GST FAQ

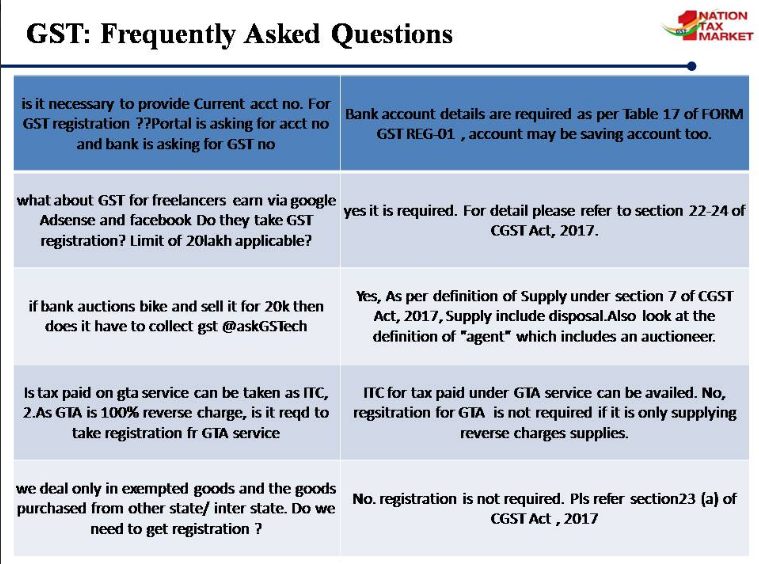

Question 1: Is it necessary to provide the current account number for GST Registration? Portal is asking for account number and bank is asking GST Number.

Answer: bank account details are required as per Table 17 of Form GSTR Reg-01, account may be savings account too.

Question 2: What about GST on freelancers who earn via google Adsense and facebook. Do they take GST Registration? Is the limit of Rs. 20 lakhs applicable to them?

Answer : Yes, it is required. For details please refer to section 22-24 of CGST Act, 2017.

Question 3: If bank auctions bike and sell it for Rs. 20 thousands then does it have to collect GST ?

Answer: Yeas as per definition of supply as per section 7 of CGST Act, 2017, supply include disposal also. Also look at the definition of “agent” which includes an auctioneer.

Question 4: Is tax paid on GTA services can be taken as ITC? As GTA is 100% reverse charge based, is it required to take registration for GTA service?

Answer: ITC for tax paid under GTA service can be availed. No, registration for GTA is not required if it is only supplying reverse charge supplies.

Question 5 : We deal only in exempted goods and the goods purchased from other State/inter state. Do we need to get registration?

Answer: No, registration is not required. Please refer section 23(a) of CGST Act, 2017.

Download TaxHeal Mobile App

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |