How to Appy for Common Enrolment of Transporter (GST ENR-02) on E Way bill Portal

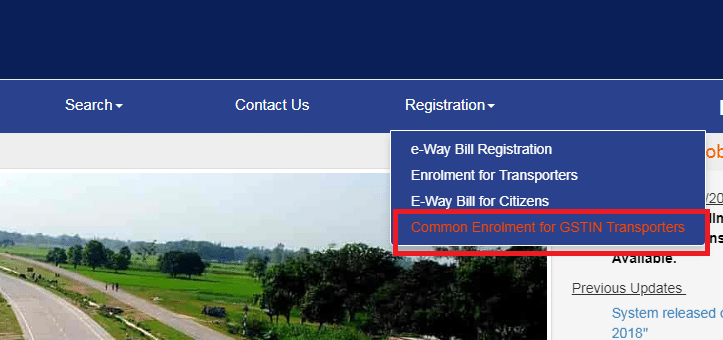

Step 1: Got to Eway Bill Portal (https://ewaybill.nic.in/) and Click Registration and then Common Enrolment for GSTIN transporters

Also refer Benefits of Common Enrolment for Registered Transporters on Eway Bill Portal

Step 2 ; Then you will be asked to enter your GSTIN number and OTP will be sent on your registered mobile number and E mail address and then you can proceed further.

Related Post

Common Enrolment for Registered Transporters on Eway Bill Portal

New E-way Bill Changes from 16.11.2018

Eway bill in case of imported goods : Amendment in CGST Rules 138A

New FAQs on E-Way Bill System enhancements w.e.f 01.10.2018

E-Way Bill FAQs on Officer (MIS) Module

E-Way Bill DashBoard system for Top Administrators of Center / State Govt

Changes in E-Way Bill System from 1st October 2018

Forthcoming changes in E-Way Bill System

Govt Proposal to allow e-way bill only if Vehicle is Fit

New Improvements in E way Bill 04.07.18

Eway bill login Official website in India

Bill to Ship to under GST and Eway Bill : Analysis

Whether Eway bill required for Exports of Goods

New tool for ewaybill generation bulk (Ver 1.0.0618)

Cases where ewaybill is not required during Transportation of Goods

[Video] Eway Bill New Updates on EWay bill Portal : GST News 326

Pingback: Eway Bill : Free Video Lectures and Study Material - Tax Heal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal