GST RCM ( GST Reverse Charge Mechanism )

we are analyzing in detail provision of GST Reverse Charge Mechanism with Examples

Meaning of GST RCM : Reverse Charge Mechanism

Normally, GST is payable by ‘taxable person’ who is supplying goods and service.However, in some cases, GST is payable by person recipient of the goods or services or both. This is termed as ‘reverse charge’.

The reverse charge has been defined in Section 2(98) of the CGST Act

” Reverse charge means “liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act.”

Thus ‘ Reverse charge under GST ‘ means the liability to pay tax by the person receiving goods or services or both instead of the supplier of such goods and/or services under section 9(3) or 9(4) of CGST Act or section 5(3) or 5(4) of IGST Act

Key Points about GST on RCM : GST Reverse Charge Mechanism

- Difference between GST by Direct Charge method and Reverse Charge Method : Under the Direct charge the tax is collected and paid by the supplier of the goods or services or both whereas in the reverse charge the tax is paid by the receiver of goods or services or both.

- Person not required to register under GST is not required to pay GST under reverse charge – Only a registered person is liable to pay tax under Reverse Charge. Thus, If a person who is not required to register under GST then he is not required to pay GST under reverse charge.

- Why GST collected on Reverse Charge Method :- GST Reverse Charge Mechanism (RCM) is an alternative method to collect the tax where the government think that collection of GST through Direct Charge may be difficult or the person may be the supplied the goods or services belong to unorganized sector where the identification and collection will not be easy

- RCM to be Paid by Receiver : -GST under RCM is paid by the receiver of the good or services or both . All the provisions of this Act shall apply to such person as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

- Compulsory Registration for Receiver: Section 24(iii) of CGST act 2017 casts a compulsion on the person liable to pay the tax under RCM to get registered irrespective of the threshold limit specified for GST Registration.

- Exemption from Registration to Supplier :- A person who is supplying only those goods or services or both, on which the recipient is liable to pay the tax under RCM on notified goods or services as per the provision of section 9(3), then that supplier of the good or services has been exempted from the registration as per Notification No -05/2017 dated 19/06/2017

- Invoice under reverse charge : A person liable to pay tax under GST under reverse charge is required to issue invoice in name of self. ( Note : Rs 5,000 per day exemption is available in respect of supplies from unregistered person . For supplies above this amount, a monthly consolidated invoice can be raised – S Nos. 50, 54 and 59 of Tweet FAQ released by CBE&C on 26-6-2017.)

However vide Notification No 38/2017 Central Tax (Rate) Dated 13th October, 2017 exempt payment of tax under section 9(4)( Purchases from unregistered person )of the CGST Act, 2017 till 31.03.2018 and Notification No 10/2018 Central Tax (Rate) Dated 23rd March, 2018 Seeks to exempt payment of tax under section 9(4) (Purchases from unregistered person ) of the CGST Act, 2017 till 30.06.2018

- Pay Tax in cash under reverse charge in GST because GST ITC can’t be claimed . [ Refer section 49(4) of CGST Act read with section 2(82) of CGST Act. ]

- Input Tax Credit only after payment is made : Recipient can avail the ITC on such services (on which he is liable to pay GST under reverse charge) only after making payment of that tax in his electronic cash ledger – Rule 36(b) of CGST and SGST Rules, 2017.

- Furnishing details of inward supplies – Every person liable to pay service tax under reverse charge is required to furnish details of inward supplies – Section 38(2) of CGST Act.

- Show in GSTR 2 return : Once consolidated invoice per month is made for GST liability under RCM then this is required to be uploaded in GSTR 2

- GST on RCM basis also applies to Composition Dealer : Person opting GST composition scheme has also to pay GST under reverse charge in case of receipt of goods from unregistered person if total supplies exceed Rs 5,000 per day. Refer Notification No.8/2017-Central Tax (Rate) Dated 28th June, 2017 CGST exemption from reverse charge upto Rs.5000 per day under section 11 (1) of CGST Act 2017

However vide Notification No 38/2017 Central Tax (Rate) Dated 13th October, 2017 exempt payment of tax under section 9(4)( Purchases from unregistered person )of the CGST Act, 2017 till 31.03.2018 and Notification No 10/2018 Central Tax (Rate) Dated 23rd March, 2018 Seeks to exempt payment of tax under section 9(4) (Purchases from unregistered person ) of the CGST Act, 2017 till 30.06.2018

- Aggregate turnover – ‘Aggregate turnover’ does not include value of supplies in which tax is levied under reverse charge – section 2(6) of CGST Act. ( Note : Outward supplies on which tax is paid on reverse charge basis by the recipient will be included in the aggregate turnover of the supplier. refer Q No 8 of Tweet FAQ replied by Govt)

- Output tax – “Output tax” excludes tax payable by him on reverse charge basis – section 2(82) of CGST Act and section 2(18) of IGST Act.

- Time of supply of goods – Section 12(3) of CGST Act makes separate provisions relating to supply of goods where tax is payable on reverse charge basis.

- Time of supply of service – Section 13(3) of CGST Act makes separate provisions relating to supply of services where tax is payable on reverse charge basis.

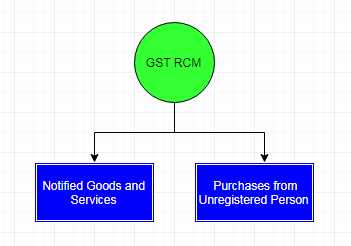

Types GST RCM : GST Reverse Charge Mechanism

There are two types of GST RCM – Reverse Charge Mechanism i.e GST has to be paid on Reverse Charge basis by receiver of goods or services under following two conditions :-

GST Reverse Charge on Notified Goods and Services

Reverse Charge on Notified Goods and Services is covered Under section 9(3) of the CGST Act.

The section 9(3) of CGST Act is reproduced as below –

“The Government may, on the recommendations of the Council, by notification ( Refer Note 1 , 2 & 3) , specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both”.

This section operates only when the government notifies certain Goods or services or Both to be covered under RCM and it operate independent of section 9(4).

Note :-

1. Reverse charge on certain specified supplies of goods under section 9 (3) of CGST Act 2017 vide Notification No.4/2017-Central Tax (Rate) Dated 28th June, 2017

2. Categories of services on which tax will be payable under reverse charge mechanism under CGST Act vide Notification No. 13/2017-Central Tax (Rate) Dated 28th June, 2017

3. By Notification No. 5/2017 – Central Tax dated 19th June, 2017 CBEC specifies the persons who are only engaged in making supplies of taxable goods or services or both, the total tax on which is liable to be paid on reverse charge basis by the recipient of such goods or services or both under sub-section (3) of Section 9 of the CGST Act 2017 as the category of persons exempted from obtaining registration under the aforesaid Act.

GST RCM on Goods / GST on Reverse charge basis on supply of notified Goods

The central government has issued the

Notification No.4/2017-Central Tax (Rate) Dated 28th June, 2017 ( Under CGST Act – Intra State) )

Notification No 4/2017-Integrated Tax (Rate) both dated 28-6-2017 ( Under IGST Act – Inter state)

effective from 1-7-2017. on which they have specified the description of the goods on which the reverse charge is applicable.

GST RCM Services / GST Reverse charge on Services

The Government has notified various services through

Notification No. 13/2017-Central Tax (Rate) Dated 28th June, 2017 ( Under CGST Act – Intra State) )

Notification Nos 10/2017-Integrated Tax (Rates) dated 28-6-2017, ( Under IGST Act – Inter state)

effective from 1-7-2017.an This Notifications specify services on which the reverse charge is applicable.

( Note : The list in CGST notification has 9 items. List in IGST notification has two additional items – (a) Import of Services and (b) Inward Ocean transport. These are not included in CGST notification as only IGST applies on these two activities )

Person Supply Goods or Services under RCM Exempted from Registration

A person who is supplying only those goods or services or both, on which the recipient is liable to pay the tax under RCM as per the provision of section 9(3), then that supplier of the good or services has been exempted from the registration as per Notification No -05/2017 dated 19/06/2017 reproduced below

In exercise of the powers conferred by sub-section (2) of section 23 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government hereby specifies the persons who are only engaged in making supplies of taxable goods or services or both, the total tax on which is liable to be paid on reverse charge basis by the recipient of such goods or services or both under sub-section (3) of section 9 of the said Act as the category of persons exempted from obtaining registration under the aforesaid Act.

GST Reverse charge on Purchase from Unregistered Persons

In case of receipt of supply of goods or services or both by a registered person from unregistered supplier, IGST/CGST will be payable by the recipient – section 9(4) of CGST Act and section 5(4) of IGST Act.

This will also apply to registered persons paying GST under composition scheme

Reverse charge on Purchase from Unregistered Perons is covered under Section 9(4) of CGST Act . and section 5(4) of IGST Act.

The Section 9(4) of the CGST Act is reproduce as below:

“The central tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both”.

The Section 5(4) of IGST Act is reproduce as below :

” The integrated tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both “

The registered person has been defined as under section 2(94) of CGST Act :

“Registered person” means a person who is registered under section 25 of the CGST Act but does not include a person having a Unique Identity Number”.

The registered person has to make the invoice and the payment voucher for each such unregistered purchase.

Exemption form Reverse Charge on Intra State (within State) Supplies from Unregistered Person

Exemption from Reverse Charge on Intra State (within State) Supplies of Rs 5000 per day from Unregistered Person till 12.10.2017

The Government has issued the Notification No 08/2017 Central Tax (Rate) Dated 28th June 2017 and it is reproduced as under.

“In exercise of the powers conferred by sub-section (1) of section 11 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on being satisfied that it is necessary in the public interest so to do, on the recommendations of the Council, hereby exempts intra-State supplies of goods or services or both received by a registered person from any supplier, who is not registered, from the whole of the central tax leviable thereon under sub-section (4) of section 9 of the Central Goods and Services Tax Act, 2017 (12 of 2017): Provided that the said exemption shall not be applicable where the aggregate value of such supplies of goods or service or both received by a registered person from any or all the suppliers, who is or are not registered, exceeds five thousand rupees in a day”.

on 13.10.2017 Govt issued following Notifications and Clarified that there is no need to pay Tax on intra state (within State) Purchase of goods from unregistered person till 30.6.2018 irrespective of value of purchase.

Exemption from Reverse Charge on Intra State (within State) Supplies from Unregistered Person till 30.06.2018

- Notification No 38/2017 Central Tax (Rate) Dated 13th October, 2017 exempt payment of tax under section 9(4) of the CGST Act, 2017 till 31.03.2018

- Notification No 10/2018 Central Tax (Rate) Dated 23rd March, 2018 Seeks to exempt payment of tax under section 9(4) of the CGST Act, 2017 till 30.06.2018

Latest Articles

Applicability of Reverse Charge Mechanism (RCM) on Purchases from Unregistered Persons

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |

Nice…. Informative…. Knowledgeable …

Thansk for It…

Keep It On..

Dear Sir,

G. Morning,

my query is related to RCM applicably under GTA services.

our transports has picking the material in our principal place that is Delhi and transported into other state like (UP, Bihar, Kerala, Tamil Nadu etc.) and he is registered in Gujarat.

so my questing is above said query what tax has to paid in above situation (CGST +SGST) OR IGST Requested please clarify the same please .

regards,

Kuber