GSTR 3B Format

This article will explain GSTR 3B meaning and will provide GSTR 3B format.

GSTR 3B meaning

GSTR 3B format as per Rule 61(5) of CGST Rules 2017 : Where the time limit for furnishing of details in FORM GSTR-1 under section 37 and in FORM GSTR-2 under section 38 has been extended and the circumstances so warrant, return in FORM GSTR-3B, in lieu of FORM GSTR-3, may be furnished in such manner and subject to such conditions as may be notified by the Commissioner

Since the Govt has deferred the filing of GSTR 3 , therefore it has notified simple form GSTR 3B

What is GSTR 3B Format ?

GSTR-3B is a monthly self-declaration that has to be filed a registered dealer from July 2017 till July 2018. Points to Note:

- You must file a separate GSTR-3B for each GSTIN you have

- Tax liability of GSTR-3B must be paid by the last date of filing GSTR-3B for that month

- GSTR-3B cannot be revised

Download GSTR 3B Format in PDF

After Download GSTR 3B format you must read instructions of GSTR 3B format

Who should file GSTR 3B Format ?

Every person who has registered for GST must file the return GSTR -3B including nill returns.

However, the following registrants do not have to file GSTR-3B

- Input Service Distributors & Composition Dealers

- Suppliers of OIDAR

- Non-resident taxable person

Late Fee & Penalty for not filing in GSTR 3B Format

Filing GSTR-3B is mandatory even for nill returns. Late Fee for filing GSTR-3B after the due date is as follows:

- Rs. 50 per day of delay

- Rs. 20 per day of delay for taxpayers having Nil tax liability for the month

Interest @ 18% per annum is payable on the amount of outstanding tax to be paid.

**Late fee for July, August, and September has been waived

GSTR 3B :Relevant Material for GST Returns

What is the late Fees for not filing GSTR 3B on due dates ?

Exporters advised to file Table 6A and GSTR 3B for IGST Refund : Govt Press release

Where to show unregistered purchase in GSTR 3B after 13th Oct 2017

[Video] GSTR 3B New Features : Explained by GSTN

[Video] GST News [ Part 172 ] GSTR 3B return Filing Changed w.e.f 21.02.2018 : by CA Satbir Singh

Filing GSTR 3B is now made more User friendly w.e.f 21.02.2018

GST Paid short in GSTR 3B : How interest will be calculated

How to rectify errors done while filing GSTR 3B ?

Will GSTR 3B be reconciled with GSTR 1 , GSTR 2 and GSTR 3

How to make Adjustments in GSTR 3B ?

GST Returns : Free study Material

Time to File GSTR 3B

| Revised Return Timelines | |||

| Month | GSTR-3B | GSTR-1 | GSTR-2 |

| July, 2017 | 20th August, 2017 | 1st -5th September, 2017 | 6th-10th September, 2017 |

| August, 2017 | 20th September, 2017 | 16th-20th September, 2017 | 21st-25th September, 2017 |

Relevant Notifications

| Title | Notification No. | Date |

|---|---|---|

| CBEC notifies date for filing of GSTR-3B for July & August 2017 | Notification No. 21/2017-Central Tax | 08/08/2017 |

| CBEC extends time for filing of Form GSTR-3 for July & August 2017 | Notification No. 20/2017-Central Tax | 08/08/2017 |

| CBEC extends time for filing of Form GSTR-2 for July & August 2017 | Notification No. 19/2017-Central Tax | 08/08/2017 |

| CBEC extends time for filing of Form GSTR-1 for July & August 2017 | Notification No. 18/2017-Central Tax | 08/08/2017 |

Video on GSTR 3B : How to fill GSTR 3B

Step-by-step Guide for filing GSTR 3B Form

Form GSTR-3B consists of 6 Tables:

| Sr No | GSTR 3B Table No | Particulars |

| 1 | 1 | GSTIN number of Registered Person |

| 2 | 2 | Legal name of Registered Person |

| 3 | 3.1 | Summary of Outward Supply & Inward Supply under Reverse Charge |

| 4 | 3.2 | Bifurcation of Inter-state outward supplies as follows: a) To unregistered Person b) To Composite taxable Person c) To UIN Holders |

| 5 | 4 | Summary of eligible ITC claim bifurcated into IGST, CGST & SGST/UTSGT and Cess |

| 6 | 5 | Summary of Exempted, Nil rated and Non GST inward supplies |

| 7 | 6.1 | Details of payment of tax, which includes Category wise tax payable, ITC availed , TDS credit and Tax paid in cash along with interest and late fees (Though it is not applicable for initial 2 return) |

| 8 | 6.2 | Summary of tax category wise TDS/TCS credit |

Following are detailed analysis of each table:

1. Details of outward supplies and inward supplies liable to reverse charge

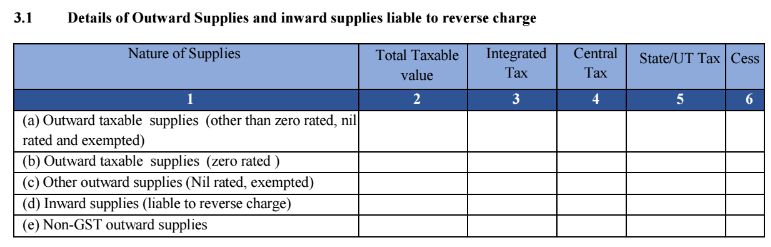

Analysis table 3.1 of Form GSTR 3B:

1. Submission of summarized details of Total taxable value, applicable tax and cess in each category i.e. IGST, CGST, SGST/UTGST and Cess.

2. Table 3.1 (a) : Reporting of Taxable Outward Supplies only

3. Table 3.1 (b) : Reporting Zero rated supplies i.e. Export and supplies to SEZ unit

4. Table 3.1 (c) : Reporting of Outward Nil Rated and Exempted supplies

5. Table 3.1 (d): Reporting of supplies liable to tax under Reverse Charge Mechanism (RCM). Reporting is only for taxable value after taking deduction of Rs. 5000/- per day.

6. Table 3.1 (d): Non-GST Outward Supplies i.e. Petrol, diesel, etc

7. Taxable value= Value of invoices + value of Debit Notes – value of credit notes + value of advances received for which invoices have not been issued in the same month – value of advances adjusted against invoices.

2. Details of inter-State supplies made to unregistered persons, composition dealer and UIN holders

Analysis table 3.2 of GSTR 3B format :

1. Table no 3.2 is breakdown of 3.1, no tax is calculated on these value

2. These details need to be reported State-wise/ union-territory wise along with IGST payable for each head

3. Details of eligible Input Tax Credit

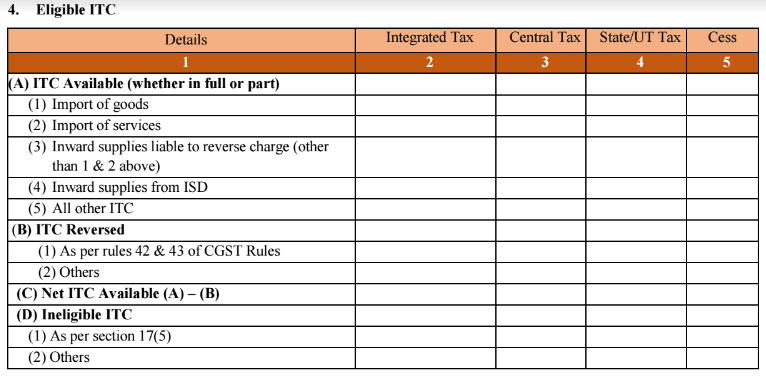

Analysis table 4 of Form GSTR 3B:

1. Table 4 is Summarized data of Input tax credit (ITC), it requires to report the details of ITC availability, ITC to be reversed, and Net ITC available. Here only value of input tax credit is required to report like ER-1 Return.

A) ITC Available

2. Table 4(A)(1): GST paid on import of goods as per bill of entry

3. Table 4(A)(2): RCM paid on import of services

4. Table 4(A)(3): RCM paid other than import of services but including URD supplies, and specified services i.e. GTA, advocate, sponsorships, etc

5. Table 4(A)(4): ITC on account of inward supply/distribution from ISD

6. Table 4(A)(5): All other ITC i.e. regular inward supply of goods and services including capital goods

B) ITC Reversal: ITC as above need to be adjusted for reversal to arrive at eligible ITC

7. Table 4(B)(1): Reversal of ITC used exclusively for exempt supplies, common ITC including capital goods towards exempt supplies & non-business use, etc

8. Table 4(B)(2): Other reversal of ITC i.e. blocked credit u/s 17

C) Net ITC available: Balance ITC, which can be utilized towards payment of GST

9. Table 4(C): Net ITC available for adjustment towards output liability

D) Ineligible ITC

10. Table 4(D)(1): Reporting of blocked ITC i.e. Food & beverages, Rent a Cab, Free Sample, write-off, etc

11. Table 4(D)(2): Other ineligible credit

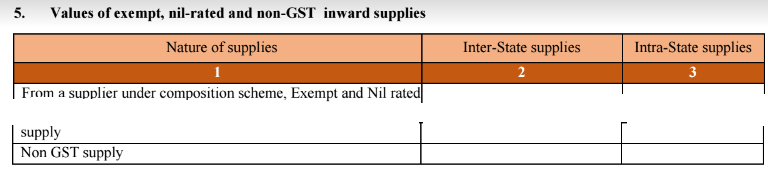

4. Details of exempt, nil-rated and non-GST inward supplies

Table 5 is for reporting of details of inward supplies from the composition dealer, nil rated items and exempt inward supplies and Non-GST inward supplies.

5. Payment of tax

Analysis table 6 of Form GSTR 3B:

- Main purpose of GSTR 3B return is to arrive at tax liability and this section helps to self-ascertain tax liability.

- Section 6.1 is the summary of table 3.1, table 4(C) and table 6.2.

- Reporting of tax payable on outward liability, RCM on inward liability into separate tax category i.e. IGST, CGST and SGST/UTGST and cess.

- Reporting of ITC utilized and balance tax payable.

- Details of tax paid through challan.

- RCM tax has to be paid in cash only; ITC cannot be utilized towards RCM liability, though no restriction is provided Form No GSTR-3B

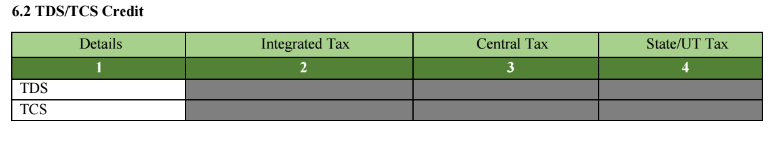

6. TDS/TCS Credit

Table 6.2 is towards reporting of TDS & TCS by the government establishment and E-commerce operator, however, these provision are kept in absence, thus no reporting for the month of July 2017.

Certain Important Aspects of GSTR 3B:

- Form GSTR 3B can filed only though ONLINE MODE, no office line utility/tool is provided to import of data

- This return is not applicable for Composite dealer.

- Figures reported in Form GSTR # 3B will be provisional, these figures will form basis for preparation of GSTR-3, and however, same can be rectified by paying additional tax liability and/or availing differential ITC in electronic credit ledger.

- GSTR-3B does not provide the column for brought forward of CENVAT credit & VAT credit from earlier indirect tax regime, thus it seems adjustment towards balance of CENVAT credit and VAT credit against GST tax liability may not be available. We will have to wait and watch for further clarification on subject matter.

- Transitional credit will only be available after submission of Form No GSTR TRNS-1.

- Applicable Sections, rules and notifications for submission of GSTR 3B is as under

| Title | Notification No. | Date |

|---|---|---|

| CBEC notifies date for filing of GSTR-3B for July & August 2017 | Notification No. 21/2017-Central Tax | 08/08/2017 |

| CBEC extends time for filing of Form GSTR-3 for July & August 2017 | Notification No. 20/2017-Central Tax | 08/08/2017 |

| CBEC extends time for filing of Form GSTR-2 for July & August 2017 | Notification No. 19/2017-Central Tax | 08/08/2017 |

| CBEC extends time for filing of Form GSTR-1 for July & August 2017 | Notification No. 18/2017-Central Tax | 08/08/2017 |

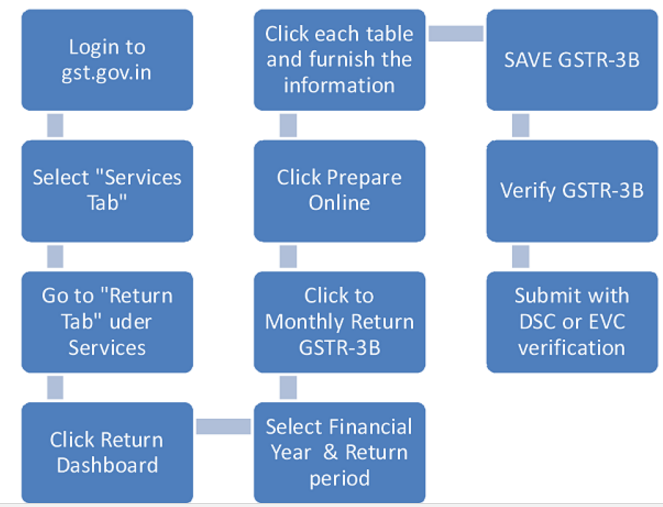

7. How to submit GSTR 3B return Online:

(i) GSTR 3B can be submitted through ONLINE MODE only, that means data has to be inserted manually using online portal “GST.GOV.IN”.

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |

This in this article we discussed

gstr 3b meaning,

gstr 3b format,

how to file gstr 3b online,

gstr 3b format download,

gstr 3b download,

gstr 3b filing,

gstr 3b form download,

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal