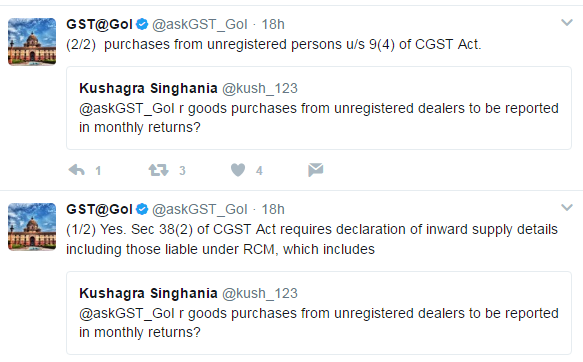

Q : Are goods purchases from unregistered dealers to be reported in monthly returns?

Yes. Section 38(2) of CGST Act requires declaration of inward supply details including those liable under RCM [ Reverse Charge Mechanism ], which includes purchases from unregistered persons under Section 9(4) of CGST Act.

[ Reply on 05.06.2017 at 2: 40 am as per Twitter Account of Govt of India for GST queries of Taxpayers ]