Instructions for filling ITR-1 SAHAJ A.Y. 2017-18

Download ITR-1 SAHAJ A.Y. 2017-18

General Instructions These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Incometax Rules, 1962.

1. Assessment Year for which this Return Form is applicable

This Return Form is applicable for assessment year 2017-18 only, i.e., it relates to income earned in Financial Year 2016-17.

2. Who can use this Return Form

This Return Form is to be used by an individual whose total income for the assessment year 2017-18 includes:-

(a) Income from Salary/ Pension; or

(b) Income from One House Property (excluding cases where loss is brought forward from previous years); or

(c) Income from Other Sources (excluding winning from lottery and income from Race Horses, Income taxable under section 115BBDA or Income of the nature referred to in section 115BBE)

NOTE: Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used only if the income being clubbed falls into the above income categories.

3. Who cannot use this Return Form

This Return Form should not be used by an individual whose total income for the assessment year 2017-18 exceeds Rs.50 lakh or includes,-

(a) Income from more than one house property; or

(b) Income from winnings from lottery or income from Race horses; or

(c) Income taxable under section 115BBDA; or

(d) Income of the nature referred to in section 115BBE; or

(e) Income under the head “Capital Gains” e.g., short-term capital gains or long-term capital gains from sale of house, plot, shares etc.; or

(f) Agricultural income in excess of ₹5,000; or

(g) Income from Business or Profession; or

(h) Loss under the head ‘Income from other sources’; or

(i) Person claiming relief under section 90 and/or 91; or

(j) Any resident having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India; or

(k) Any resident having income from any source outside India.

4. Annexure-less Return Form

No document (including TDS certificate) should be attached to this Return Form. All such documents enclosed with this Return Form will be detached and returned to the person filing the return.

5. Manner of filing this Return Form

This Return Form can be filed with the Income Tax Department in any of the following ways, –

(i) by furnishing the return in a paper form;

(ii) by furnishing the return electronically under digital signature;

(iii) by transmitting the data in the return electronically under electronic verification code;

(iv) by transmitting the data in the return electronically and thereafter submitting the verification of the return in Return Form ITR-V;

NOTE: Where the Return Form is furnished in the manner mentioned at 5(iv), the assessee should print out two copies of Form ITR-V.

One copy of ITR-V, duly signed by the assessee, has to be sent by post to – Post Bag No. 1, Electronic City Office, Bengaluru— 560 100, Karnataka.

The other copy may be retained by the assessee for his record. Only the following persons have an option to file return in paper form:-

(i) an individual of the age of 80 years or more at any time during the previous year; or

(ii) an individual or HUF whose income does not exceed five lakh rupees and no refund is claimed in the return of income.

6. Filling out the acknowledgment

Only one copy of this Return Form is required to be filed. Where the Return Form is furnished in the manner mentioned at 5(i), the acknowledgment/ ITR-V; should be duly filled.

7. Obligation to file return

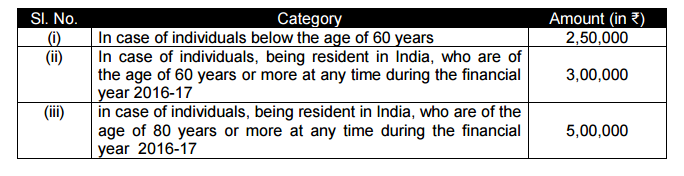

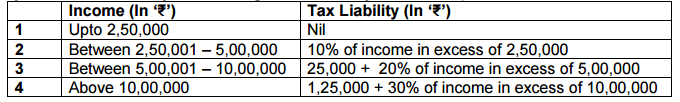

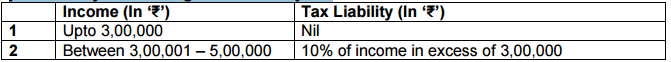

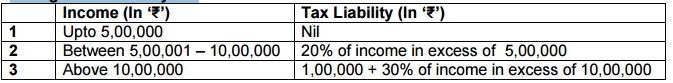

Every individual or HUF whose total income before allowing deductions under Chapter VI-A of the Income-tax Act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his return of income. The deductions under Chapter VI-A are to be mentioned in Part C of this Return Form. In case of any doubt, please refer to relevant provisions of the Act. The maximum amount not chargeable to income tax in case of different categories of individuals is as follows:-

