GST Refunds – Analysis of Draft Rules released by Govt of India

Key Points about Draft Rules Related to GST Refunds

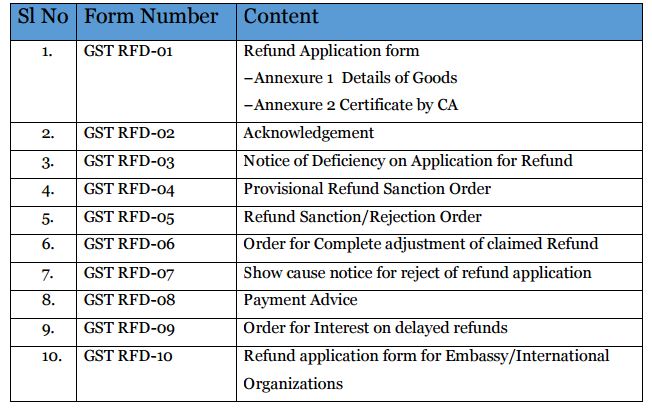

- 10 Forms (Form GST RFD-01 to GST RFD-10) pertain to GST refund are released.

- A common GST refund application is prescribed for all refunds arising on various instances including refund of unutilised input tax credits except for certain persons notified. The GST refund application has to be filed through GSTN.

- The GST refund of balance in Electronic Cash Ledger can be claimed through periodical returns.

- GST Refund application has to be accompanied by prescribed documents along with CA Certificate to certify that incidence of the tax has not been passed to any person, wherever applicable.

- The acknowledgment for filing GST refund application will be available in GSTN only after verification of information and documents filed. Any deficiency will be communicated in prescribed form through GSTN.

- Any deficiency noted by Central GST officer will be communicated to State GST officer and vice versa.

- Acknowledgment for GST refund of balance in Electronic Cash Ledger will be given immediately.

- The GST refund of tax on supplies made to Developer of SEZ or Unit in a SEZ shall be made by the respective developer of the SEZ or the SEZ unit itself.

- Provisional GST Refund of 80% to prescribed taxable persons as per the GST law is subject to conditions including GST Compliance Rating of more than 5 on a scale of 10.

- GST Refunds including provisional GST refunds will be directly credited to the bank accounts of the tax payer as declared while obtaining registration including interest on delayed refunds.

Download Draft GST Refund Rules released by Govt

Download Draft GST Refund Forms released by CBEC

Education Guide on Goods & Service Tax (GST)