INCOME TAX RATES AS PER FINANCE ACT, 2015

As per the Finance Act, 2015,Income tax rates for for the financial year 2015-16 (i.e. Assessment Year 2016-17) are as follow

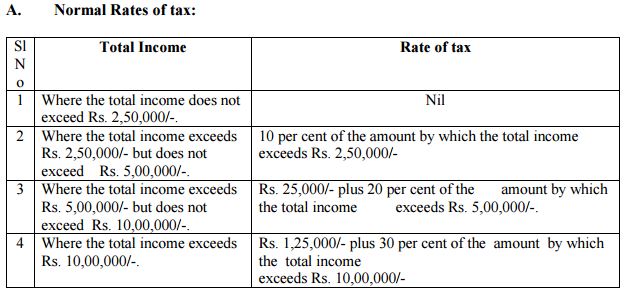

INCOME TAX RATES FOR FY 2015 -16 FOR INDIVIDUAL

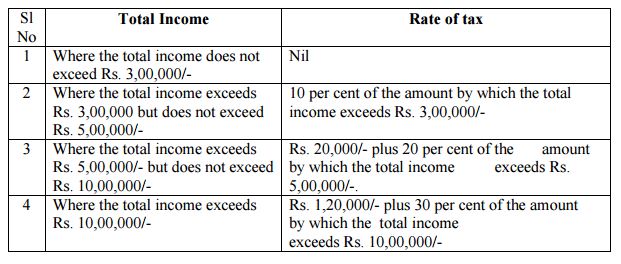

INCOME TAX RATES FOR FY 2015 -16 FOR INDIVIDUAL , RESIDENT IN INDIA (AGE>=60 YEARS BUT < 80 YEARS)

B. Rates of tax for every individual, resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

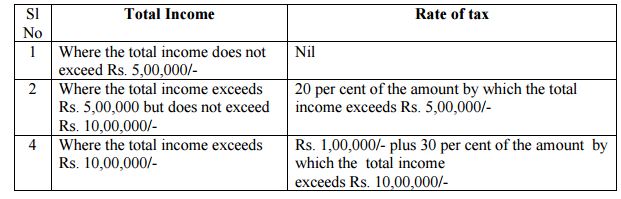

INCOME TAX RATES FOR FY 2015 -16 FOR INDIVIDUAL , RESIDENT IN INDIA (AGE>=80 YEARS )

C. In case of every individual being a resident in India, who is of the age of eighty years or more at any time during the financial year:

Surcharge on Income tax:

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph, or the provisions of section 111A or section 112 of the Income-tax Act, shall, in the case of every individual or Hindu undivided family or association of persons or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Income-tax Act, having a total income exceeding one crore rupees, be increased by a surcharge for the purpose of the Union calculated at the rate of twelve per cent of such income-tax:

Provided that in the case of persons mentioned above having total income exceeding one crore rupees, the total amount payable as income-tax and surcharge on such income shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees.

Education Cess on Income tax:

The amount of income-tax including the surcharge if any, shall be increased by Education Cess on Income Tax at the rate of two percent of the income-tax.

Secondary and Higher Education Cess on Income-tax:

An additional education cess is chargeable at the rate of one percent of income-tax including the surcharge if any, but not including the Education Cess on income tax