Professional Indemnity Insurance for Chartered Accountants

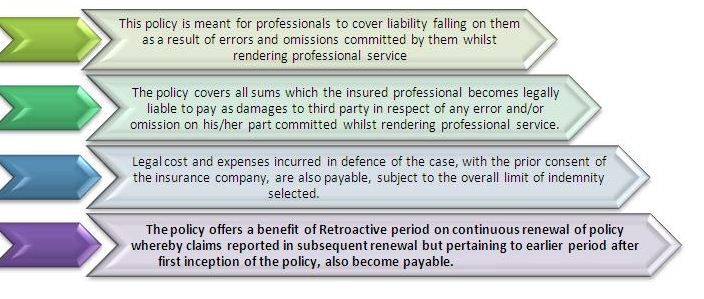

Key Benefits of the Policy are :-

1. WHO CAN TAKE THIS POLICY

Any professional acting in professional capacity can take this policy.

Failure to exercise due care in one’s profession may give cause of action against him by his client, since such duty to the client applies to any profession be that a doctor, solicitor or a Chartered Accountant.

2. WHY SHOULD ONE TAKE THIS POLICY COVER?

There could be two counts based upon which an action may be initiated against any professional for damages due to negligence

1) Professional did not have the necessary degree of skill or

2) Professional had the necessary skill but not exercise the same in particular case.

The consequences of such an action could be very grievous as far as the professional is concerned since it may invite unwanted publicity or legal action against the professional in case of negligence. Moreover, any such action not only affects the reputation of the professional but may also invite bankruptcy in case of legal action and penalties imposed by the court or such other institutions.

3. WHAT DOES THE POLICY COVER?

This policy covers all sums that Courts may direct the professional to pay to third party.

This also includes legal costs/expenses incurred by the insured.

4. HOW TO SELECT SUM INSURED ?

In Professional Indemnity Policy, The sum insured is referred to as Limits of Indemnity. The limit is fixed per accident and per policy period which is called Any One Accident (AOA) limit and Any One Year (AOY) limit respectively. The ratio of AOA limit to AOY limit can be chosen from the following:

a. 1:1 ; b. 1:2 ; c.1:3 ; d.1:4

The AOA limit, which is maximum amount payable for each accident, should be fixed taking into account the nature of activity of the insured and the maximum number of people who could be affected and maximum property damage that could occur, in the worst possible accident.

5. GEOGRAPHICAL SCOPE OF THE POLICY:

Aggregate limits within geographical limits of India including Nepal/Bhutan are covered on annual basis.

6. WHAT IS NOT COVERED /EXCLUSIONS:

1) Criminal act or any act committed in violation of any law or ordinance.

2) Any services rendered under influence of intoxicants.

3) Third party liability.

4) Any contractual liability which would not exist but for the contract.

5) Non compliance of statutory provisions.

6) Loss of goodwill/market.

7) Any libel, false arrest, detention.

8) Fine, penalty punitive or exemplary damages.

9) War and allied perils, radioactive contamination, etc.

10) Deliberate disregard of technical/administrative management &/or reasonable steps to prevent the claim.

7. HOW TO CLAIM

In case of any event likely to give rise to a liability claim, insurance company should be informed immediately. In case any legal notice or summons received, it should be sent to the insurance company. The company has the option of arranging the defence of the case.

8. What is Indemnity Claim?

The term “liability” means responsibility and “legal liability” means responsibilities which can be enforced by law. Legal Liability may be classified into Criminal Liability and Civil Liability. Only Civil Liability claims are payable. Civil Liability claims will arise if there is prima facie evidence of negligence by the insured resulting in injury or death to any third party or resulting in damage to property belonging to a person other than insured. Negligence will be proved only when following conditions are satisfied:

1. Existence of duty of care

2. Breach of this duty

3. Injury suffered by a person or property damaged as a result of that breach.

The event giving rise to the claim should have occurred during the period of insurance or retroactive period and the claim first made in writing against the insured during the policy period. The maximum amount payable including defence cost will be the AOA limit selected. The Any One Year limit will get reduced by the amount of claim or indemnity paid for any one accident. Any number of such claims made during the policy period will be covered subject to the total indemnity not exceeding the Any One Year limit.

9. Where and how to claim?

Website Address Click or http://icai.newindia.co.in/

For any communication related to claim , please contact :

Web Portal DO – 113000,

THE NEW INDIA ASSURANCE CO. LTD.

New India Bhavan,

2nd Floor, 34/38 Bank Street, Fort, Mumbai – 400023

Email – nia.113000@newindia.co.in

Phone : 022-24620311/ 022-4620363

Disclaimer: The wordings of the claim process have been simplified for the understanding of the members/ Insured. .Though we have taken care to ensure that this document explains the scope of coverage under the Policy, if there is any conflict between this document and the Policy, then the provisions of the Policy would prevail over this document. We therefore advise you to read the terms and conditions of the Policy.