How to get GST TDS Refund

GST Law also mandates Tax Deduction at Source (TDS) vide Section 51 of the CGST/SGST Act 2017, Section 20 of the IGST Act, 2017 and Section 21 of the UTGST Act, 2017. GST Council in its 28th meeting held on 21.07.2018 recommended the introduction of TDS from 01.10.2018. [ Refer Notification No. 50/2018 – Central Tax ]

How to get refund of TDS deducted under GST ,explained by CA Satbir Singh in Hindi

when can you apply for refund of GST TDS ?

Relevant portion of Section 51 (8) of CGST Act 2017 :-

(8)The refund to the deductor or the deductee arising on account of excess or erroneous deduction shall be dealt with in accordance with the provisions of section 54:

When you can not apply for refund of GST TDS ?

Relevant portion of Section 51 (8) of CGST Act 2017 :-

Provided that no refund to the deductor shall be granted, if the amount deducted has been credited to the electronic cash ledger of the deductee.

Note: The deductee can accept/ reject the TDS details auto-populated to TDS and TCS Credit received table of his/her return. Taking action by deductee is mandatory for crediting the amount of TDS to cash ledger.

Thus TDS amount will be credited to deductee’s Electronic Cash Ledger only after his/ her accepting of TDS and TCS credit received (which is auto populated on filing of returns by the deductor in GSTR 7 ).

Refer How to Accept GST TDS deducted by Deductee

How can you apply for refund of GST TDS ?

TDS liability can be discharged by Tax deductor through Electronic Cash Ledger only at the time of filing return (GSTR -7)

Relevant portion of Section 49 (6 ) of CGST Act 2017 :-

(6) The balance in the electronic cash ledger or electronic credit ledger after payment of tax, interest, penalty, fee or any other amount payable under this Act or the rules made thereunder may be refunded in accordance with the provisions of section 54.

Relevant portion of Section 54 of CGST Act 2017

Provided that a registered person, claiming refund of any balance in the electronic cash ledger in accordance with the provisions of sub-section (6) of section 49, may claim such refund in the return furnished under section 39 in such manner as may be prescribed [ Refer Rule 89 of CGST Rules 2017 ]

As per Rule 89 (1) of CGST Rules 2017

Provided that any claim for refund relating to balance in the electronic cash ledger in accordance with the provisions of sub-section (6) of section 49 may be made through the return furnished for the relevant tax period in FORM GSTR-3 or FORM GSTR-4 or FORM GSTR-7, as the case may be:

Comment :GSTR 7 is return which the TDS deductor is required to file.

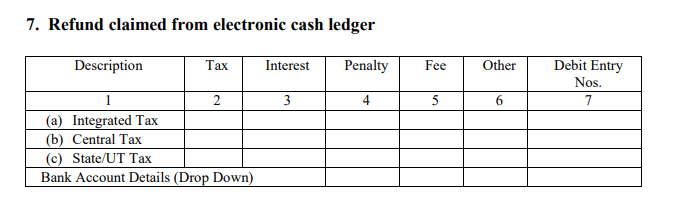

Relevant Portion of GSTR 7 to Claim refund of GST TDS

Refer GST Refund of Excess amount from Electronic Cash Ledger : FAQ’s

Pingback: How to Accept GST TDS deducted by Deductee - Tax Heal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal