Input Tax Credit under GST

Registration for availing Input Tax Credit under GST:

1. The person intending to avail ITC should be Registered taxable person.

2. The supplier of goods and/or supplies in respect of which ITC is intended to be availed has to be registered under IGST or MGST as the case may be.

3. If a person who has applied for registration under the Act within thirty days from the date on which he becomes liable to registration and has been granted such registration then He shall be entitled to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax under the provisions of this Act.

Illustration : A person becomes liable to pay tax on 1st August 2017 and has obtained registration on 15th August 2017. Such person is eligible for input tax credit on inputs held in stock as on 31st July 17

4. If the registration is not taken within 30 days from the date the person so becomes liable then ITC on pre-registration stock would not be admissible.

5. A taxable person takes voluntary registration even if his turnover is below exemption limit.The person who obtains voluntary registration is entitled to take the input tax credit of input tax on inputs in stock, inputs in semifinished goods and finished goods in stock, held on the day immediately preceding the date of registration.

Illustration :- Mr. A applies for voluntary registration on 5th June, 2017 and obtained registration on 22nd June, 2017. Mr. A is eligible for input tax credit on inputs held in stock and inputs contained in semi-finished or finished goods held in stock as on 21st June, 2017.

6 Switching from Composition Scheme :-.If a dealer paying tax on compounding basis crosses the compounding threshold and becomes a regular taxable person, then as per section 16(3) of the MGL, he can avail ITC in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax under section 7.

Illustration : Mr. B, a registered taxable person was paying tax under composition rate up to 30th July, 2017. However, w.e.f 31st July, 2017. Mr. B becomes liable to pay tax under regular scheme. Mr. B is eligible for input tax credit on inputs held in stock and inputs contained in semi-finished or finished goods held in stock as on 30th July,2017.

7. A supplier of goods and services may have head office/regional office at different place/s. The services may be received at head office/regional office, but ultimately, these will be indirectly used for manufacture or providing output service.

Provision has been made to avail input credit of services received and paid for at head office/regional office. Such head office/regional office can be registered under GST as ‘Input Service Distributor’ and it can issue invoice on its branches/factories/depots.

If assessee intends to use the facility, he has to register under GST.

Documentation required for availing Input Tax Credit under GST:

The person claiming ITC should be in possession of below referred documents:

1. Tax invoice, debit note, supplementary invoice or such other taxpaying document as may be prescribed, issued by a supplier.

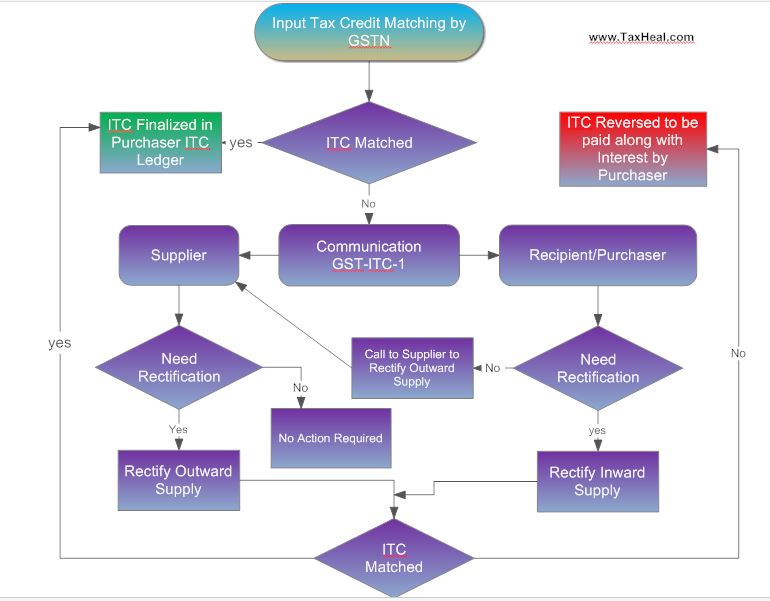

2. The Person should have filed returns as are specified under Sec 27 .ITC would be confirmed only if the inward details filed by the recipient are matched with the outward details furnished by the supplier in his valid return. In case of mismatch between the inward and outward details, the supplier would be required to rectify the mis-match within a period of two months and if the mis-match continues, the ITC would have to be reversed by the recipient.

If the supplier uploads the invoice at any time after the reversal but by September of the next financial year, the credit reversed earlier gets restored along with refund of the interest paid during reversal.

Conditions for availing Input Tax Credit under GST:

The person claiming ITC should have:

1. Received the goods and/or services.

2. Use or should intend to use these goods and/or services in course or furtherance of his business.

3. Tax charged in respect of such supply has been actually paid to the credit of the appropriate Government, either in cash or through utilization of input tax credit admissible in respect of the said supply.

4. Where the goods against an invoice are received in lots or instalments then the registered taxable person shall be entitled to the ITC upon receipt of the last lot or installment.

5. GST paid on reverse charge be considered as input tax. The ITC can be availed if such goods and/or services are used, or are intended to be used, in the course or furtherance of his business.

6. ITC of tax paid on capital goods is permitted to be availed in one instalment.

7. Where goods and/or services received by a taxable person are used for effecting both taxable and non-taxable supplies,then as per section 16(6) of MGL, the input tax credit of goods and / or service attributable to only taxable supplies can be taken by registered taxable person. The amount of eligible credit would be calculated in a manner to be prescribed in terms of section 16(7) of the MGL read with GST ITC Rules (yet to be issued). It is important to note that credit on capital goods also would now be permitted on proportionate basis.

8. Where goods and/or services received by a taxable person are used for the purpose of business and non-business supplies then as per section 16(5) of the MGL, the input tax credit of goods and / or service attributable to only supplies effected for business purpose can be taken by registered taxable person. The amount of eligible credit would be calculated in a manner to be prescribed in terms of section 16(7) of the MGL read with GST ITC Rules (yet to be issued). It is important to note that credit on capital goods also would now be permitted on proportionate basis.

9. where there is a change in the constitution of a registered taxable person on account of sale, merger, demerger, amalgamation, lease or transfer of the business, then as per section 16(8) of the MGL , the transferor shall be allowed to transfer the input tax credit that remains unutilized in its books of accounts to the transferee provided that there is a specific provision for transfer of liabilities.

10. The principal is eligible to avail the input tax credit on inputs sent to job worker for job work in terms of Section 16A(2) of the MGL. The principal has to reverse the credit along with interest on on inputs which have not been received back from the job worker within 180 days but he can reclaim the credit on receipt of inputs.

11. Zero rated supplies is included for computation of taxable supplies for the purpose of availing ITC.

12. If if the capital goods sent to job worker have not been received within 2 years from the date of being sent then the principal has to pay an amount equal to credit taken on such capital goods along with interest. But he can reclaim the credit on receipt of inputs.

13. Who will get the ITC where goods have been delivered to a person other than taxable person (‘bill to’- ‘ship to’ scenarios)?

Ans. As per explanation clause to section 16(11) of the MGL, for this purpose of receiving the goods, it would be deemed that the taxable person has received the goods when the goods have been delivered to a third party on the direction of such taxable person. So ITC will be available to the person on whose order the goods are delivered to third person.

Manner of Taking Input Tax Credit under GST

Every registered taxable person shall be entitled to take credit of input tax admissible to him and the said amount shall be credited to the electronic credit ledger of such person.

“Electronic credit ledger” means the input tax credit ledger in electronic form maintained at the common portal for each registered taxable person in the manner as may be prescribed in this behalf [ clause 2(41) of GST Model Law, 2016.]

One major provision is that the input tax credit will be available only when tax charged in respect of such supply has been actually paid to the credit of the appropriate Government.

For this purpose, a provision has been made of ‘provisional credit’ and ‘final credit’.

The provisional input tax credit will be available on basis of initial return filed by supplier of goods and services. This return is to be filed on or before 10th of the subsequent month. The receiver of goods and services is required to file return of receipt of goods and services by 15th of the subsequent month. Where the entries match with return filed by supplier, provisional input tax credit will be available, which can be utilised for payment of tax and filing of return by 20th of subsequent month.

However, if the supplier of goods and services fails to pay the tax (i.e. unless he files a ‘valid return’) the final input tax credit will not be available.

It may be noted that unless supplier of goods and services pays entire tax due, the return filed by him will not be ‘valid return’. Thus, partial payment by supplier will not entitle the receiver of goods and services to avail input tax credit.

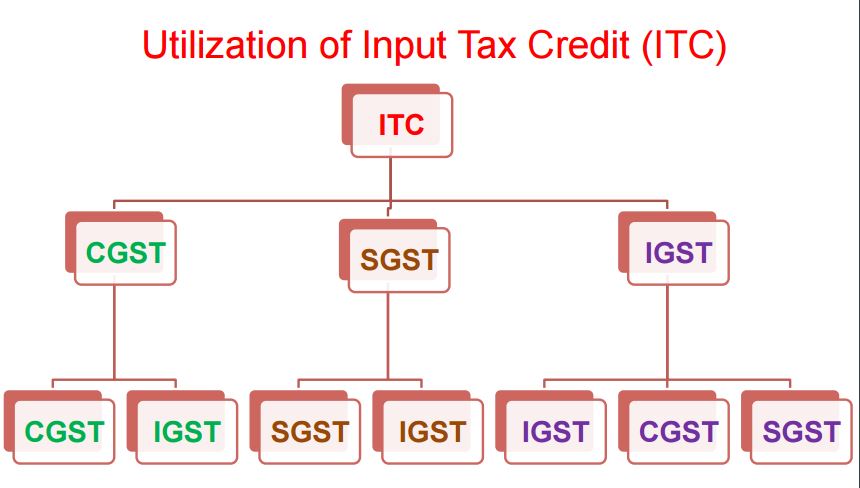

Manner of utilization of “Input Tax Credit under GST

Input tax consists of IGST & CGST in CGST Act and IGST & SGST in SGST Act.

In the IGST Act, input tax consists of all three taxes namely, IGST, CGST and SGST.

It further implies that credit of all three can be used for discharging IGST liability, whereas only credit of IGST & CGST can be taken in CGST Act and that of IGST & SGST can be taken under SGST Act.

Further the credit of CGST & SGST cannot be cross-utilized.

Manner of distribution of credit by Input Service Distributor

The Input Service Distributor may distribute following by issue of prescribed document [clause 17(1) of GST Model Law, 2016]

The credit of CGST as IGST and IGST as IGST where the Distributor and the recipient of credit are located in different States [CGST Act]

The credit of SGST as IGST where the Distributor and the recipient of credit are located in different States(SGST Act)

The credit of CGST and IGST as CGST where the Distributor and the recipient of credit, being a business vertical, are located in the same State.(CGST Act)

The credit of SGST and IGST as SGSTwhere the Distributor and the recipient of credit, being a business vertical, are located in the same State (SGST Act)

Conditions for distribution of Input Tax Credit by Input Service Distributor

The Input Service Distributor may distribute the credit as per following conditions – clause 17(3) of GST Model Law, 2016.

| (a) | the credit can be distributed against a prescribed document issued to each of the recipients of the credit so distributed, and such invoice or other document shall contain such details as may be prescribed | |

| (b) | the amount of the credit distributed shall not exceed the amount of credit available for distribution; | |

| (c) | the credit of tax paid on input services attributable to a supplier shall be distributed only to that supplier (of goods and services) | |

| (d) | the credit of tax paid on input services attributable to more than one supplier shall be distributed only amongst such supplier(s) to whom the input service is attributable and such distribution shall be pro rata on the basis of the turnover in a State of such supplier, during the relevant period, to the aggregate of the turnover of all such suppliers to whom such input service is attributable and which are operational in the current year, during the said relevant period. |

Time for taking Input tax Credit under GST

As per Section 16 (15) of the MGL, ITC cannot be taken beyond the month of September of the following Financial year to which invoice pertains or date of filing of annual return, whichever is earlier. The underlying reasoning for this restriction is that no change in return is permitted after September of next FY. If annual return is filed before the month of September then no change can be made after filing of annual return.

Amount of Input Tax Credit under GST

The amount of input tax credit shall be calculated in accordance with generally accepted accounting principles in such manner as may be prescribed – clause 16(4) of GST Model Law, 2016.

Zero rated supplies is included for computation of taxable supplies for the purpose of availing ITC.

Where goods and/or services received by a taxable person are used for the purpose of business and non-business supplies then as per section 16(5) of the MGL, the input tax credit of goods and / or service attributable to only supplies effected for business purpose can be taken by registered taxable person. The amount of eligible credit would be calculated in a manner to be prescribed in terms of section 16(7) of the MGL read with GST ITC Rules (yet to be issued). It is important to note that credit on capital goods also would now be permitted on proportionate basis.

Where goods and/or services received by a taxable person are used for effecting both taxable and non-taxable supplies,then as per section 16(6) of MGL, the input tax credit of goods and / or service attributable to only taxable supplies can be taken by registered taxable person. The amount of eligible credit would be calculated in a manner to be prescribed in terms of section 16(7) of the MGL read with GST ITC Rules (yet to be issued). It is important to note that credit on capital goods also would now be permitted on proportionate basis.

The Central or a State Government may, by notification issued in this behalf, prescribe the manner in which the proportionate input tax credit is to be taken- clause 16(7) of GST Model Law, 2016.

Process of Intimation of Input Tax Credit Mismatch under GST of India

- Any discrepancy in the claim of input tax credit in respect of any tax period, shall be made available to the registered taxable person making such claim and the supplier electronically in FORM GST ITC-1 through the Common Portal on or before the last date of the month in which the matching has been carried out.

- A supplier to whom any discrepancy is made available may make suitable rectifications in the statement of outward supplies to be furnished for the month in which the discrepancy is made available

- A recipient to whom any discrepancy is made available may make suitable rectifications in the statement of inward supplies to be furnished for the month in which the discrepancy is made available.

- Where the discrepancy is not rectified an amount to the extent of discrepancy shall be added to the output tax liability of the recipient in his return in FORM GSTR-3 for the month succeeding the month in which the discrepancy is made available

Input Tax Credit not available under GST

ITC on Motor Car under GST:-

ITC on motor vehicles can be availed only if the taxable person is in the business of transport of passengers or goods or is providing the services of imparting training on motor vehicles .[ As per section 16(9)(a) of the Model GST Law]

Illustration ;Thus if A Taxable person is in the business of information technology. He buys a motor vehicle for use of his Executive Directors. He can not avail the ITC in respect of GST paid on purchase of such motor vehicle

ITC not available in case of Mismatch in GST returns

ITC would be confirmed only if the inward details filed by the recipient are matched with the outward details furnished by the supplier in his valid return. In case of mismatch between the inward and outward details, the supplier would be required to rectify the mis-match within a period of two months and if the mis-match continues, the ITC would have to be reversed by the recipient.

If the supplier uploads the invoice at any time after the reversal but by September of the next financial year, the credit reversed earlier gets restored along with refund of the interest paid during reversal.

ITC after Expiry of one year of Tax Invoice

A taxable person shall not be entitled to take input tax credit in respect of any supply of goods and / or services to him after the expiry of one year from the date of issue of tax invoice relating to such supply. Sec 16(3A).

ITC if Depreciation is claimed

If a Registered taxable person has claimed depreciation on the tax component of the cost of capital goods under the provisions of the Income Tax Act, 1961 then the input tax credit shall not be allowed on the said tax component

Thus, if net value of capital goods is Rs 100 lakhs and GST paid is 16 lakhs, the taxable person should claim depreciation in income tax only on Rs 100 lakhs. and he should claim ITC on Rs 16 Lakh. If he claims depreciation on Rs 116 Lakh then he can not claim ITC.

Goods and/or services supplied becomes absolutely exempt

As per section 16(12) of the MGL, the registered taxable person who supplies goods and / or services which become absolutely exempt, has to pay an amount equivalent to the input tax credit in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date of such exemption. It has also been provided that after payment of the amount on such goods, the balance, if any available in electronic credit ledger would lapse. The amount, required to be paid, is to be calculated as per GAAP in terms of section 16(13) of the MGL.

Shifting to Compounding Scheme

As per section 16(12) of the MGL, the registered taxable person, who was paying tax under section 7 opts to pay tax under Compounding Scheme under Section 8, has to pay an amount equivalent to the input tax credit in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date of such switch over. It has also been provided that after payment of the amount on such goods, the balance, if any available in electronic credit ledger would lapse. The amount, required to be paid, is to be calculated as per GAAP in terms of section 16(13) of the MGL.

Inputs sent to Job Worker not received back in 180 days

The principal is eligible to avail the input tax credit on inputs sent to job worker for job work in terms of Section 16A(2) of the MGL. The principal has to reverse the credit along with interest on on inputs which have not been received back from the job worker within 180 days but he can reclaim the credit on receipt of inputs.

Capital Goods send to Job worker not received back in 2 years

If if the capital goods sent to job worker have not been received within 2 years from the date of being sent then the principal has to pay an amount equal to credit taken on such capital goods along with interest. But he can reclaim the credit on receipt of inputs.

Supply of Capital Goods after use

As per section 16(15) of the MGL, in case of supply of capital goods on which input tax credit has been taken, the registered taxable person shall pay an amount equal to the input tax credit taken on the said capital goods reduced by the percentage points as may be specified in this behalf or the tax on the transaction value of such capital goods, whichever is higher

Negative list on which ITC is not permitted

Section 16 (9) of the MGL provides for the negative list with respect to the admissibility of ITC. It has been provided that the ITC on following items cannot be availed:

(a) motor vehicles, except when they are supplied in the usual course of business or are used for providing the following taxable services—

(i) transportation of passengers, or

(ii) transportation of goods, or

(iii) imparting training on motor driving skills;

(b) goods and / or services provided in relation to food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, membership of a club, health and fitness center, life insurance, health insurance and travel benefits extended to employees on vacation such as leave or home travel concession, when such goods and/ or services are used primarily for personal use or consumption of any employee;

(c) goods and/or services acquired by the principal in the execution of works contract when such contract results in construction of immovable property, other than plant and machinery;

(d) goods acquired by a principal, the property in which is not transferred (whether as goods or in some other form) to any other person, which are used in the construction of immovable property, other than plant and machinery;

(e) goods and/or services on which tax has been paid under section 8 [i.e Composition Scheme ]; and

(f) goods and/or services used for private or personal consumption, to the extent they are so consumed.

Recovery mechanism for wrongly availed ITC

As per section 16(16) of the MGL, the wrongly availed credit would be recovered from the registered taxable person in terms of section 51 of MGL.

Transitional provisions of ITC at the time of switching

GST Model Law, 2016 makes detailed provisions for switch over from existing tax structure to GST. The provisions are summarized below.

Cenvat Credit carried forward – Eligible Cenvat credit can be carried forward – clause 143(1) of GST Model Law, 2016.

State VAT Credit carried forward – Eligible State VAT credit can be carried forward – clause 143(2) of GST Model Law, 2016.

Unvailed Cenvat Credit on capital goods – Unvailed Cenvat Credit on eligible capital goods not carried forward in a return can taken – clause 144(1) of GST Model Law, 2016

Unvailed State VAT Credit on capital goods – Unvailed State VAT Credit on eligible capital goods not carried forward in a return can taken – clause 144(2) of GST Model Law, 2016

Eligible duties and taxes on goods which were exempt prior to GST -Some goods are presently exempt from excise duty and hence Cenvat credit or State VAT credit was not available. Some of these goods may become taxable under GST. In such cases, input tax credit of specified duties paid on such inputs and inputs contained in semi-finished and finished which are in stock on the date of introduction of GST can be taken, if documents and records are available. The credit can be taken on basis of generally accepted accounting principles – clause 145 of GST Model Law, 2016.

Credit if taxable person switches from composition scheme to normal scheme and vice versa – A taxable person who was under composition scheme may shift to normal scheme of payment of GST. In that case, he can take credit of taxes paid on inputs and inputs contained in semi finished and finished goods which are in stock on the date of introduction of GST can be taken, if documents and records are available. The credit can be taken on basis of generally accepted accounting principles – clause 146 of GST Model Law, 2016.

If a taxable person switches from normal scheme to composition scheme under GST will have to pay an amount equal to taxes paid on inputs and inputs contained in semi finished and finished goods which are in stock on the date of introduction of GST – clause 147 of GST Model Law, 2016.

Exempted goods returned to place of business – If goods which were exempt earlier but now subject to GST are returned to place of business within 6 months from introduction of GST, these will be exempt from tax, if these are identifiable – – clause 148 of GST Model Law, 2016.

Duty paid goods returned to place of business – If goods which were dutiable earlier but now subject to GST are returned to place of business within 6 months from introduction of GST, these will be exempt from tax, if these are identifiable -clause 149 of GST Model Law, 2016.

Distribution of credit by Input service distributor of service invoices received after GST – Input service distributor can distribute credit in respect of services received prior to GST, even if invoices of such services were received after introduction of GST – clause 162 GST Model Law, 2016.

Transitory provision for distribution of credit by Input service distributor of service invoices received after GST – Input service distributor can distribute credit in respect of services received prior to GST, even if invoices of such services were received after introduction of GST – clause 162 GST Model Law, 2016.

Steps for Hassle free compliance of ITC under GST

One of the most important things under GST will be timely uploading of the details of outward supplies in Form GSTR-1 by 10th of next month. How best this can be ensured will depend on the number of B2B invoices that the taxpayer issues. If the number is small, the taxpayer can upload all the information in one go. However, if the number of invoices is large, the invoices (or debit/ credit notes) should be uploaded on a regular basis. GSTN will allow regular uploading of invoices even on a real time basis. Till the statement is actually submitted, the system will also allow the taxpayer to modify the uploaded invoices.

- It would always be beneficial for the taxpayers to regularly upload the invoices. Last minute rush will make uploading difficult and will come with higher risk of possible failure and default

- Taxpayers should follow up on uploading the invoices of their inward supplies by their suppliers. This would be helpful in ensuring that the input tax credit is available without any hassle and delay. Recipients can also encourage their suppliers to upload their invoices on a regular basis instead of doing it on or close to the due date. The system would allow recipients to see if their suppliers have uploaded invoices pertaining to them. The GSTN system will also provide the track record about the compliance level of a tax payer, especially about his track record in respect of timely uploading of his supply invoices giving details about the auto reversals that have happened for invoices issued by a supplier. The Common Portal of GST would have pan India data at one place which will enable valuable services to the taxpayers.

Relevant Definitions under Model GST Law relating to ITC

“Input” means any goods other than capital goods, subject to exceptions as may be provided under this Act or the rules made thereunder, used or intended to be used by a supplier for making an outward supply in the course or furtherance of business – clause 2(54) of GST Model Law, 2016.

“Input tax credit” means credit of ‘input tax’ as defined in section 2(57) – clause 2(58) of GST Model Law, 2016.

“Input tax” in relation to a taxable person, means the {IGST and CGST}/{IGST and SGST} charged on any supply of goods and/or services to him which are used, or are intended to be used, in the course or furtherance of his business and includes the tax payable under section 7(3)- clause 2(57) of GST Model Law, 2016.

Every registered taxable person shall, subject to such conditions and restrictions as may be prescribed and within the time and manner specified in section 35, be entitled to take credit of input tax admissible to him and the said amount shall be credited to the electronic credit ledger of such person – clause 16(1) of GST Model Law, 2016.

“Electronic credit ledger” means the input tax credit ledger in electronic form maintained at the common portal for each registered taxable person in the manner as may be prescribed in this behalf – clause 2(41) of GST Model Law, 2016.

“Outward supply” in relation to a person, shall mean supply of goods and/or services, whether by sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made by such person in the course or furtherance of business except in case of such supplies where the tax is payable on reverse charge basis – clause 2(72) of GST Model Law, 2016.

“Exempt supply” means supply of any goods and/or services which are not taxable under this Act and includes such supply of goods and/or services which are specified in Schedule . . . of the Act or which may be exempt from tax under section 10 – clause 2(42) of GST Model Law, 2016.

“Taxable supply’‘ means a supply of goods and/or services which is chargeable to tax under this Act – clause 2(97) of GST Model Law, 2016.

Zero rated supply – “Zero-rated supply” means a supply of any goods and/or services on which no tax is payable but credit of the input tax related to that supply is admissible. – – Explanation – Exports shall be treated as zero-rated supply – clause 2(109) of GST Model Law, 2016.

“Principal” means a person on whose behalf an agent carries on the business of supply or receipt of goods and/or services – clause 2(77) of GST Model Law, 2016.

“Agent” means a person who carries on the business of supply or receipt of goods and/or services on behalf of another, whether disclosed or not and includes a factor, broker, commission agent, arhatia, del credere agent, intermediary or an auctioneer or any other mercantile agent, by whatever name called, and whether of the same description as hereinbefore mentioned or not – clause 2(5) of GST Model Law, 2016.

‘Capital goods‘ is defined in clause 2(20) of GST Model Law, 2016.

“Capital goods” means: —

| (A) | the following goods, namely:— |

| (i) | all goods falling within Chapter 82, Chapter 84, Chapter 85, Chapter 90, heading 6805, grinding wheels and the like, and parts thereof falling under heading 6804 of the Schedule to this Act | |

| (ii) | pollution control equipment | |

| (iii) | components, spares and accessories of the goods specified at (i) and (ii); | |

| (iv) | moulds and dies, jigs and fixtures; | |

| (v) | refractories and refractory materials; | |

| (vi) | tubes and pipes and fittings thereof; | |

| (vii) | storage tank and | |

| (viii) | motor vehicles other than those falling under tariff headings 8702, 8703, 8704, 8711 and their chassis but including dumpers and tippers used (1) at the place of business for supply of goods; or (2) outside the place of business for generation of electricity for captive use at the place of business (3) for supply of services |

| (B) | motor vehicle designed for transportation of goods including their chassis registered in the name of the supplier of service, when used for (i) supplying the service of renting of such motor vehicle; or (ii) transportation of inputs and capital goods used for supply of service; or (iii) supply of courier agency service; | |

| (C) | motor vehicle designed to carry passengers including their chassis, registered in the name of the supplier of service, when used for supplying the service of— (i) transportation of passengers; or (ii) renting of such motor vehicle; or (iii) imparting motor driving skills. | |

| (D) | Components, spares and accessories of motor vehicles which are capital goods for the taxable person. |

“Input Service Distributor” means an office of the supplier of goods and/or services which receives tax invoices issued under section 23 towards receipt of input services and issues tax invoice or such other document as prescribed for the purposes of distributing the credit of CGST (SGST in State Acts) and/or IGST paid on the said services to a supplier of taxable goods and/or services having same PAN as that of the office referred to above.Explanation.- For the purposes of distributing the credit of CGST (SGST in State Acts) and/or IGST, Input Service Distributor shall be deemed to be a supplier of services – clause 2(56) of GST Model Law, 2016.

“Business vertical” shall have the meaning assigned to a ‘business segment’ in Accounting Standard 17 issued by ICAI – clause 2(18) of GST Model Law, 2016.

As per AS-17, ‘business segment’ is a distinguishable component of an enterprise. It is engaged in providing an individual product or service or a group of related products or services. The risks and returns from the product or service or a group of related products or services differ from those of other business segments. Whether products or services are related or not should be judged with reference to following factors – (a) the nature of product or services (b) the nature of production process (c) the type or class of customers for the products or services (d) the methods used to distribute the products or provide the services, if applicable (e) the nature of regulatory environment for example, banking, insurance or public utilities.

Free Education Guide on Goods & Service Tax (GST)