FORM GST EWB 1

(GST EWB 1 read rule 138 of CGST Rules 2017)

( GST EWB 1 inserted in CGST Rules 2017 and is covered in Chapter XVI – E-Way Rules : Inserted by the Central Goods and Services Tax (Sixth Amendment) Rules 2017. Notification No 27 /2017 Central Tax Dated 30th August, 2017 )\

New Format of FORM GST EWB 1

. Substituted by the Central Goods and Services Tax (Second Amendment) Rules, 2018, w.e.f.

1-4-2018. Earlier, Form GST EWB-01, was amended by the Central Goods and Services Tax

(Amendment) Rules, 2018, Central Goods and Services Tax (Sixth Amendment) Rules, 2017

and Central Goods and Services Tax (Seventh Amendment) Rules, 2017.

Notes:

1. HSN Code in column A.8 shall be indicated at minimum two digit level for taxpayers

having annual turnover upto five crore rupees in the preceding financial year and

at four digit level for taxpayers having annual turnover above five crore rupees in

the preceding financial year.

2. Document Number may be of Tax Invoice, Bill of Supply, Delivery Challan or Bill of

Entry.

3. Transport Document number indicates Goods Receipt Number or Railway Receipt

Number or Forwarding Note number or Parcel way bill number issued by railways

or Airway Bill Number or Bill of Lading Number.

4. Place of Delivery shall indicate the PIN Code of place of delivery

5. Place of dispatch shall indicate the PIN Code of place of dispatch.

6. Where the supplier or the recipient is not registered, then the letters “URP” are to be

filled-in in column A.l or, as the case may be, A.3.

7. Reason for Transportation shall be chosen from one of the following:—

Code Description

1 Supply

2 Export or Import

3 Job Work

4 SKD or CKD

5 Recipient not known

6 Line Sales

7 Sales Return

8 Exhibition or fairs

9 For own use

10 Others

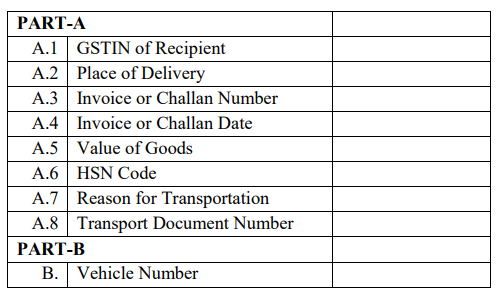

Old format of FORM GST EWB 1

FORM GST EWB 1

E-Way Bill

Notes:

1. HSN Code in column A.6 shall be indicated at minimum two digit level for taxpayers

having annual turnover upto five crore rupees in the preceding financial year and at

four digit level for taxpayers having annual turnover above five crore rupees in the

preceding financial year.

2. Transport Document number indicates Goods Receipt Number or Railway Receipt

Number or Airway Bill Number or Bill of Lading Number.

3. Place of Delivery shall indicate the PIN Code of place of delivery.

4. Reason for Transportation shall be chosen from one of the following:

Code Description

1 Supply

2 Export or Import

3 Job Work

4 SKD or CKD

5 Recipient not known

6 Line Sales

7 Sales Return

8 Exhibition or fairs

9 For own use

0 Others

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |