E file Income Tax Appeal with CIT (appeals)

1. Login to user account in Income Tax E-filing Website

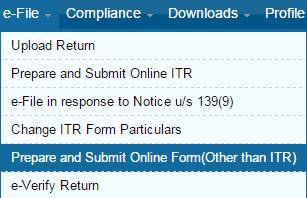

2. Go to menu -> e-File -> Prepare and Submit Online Form (Other than ITR)

3. The following window appears:

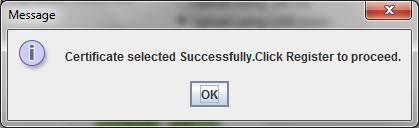

Fill the PAN, under Form Name Select “35” , select the Assessment year for which appeal is to be filed and finally Select the type of Digital Signature Certificate. (make sure that you have registered the DSC with e-filing portal under “Profile” menu)

On successful selection of DSC, the following message will flash.

Click on “OK” and then on Continue to proceed to fill Form-35

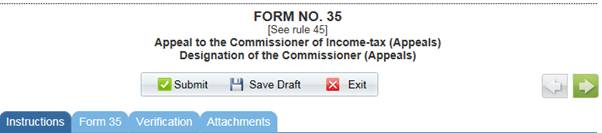

4. The following Form-35 window opens:

(a) There are four sections in the form:

1. Instruction,

2. Form-35,

3. Verification, and

4. Attachments (must not exceed 50mb in size/ must be in pdf/zip format)

(b) Read all the Instructions carefully before beginning to fill Form-35

(c) In Form-35 there are 16 para where information is required to be filled including statement of facts and grounds of appeals

(d) Name and PAN of the appellant is pre-filled and rest of the paras are required to be responded by filling/selecting appropriate facts/options

(e) The following attachments are mandatorily required:

(i) Copy of Challan for appeal fee paid

(ii) Copy of order appealed against

(iii) Notice of demand

5. After fully satisfying that form-35 has been properly filled and all required attachments have been duly attached, it can be submitted, saved as draft for filing later.

Electronic filing of first appeal before CIT(Appeals)

CBDT Notification e-Form 35 Format, manner of signing by DSC or EVC