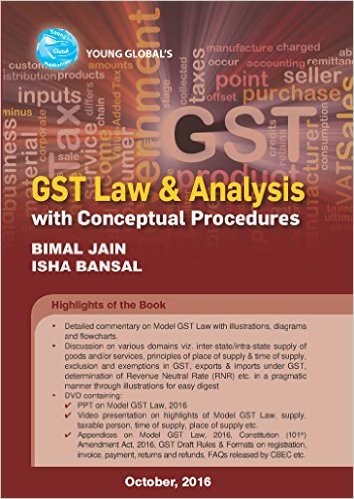

GST LAW & ANALYSIS – WITH CONCEPTUAL PROCEDURES

We are pleased to announce release of our book (2nd Edition) on Goods and Services Tax, titled, “GST LAW & ANALYSIS – WITH CONCEPTUAL PROCEDURES”

Key features of the Book:

- Detailed commentary on Model GST Law, Draft GST Business Processes for Registration, Payment, Return and Refunds to encapsulate the provisions for easy digest

- Overview of present indirect taxes – shortcomings, cascading and double taxes

- GST – need and necessity, what it is, how it works, etc., along with discussion on challenges ahead

- Detailed discussion on meaning and scope of the term ‘supply’ along with the discussion on likely issues

- Detailed discussion on meaning of taxable person, liability to be registered, exclusion and compulsory registration

- Discussion on various domains viz. inter-state/intra- state supply of goods and/or services, principles of place of supply & time of supply, exclusion and exemptions in GST, exports & imports under GST, determination of Revenue Neutral Rate (RNR) etc. in a pragmatic manner through illustrations for easy digest

- Discussion on flow of input tax credit in GST with multiple illustrations

- Business processes and procedural aspects of GST– registration, return, payment, refund, demand & recovery, adjudication, appeals, etc., along with key suggestions

- Journal entries for various scenarios in GST to provide clarity from accounting perspective

- Transitional issues and impact of GST on manufacturer, trader and service sector and specifically on various sectors viz. alcohol, real estate, automobiles, telecom, FMCG, insurance, e-commerce etc.

- Section-by-Section study of the Constitution (101st Amendment) Act, 2016 for GST along with its comparison with the 122nd Constitutional Amendment Bill, 2014

- Journey of GST including important milestones with way forward for GST

- Comprehensive FAQs to provide conceptual clarity on various aspects of GST in easy and understandable way

- Appendices on Model GST Law, 2016, Constitution (101st Amendment) Act, 2016, GST Draft Rules and Formats for registration, invoice, payment, returns and refunds, FAQs on GST released by CBEC etc.

DVD containing:

- Comprehensive PPT on Model GST Law, 2016

- Video presentation on highlights of Model GST Law, supply, taxable person, time of supply, place of supply, GST impact and preparedness for Service sector etc.

- GST Draft Rules & Formats on registration, invoice and payment released by the CBEC on September 26, 2016

- GST Draft Rules & Formats on returns and refunds released by the CBEC on September 27, 2016

- The Constitution (101st Amendment) Act, 2016

- Model CGST/SGST and IGST Act, 2016 along with Schedules and GST Valuation Rules

- Draft Business Processes Report on registration, payment, returns and refund, placed on public domain in the month of October, 2015

- FAQs released by CBEC

- CBEC’s PPT on GST, Background material on GST by NACEN, etc.

Our sincere thanks to you for providing your continuous support and blessings at all time and we are sure that you will find this book most comprehensive, illustrative and easy to understand. Your feedback and suggestions are important for us. Please do write back to us with your valuable suggestions and inputs.