Increase in threshold monetary limits for filing Appeals : CBIC Instruction

F.No.390/Misc./116/2017-JC

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes & Customs

(Judicial Cell)

********

‘B’ Wing, 4th Floor, HUDCO-VISHALA Building

Bhikaji Cama Place, R.K. Puram, New Delhi-66

Dated 11 .07.2018

INSTRUCTION

To

1. All Principal Chief Commissioners/Chief Commissioners/Principal Commissioners/Commissioners of

Customs/ Customs (Preventive)/ GST & CX;

2. All Principal Director Generals/ Director Generals of Customs, GST & CX;

3. Chief Commissioner (AR); Commissioner Directorate of Legal Affairs, CBIC;

4.<webmaster.cbec@icegate.gov.in>

Subject : Reduction of Government Litigation – Raising of monetary limits for filing appeals by the

Department before CESTAT/ High Courts and Supreme Court in Legacy Central Excise and Service

Tax : regarding.

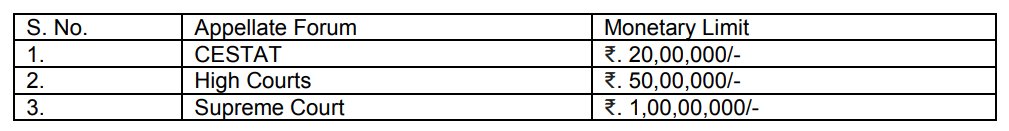

In exercise of the powers conferred by Section 35R of the Central Excise Act, 1944 made applicable to Service Tax vide Section 83 of the Finance Act, 1944, the Central Board of Indirect Taxes and Customs fixes the following monetary limits below which appeal shall not be filed in the CESTAT, High and Supreme Court:

2. This instruction applies only to legacy issues i.e. matters relating to Central Excise and Service Tax, and will apply to pending cases as well.

3. Withdrawal process in respect of pending cases in above forums, as per the above revised limits, will follow the current practice that is being followed for the withdrawal of cases from the High Courts, CESTAT and Commissioner (Appeals). All other terms and conditions of concerned earlier instructions will continue to apply.

4. It may be noted that issues involving substantial questions of law as described in para 1.3 of the Instruction dt 17.08.2011 from F No 390/Misc/163/2010-JC would be contested irrespective of the prescribed monetary limits

5. Since withdrawal of Departmental Appeals is a long drawn activity requiring routine and constant monitoring, formats have been introduced in the Monthly Performance Report for all field formations to send monthly reports regarding status of withdrawal of appeals in the MPR (refer table M/ M-1). Details of the said cases should also be available in a separate register for further perusal by the Board as and when required. Tables are in the Annexure – A attached. The description of the Tables in brief is provided below:

a) Table M: Position of withdrawal with reference to raised monetary limits SC/HC/CESTAT (as per instruction dated 11/07/2018)

b)Table M- 1: Remaining to be filed/withdrawn SC/HC/CESTAT.

(Ranjana Jha)

Joint Secretary (Review)

Download Complete Circular in PDF