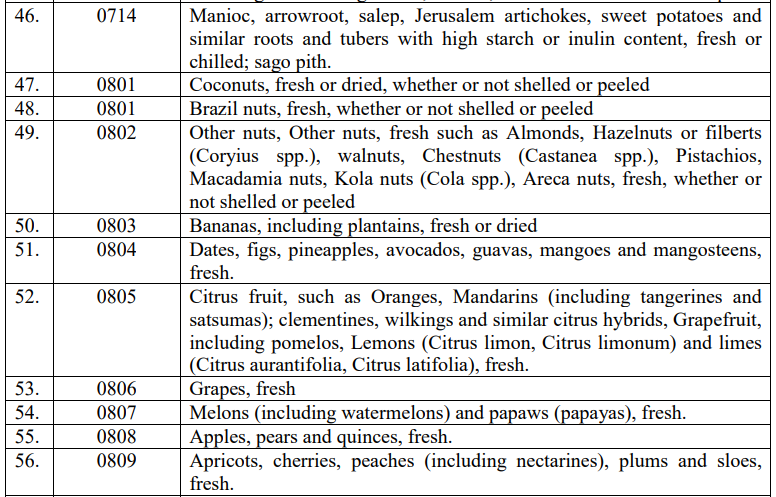

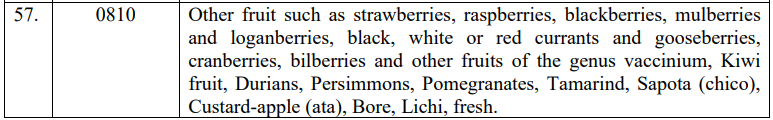

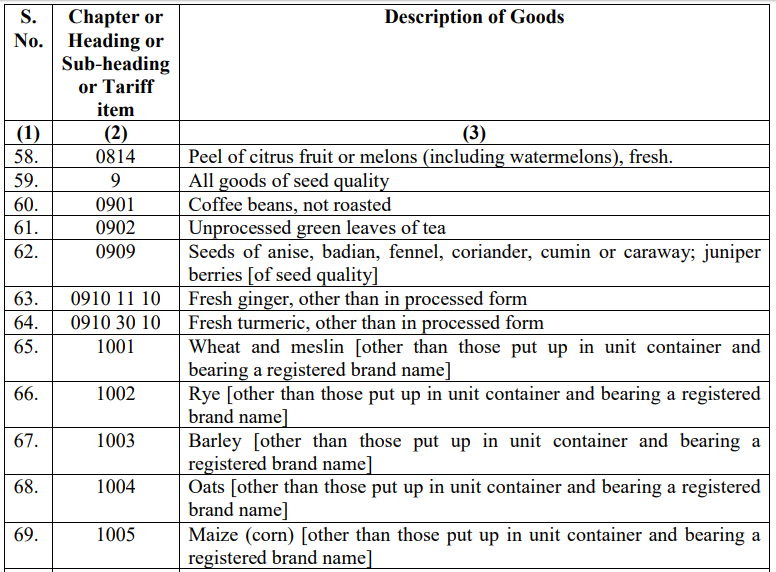

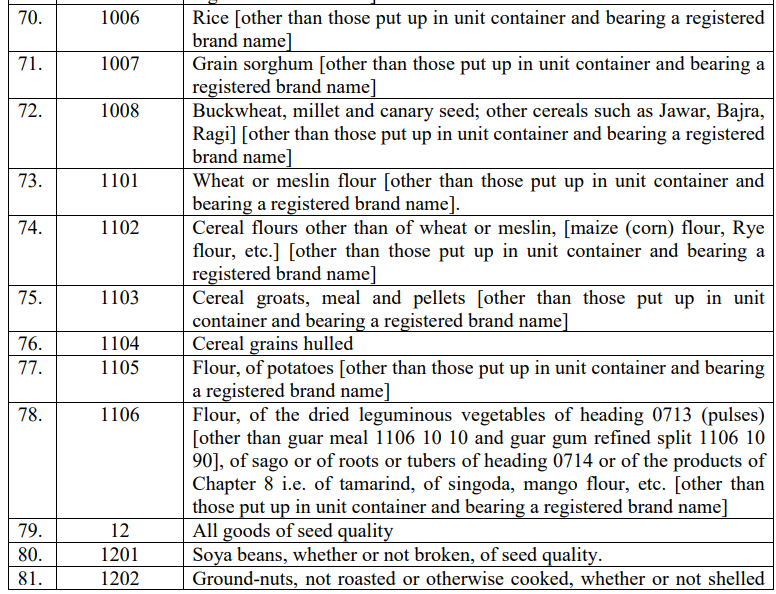

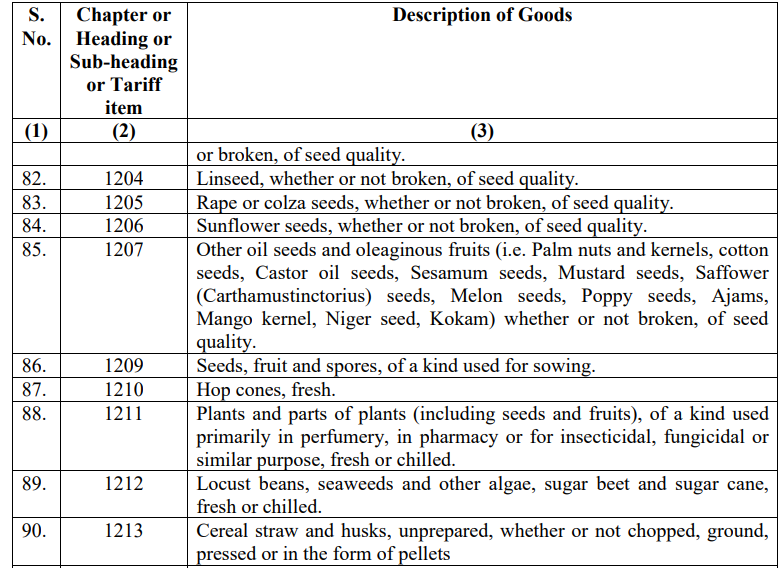

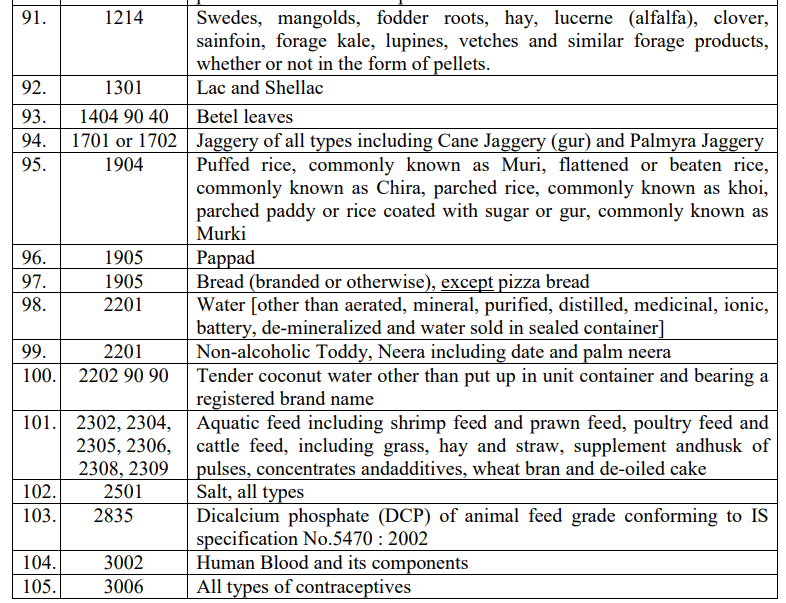

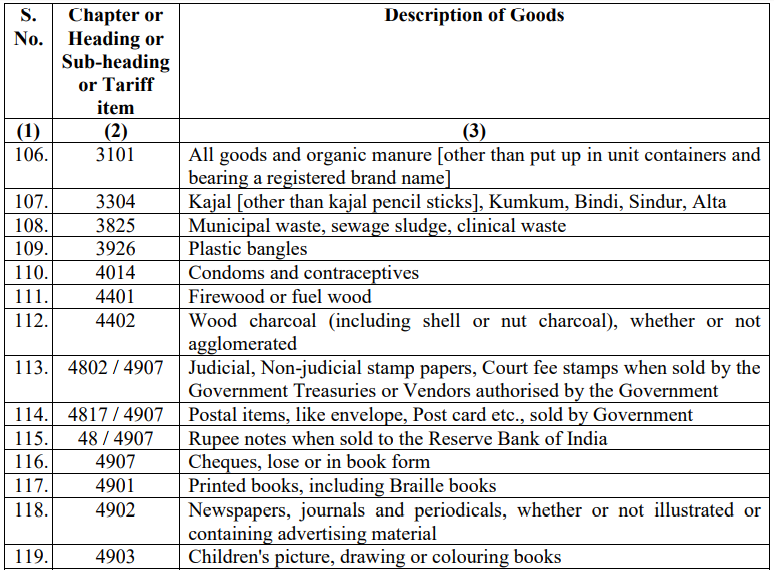

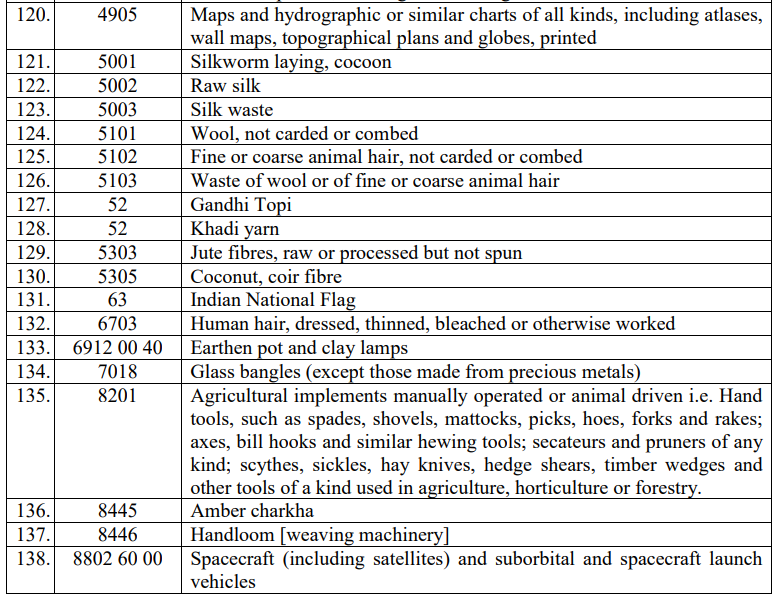

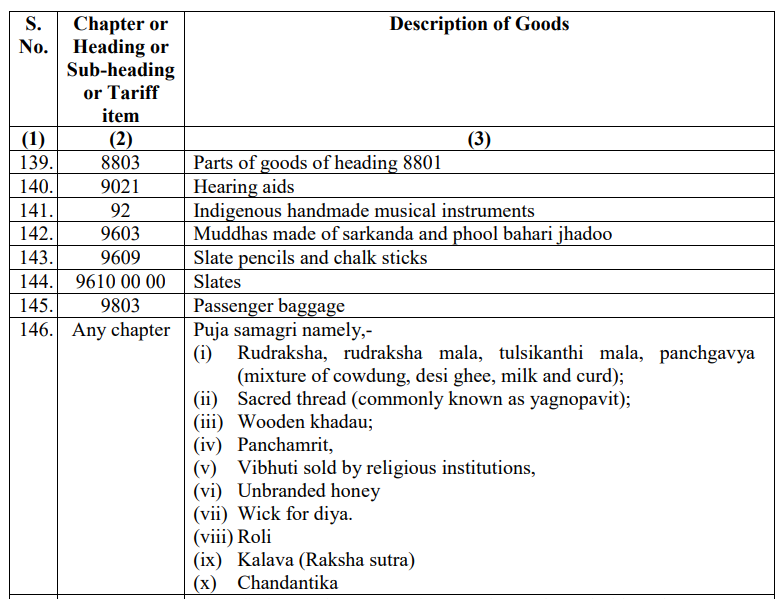

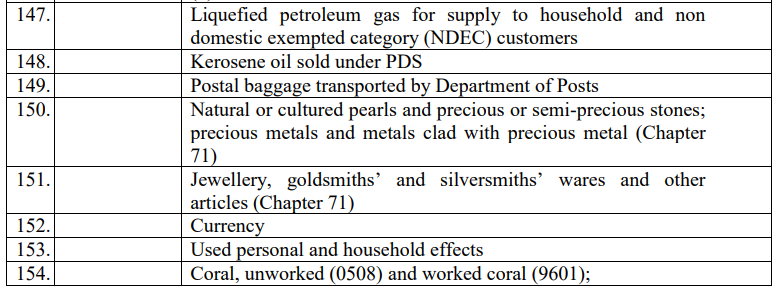

When E Way Bill is not required to be generated

No e-way bill is required to be generated where the goods being transported :-

(a are specified in Annexure;

(b) by a non-motorised conveyance;

(c) from the port, airport, air cargo complex and land customs station to an inland container depot or a container freight station for clearance by Customs; and

(d) in respect of movement of goods within such areas as are notified under clause (d) of sub-rule (14) of rule 138 of the Goods and Services Tax Rules of the concerned State.

ANNEXURE

[(See rule 138 (14)]

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |