Section 270A of Income Tax Act

( Section 270A – penalty in cases of under reporting and misreporting of income )

Finance Bill 2016

Rationalisation of penalty provisions

Under the existing provisions, penalty on account of concealment of particulars of income or furnishing inaccurate particulars of income is leviable under section 271(1)(c) of the Income-tax Act. In order to rationalize and bring objectivity, certainty and clarity in the penalty provisions, it is proposed that section 271 shall not apply to and in relation to any assessment for the assessment year commencing on or after the 1stday of April, 2017 and subsequent assessment years and penalty be levied under the newly inserted section 270A with effect from 1stApril, 2017. The new section 270A provides for levy of penalty in cases of under reporting and misreporting of income.

[ Read Post :-How much Taxes to be Paid if you Deposit Undisclosed Income in Bank Account

Analysis with Examples section 270A of Income Tax -200% Penalty ]

Sub-section (1) of the proposed new section 270A seeks to provide that the Assessing Officer, Commissioner (Appeals) or the Principal Commissioner or Commissioner may levy penalty if a person has under reported his income.

It is proposed that a person shall be considered to have under reported his income if,-

(a) the income assessed is greater than the income determined in the return processed under clause (a) of sub-section (1) of section 143;

(b) the income assessed is greater than the maximum amount not chargeable to tax, where no return of income has been furnished;

(c) the income reassessed is greater than the income assessed or reassessed immediately before such re-assessment;

(d) the amount of deemed total income assessed or reassessed as per the provisions of section 115JB or 115JC, as the case may be, is greater than the deemed total income determined in the return processed under clause (a) of sub-section (1) of section 143;

(e) the amount of deemed total income assessed as per the provisions of section 115JB or 115JC is greater than the maximum amount not chargeable to tax, where no return of income has been filed;

(f) the income assessed or reassessed has the effect of reducing the loss or converting such loss into income.

The amount of under-reported income is proposed to be calculated in different scenarios as discussed herein. In a case where return is furnished and assessment is made for the first time the amount of under reported income in case of all persons shall be the difference between the assessed income and the income determined under section 143(1)(a). In a case where no return has been furnished and the return is furnished for the first time, the amount of under-reported income is proposed to be:

(i) for a company, firm or local authority, the assessed income;

(ii) for a person other than company, firm or local authority, the difference between the assessed income and the maximum amount not chargeable to tax.

In case of any person, where income is not assessed for the first time, the amount of under reported income shall be the difference between the income assessed or determined in such order and the income assessed or determined in the order immediately preceding such order.

It is further proposed that in a case where under reported income arises out of determination of deemed total income in accordance with the provisions of section 115JB or section 115JC, the amount of total under reported income shall be determined in accordance with the following formula-

(A – B) + (C – D)

where,

A = the total income assessed as per the provisions other than the provisions contained in section 115JB or section 115JC (herein called general provisions);

B = the total income that would have been chargeable had the total income assessed as per the general provisions been reduced by the amount of under reported income;

C = the total income assessed as per the provisions contained in section 115JB or section 115JC;

D = the total income that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JC been reduced by the amount of under reported income.

However, where the amount of under reported income on any issue is considered both under the provisions contained in section 115JB or section 115JC and under general provisions, such amount shall not be reduced from total income assessed while determining the amount under item D.

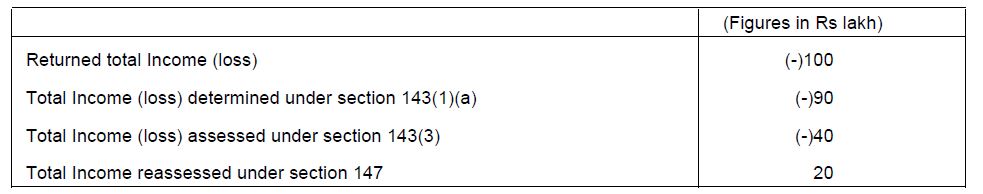

It is clarified that in a case where an assessment or reassessment has the effect of reducing the loss declared in the return or converting that loss into income, the amount of under reported income shall be the difference between the loss claimed and the income or loss, as the case may be, assessed or reassessed.

Calculation of under-reported income in a case where the source of any receipt, deposit or investment is linked to earlier year is proposed to be provided based on the existing Explanation 2 to sub-section (l) of section 271 (1).

It is also proposed that the under-reported income under this section shall not include the following cases:

(i) where the assessee offers an explanation and the income-tax authority is satisfied that the explanation is bona fide and all the material facts have been disclosed;

(ii) where such under-reported income is determined on the basis of an estimate, if the accounts are correct and complete but the method employed is such that the income cannot properly be deducted therefrom;

(iii) where the assessee has, on his own, estimated a lower amount of addition or disallowance on the issue and has included such amount in the computation of his income and disclosed all the facts material to the addition or disallowance;

(iv) where the assessee had maintained information and documents as prescribed under section 92D, declared the international transaction under Chapter X and disclosed all the material facts relating to the transaction;

(v) where the undisclosed income is on account of a search operation and penalty is leviable under section 271AAB.

It is proposed that the rate of penalty shall be fifty per cent of the tax payable on under-reported income. However in a case where under reporting of income results from misreporting of income by the assessee, the person shall be liable for penalty at the rate of two hundred per cent of the tax payable on such misreported income. The cases of misreporting of income have been specified as under:

(i) misrepresentation or suppression of facts;

(ii) non-recording of investments in books of account;

(iii) claiming of expenditure not substantiated by evidence;

(iv) recording of false entry in books of account;

(v) failure to record any receipt in books of account having a bearing on total income;

(vi) failure to report any international transaction or deemed international transaction under Chapter X.

It is also proposed that in case of company, firm or local authority, the tax payable on under reported income shall be calculated as if the under-reported income is the total income. In any other case the tax payable shall be thirty per cent of the under-reported income.

It is also proposed that no addition or disallowance of an amount shall form the basis for imposition of penalty, if such addition or disallowance has formed the basis of imposition of penalty in the case of the person for the same or any other assessment year.

These amendments will take effect from 1st day of April, 2017 and will, accordingly apply in relation to assessment year 2017-2018 and subsequent years.

Consequential amendments have been proposed in sections 119, 253, 271A, 271AA, 271AAB, 273A and 279 to provide reference to newly inserted section 270A.

The provisions of section 270A are illustrated through examples as below:

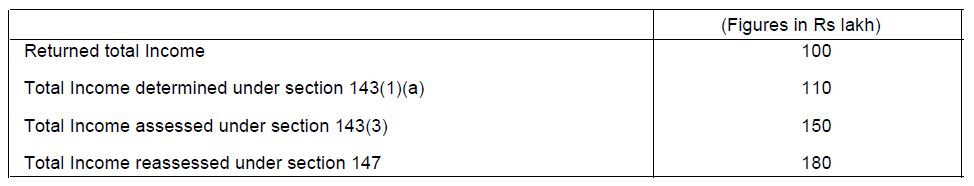

Example 1. Case is of a firm liable to tax at the rate of 30 per cent.:

Considering that none of the additions or disallowances made in assessment or reassessment as above qualifies under sub-section (6) of section 270A, the penalty would be calculated as under:

* Considering under-reported income is not on account of misreporting

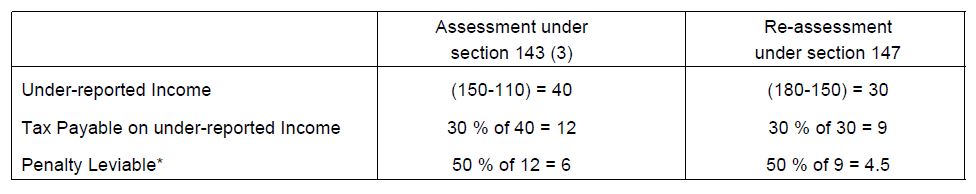

Example 2. Case is of an individual below 60 years of age and no return of income has been furnished:

* Being maximum amount not chargeable to tax

** Considering under-reported income is not on account of misreporting

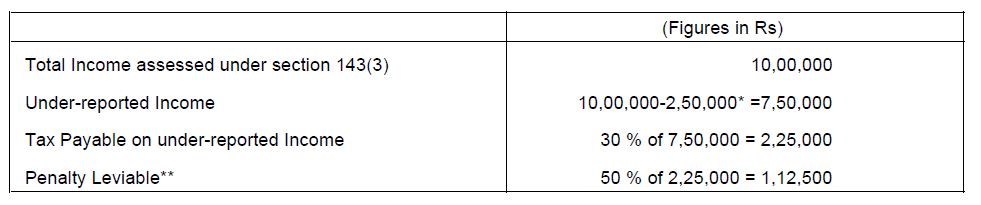

Example 3. Case is of a company liable to tax at the rate of 30 per cent.:

Considering that none of the additions or disallowances made in assessment or reassessment as above qualifies under sub-section (6) of section 270A, the penalty would be calculated as under:

* Considering under-reported income is not on account of misreporting

[Clause 62, 93, 96, 98, 99, 100, 101, 104 & 107 of Finance Bill 2016]

Immunity from Penalty :- Finance Act, 2016 provides for Immunity from imposition of penalty in certain circumstances through insertion of section 270AA in the Act

Section 270A of Income Tax Act [ Inserted by Section 98 of Finance Act 2016 ]

Insertion of new section 270A.

98. After section 270 of the Income-tax Act [as it stood immediately before its omission by section 105 of the Direct Tax Laws (Amendment) Act, 1987], the following section shall be inserted with effect from the 1st day of April, 2017, namely:—

‘270A. Penalty for under reporting and misreporting of income.—(1) The Assessing Officer or the Commissioner (Appeals) or the Principal Commissioner or Commissioner may, during the course of any proceedings under this Act, direct that any person who has under-reported his income shall be liable to pay a penalty in addition to tax, if any, on the under-reported income.

(2) A person shall be considered to have under-reported his income, if—

| (a) | the income assessed is greater than the income determined in the return processed under clause (a) of sub-section (1) of section 143; | |

| (b) | the income assessed is greater than the maximum amount not chargeable to tax, where no return of income has been furnished; | |

| (c) | the income reassessed is greater than the income assessed or reassessed immediately before such reassessment; | |

| (d) | the amount of deemed total income assessed or reassessed as per the provisions of section 115JB or section 115JC, as the case may be, is greater than the deemed total income determined in the return processed under clause (a) of sub-section (1) of section 143; | |

| (e) | the amount of deemed total income assessed as per the provisions of section 115JB or section 115JC is greater than the maximum amount not chargeable to tax, where no return of income has been filed; | |

| (f) | the amount of deemed total income reassessed as per the provisions of section 115JB or section 115JC, as the case may be, is greater than the deemed total income assessed or reassessed immediately before such, reassessment; | |

| (g) | the income assessed or reassessed has the effect of reducing the loss or converting such loss into income. |

(3) The amount of under-reported income shall be,—

| (i) | in a case where income has been assessed for the first time,— |

| (a) | if return has been furnished, the difference between the amount of income assessed and the amount of income determined under clause (a) of sub-section (1) of section 143; | |

| (b) | in a case where no return has been furnished,— |

| (A) | the amount of income assessed, in the case of a company, firm or local authority; and | |

| (B) | the difference between the amount of income assessed and the maximum amount not chargeable to tax, in a case not covered in item (A); |

| (ii) | in any other case, the difference between the amount of income reassessed or recomputed and the amount of income assessed, reassessed or recomputed in a preceding order: |

Provided that where under-reported income arises out of determination of deemed total income in accordance with the provisions of section 115JB or section 115JC, the amount of total under-reported income shall be determined in accordance with the following formula—

(A — B) + (C — D)

where,

A = the total income assessed as per the provisions other than the provisions contained in section 115JB or section 115JC (herein called general provisions);

B = the total income that would have been chargeable had the total income assessed as per the general provisions been reduced by the amount of under-reported income;

C = the total income assessed as per the provisions contained in section 115JB or section 115JC;

D = the total income that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JC been reduced by the amount of under-reported income:

Provided further that where the amount of under-reported income on any issue is considered both under the provisions contained in section 115JB or section 115JC and under general provisions, such amount shall not be reduced from total income assessed while determining the amount under item D.

Explanation.—For the purposes of this section,—

| (a) | “preceding order” means an order immediately preceding the order during the course of which the penalty under sub-section (1) has been initiated; | |

| (b) | in a case where an assessment or reassessment has the effect of reducing the loss declared in the return or converting that loss into income, the amount of under-reported income shall be the difference between the loss claimed and the income or loss, as the case may be, assessed or reassessed. |

(4) Subject to the provisions of sub-section (6), where the source of any receipt, deposit or investment in any assessment year is claimed to be an amount added to income or deducted while computing loss, as the case may be, in the assessment of such person in any year prior to the assessment year in which such receipt, deposit or investment appears (hereinafter referred to as “preceding year”) and no penalty was levied for such preceding year, then, the under-reported income shall include such amount as is sufficient to cover such receipt, deposit or investment.

(5) The amount referred to in sub-section (4) shall be deemed to be amount of income under-reported for the preceding year in the following order—

| (a) | the preceding year immediately before the year in which the receipt, deposit or investment appears, being the first preceding year; and | |

| (b) | where the amount added or deducted in the first preceding year is not sufficient to cover the receipt, deposit or investment, the year immediately preceding the first preceding year and so on. |

(6) The under-reported income, for the purposes of this section, shall not include the following, namely:—

| (a) | the amount of income in respect of which the assessee offers an explanation and the Assessing Officer or the Commissioner (Appeals) or the Commissioner or the Principal Commissioner, as the case may be, is satisfied that the explanation is bona fide and the assessee has disclosed all the material facts to substantiate the explanation offered; | |

| (b) | the amount of under-reported income determined on the basis of an estimate, if the accounts are correct and complete to the satisfaction of the Assessing Officer or the Commissioner (Appeals) or the Commissioner or the Principal Commissioner, as the case may be, but the method employed is such that the income cannot properly be deduced therefrom; | |

| (c) | the amount of under-reported income determined on the basis of an estimate, if the assessee has, on his own, estimated a lower amount of addition or disallowance on the same issue, has included such amount in the computation of his income and has disclosed all the facts material to the addition or disallowance; | |

| (d) | the amount of under-reported income represented by any addition made in conformity with the arm’s length price determined by the Transfer Pricing Officer, where the assessee had maintained information and documents as prescribed under section 92D, declared the international transaction under Chapter X, and, disclosed all the material facts relating to the transaction; and | |

| (e) | the amount of undisclosed income referred to in section 271AAB. |

(7) The penalty referred to in sub-section (1) shall be a sum equal to fifty per cent of the amount of tax payable on under-reported income.

(8) Notwithstanding anything contained in sub-section (6) or sub-section (7), where under-reported income is in consequence of any misreporting thereof by any person, the penalty referred to in sub-section (1) shall be equal to two hundred per cent of the amount of tax payable on under-reported income.

(9) The cases of misreporting of income referred to in sub-section (8) shall be the following, namely:—

| (a) | misrepresentation or suppression of facts; | |

| (b) | failure to record investments in the books of account; | |

| (c) | claim of expenditure not substantiated by any evidence; | |

| (d) | recording of any false entry in the books of account; | |

| (e) | failure to record any receipt in books of account having a bearing on total income; and | |

| (f) | failure to report any international transaction or any transaction deemed to be an international transaction or any specified domestic transaction, to which the provisions of Chapter X apply. |

(10) The tax payable in respect of the under-reported income shall be—

| (a) | where no return of income has been furnished and the income has been assessed for the first time, the amount of tax calculated on the under-reported income as increased by the maximum amount not chargeable to tax as if it were the total income; | |

| (b) | where the total income determined under clause (a) of sub-section (1) of section 143 or assessed, reassessed or recomputed in a preceding order is a loss, the amount of tax calculated on the under-reported income as if it were the total income; | |

| (c) | in any other case determined in accordance with the formula— | |

| (X-Y) | ||

| where, | ||

| X = the amount of tax calculated on the under-reported income as increased by the total income determined under clause (a) of sub-section (1) of section 143 or total income assessed, reassessed or recomputed in a preceding order as if it were the total income; and | ||

| Y = the amount of tax calculated on the total income determined under clause (a) of sub-section (1) of section 143 or total income assessed, reassessed or recomputed in a preceding order. |

(11) No addition or disallowance of an amount shall form the basis for imposition of penalty, if such addition or disallowance has formed the basis of imposition of penalty in the case of the person for the same or any other assessment year.

(12) The penalty referred to in sub-section (1) shall be imposed, by an order in writing, by the Assessing Officer, the Commissioner (Appeals), the Commissioner or the Principal Commissioner, as the case may be.”.

Related Posts on Income Tax Penalty

- Download Form No 68 – Grant immunity from penalty u/s 270A -Notified by CBDT for under-reporting or misreporting of income

- No penalty when Assessee surrendered undisclosed income & taxed based on seized papers

- Analysis with Examples section 270A of Income Tax -200% Penalty

- Penalty in Search u/s 271AAB of Income Tax Act

- Penalty for inaccurate particulars in Income Tax Return

- Penalty Rs 10000 for failure to comply notice of Income tax

- TCS Penalty as per Income tax Act

- No penalty on possession of high denomination notes if period to encash expired

- No Penalty merely on admission of addition of Income by Assessee when it is not part of undisclosed Income

- Penalty for sec. 269SS violation couldn’t imposed after six months of limitation period

- Download Form No 68 – Grant immunity from penalty u/s 270A -Notified by CBDT for under-reporting or misreporting of income

- Date of failure is relevant for the purpose of Imposing penalty : Supreme Court

- No penalty when show cause notice is silent on ‘ suppression ‘

- Section 269SS Loan Accepted in cash with reasonable cause hence no penalty

- No penalty section 271(1)(c) if Complete disclosure of facts

- Penalty of Section 271(1)(c) could not be imposed if notice did not contain any grounds on which penalty sought to be imposed

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal