Decisions taken by the GST Council in the 17th meeting – 18 June 2017

I. Decisions with respect to GST rates for Services

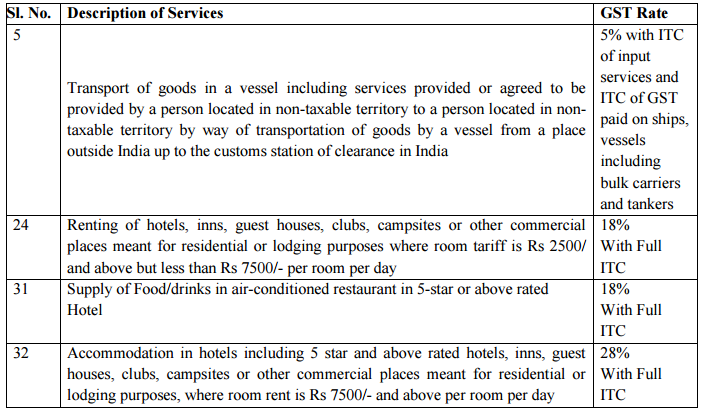

1. It has been decided in respect of the service of transport of goods by a vessel that GST rate of 5% will be available with ITC in respect of input services and GST paid on ships, vessels including bulk carriers and tankers.

2. It has been decided that accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes where room tariff is Rs 2500/- and above but less than Rs 7500/- per room per day shall attract GST rate of 18% with full ITC.

3. Accommodation in hotels including 5 star and above rated hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes, where room rent is Rs 7500/- and above per day per room shall attract GST rate of 28% with full ITC.

4. Supply of Food/drinks in air-conditioned restaurant in 5-star or above rated Hotel shall attract GST rate of 18% with full ITC.

Accordingly, the following entries of the schedule of GST Rates for Services as approved by the GST Council shall be modified as under:

II. It has been decided that supply of lottery shall attract GST rates as under –

1. Lottery run by State Governments – 12% of face value of lottery ticket

2. Lottery authorized by State Governments – 28% of face value of lottery ticket

Related Post on 17th GST Council Decisions

GST Return filing for July & Aug 2017 relaxed by Govt 18.06.2017

17 th GST Council Meeting Decisions on 18.06.2017 – Composition Levy and GST Rate on Certian Goods

Result of GST Council 17th meeting 18.06.2017 – Press Conference by Arun Jaitley

Download PDF file of GST Council Decision on Services in 17th GST Council Meeting on 18.06.2017