Item by Item Instructions

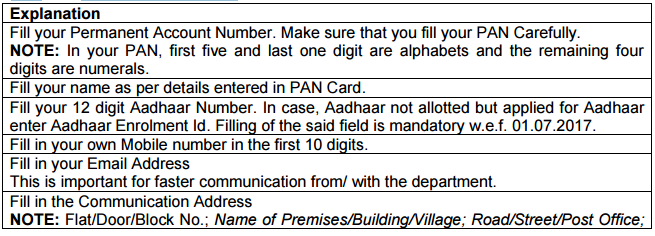

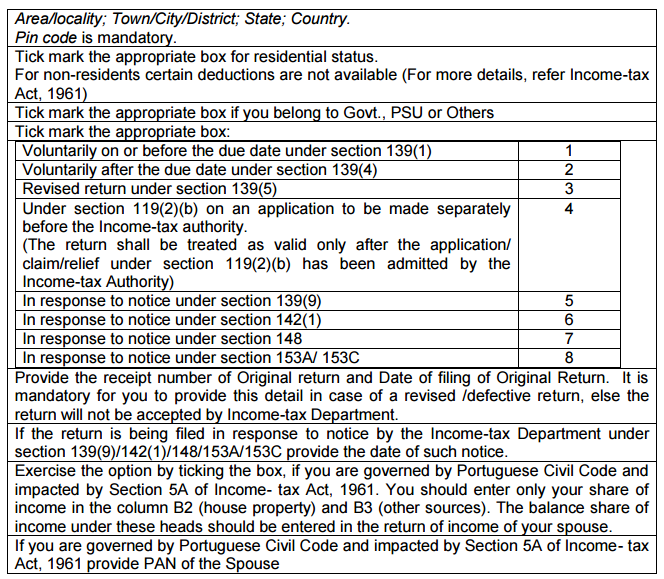

Part- A – General Information

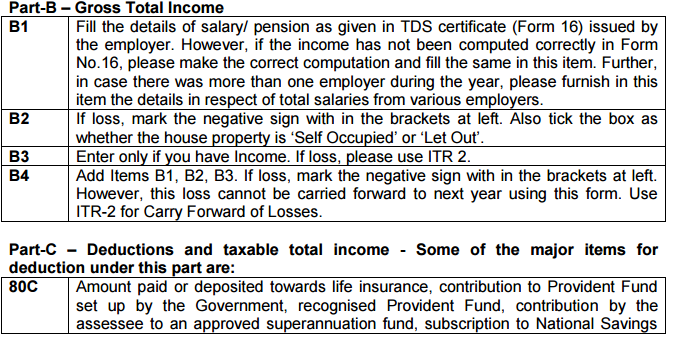

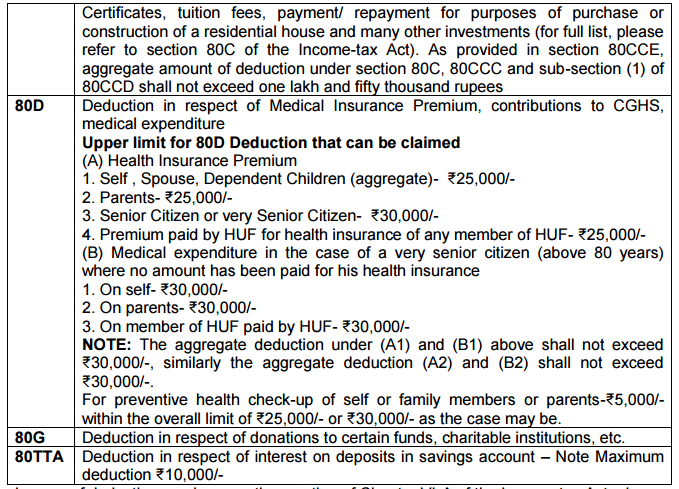

In case of deductions under any other section of Chapter VI-A of the Income-tax Act, please specify the section and the deduction claimed therein.

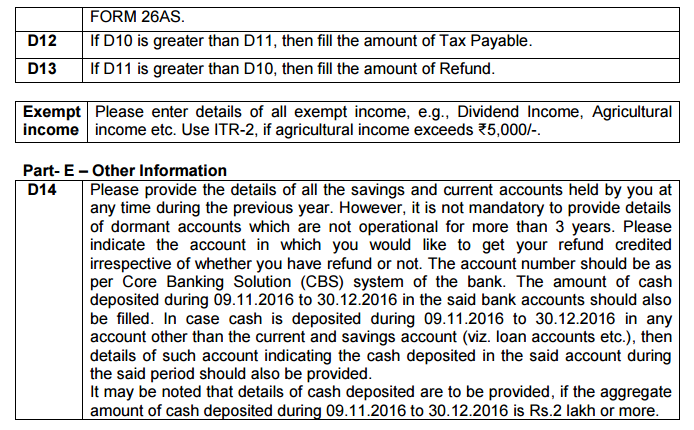

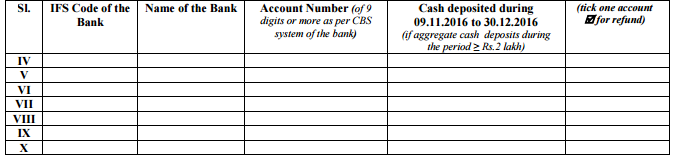

Note: If you have more details to be entered in D14, then fill the following table and tear and attach the same with the return (in case return is filed in paper form).

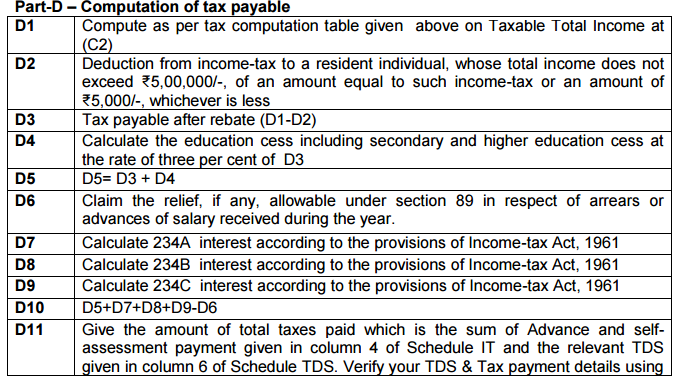

Tax Computation Table

(I) In case of every individual (other than resident individual who is of the age of 60 years or more at any time during the financial year 2016-17) –

(ii) In case of resident individual who is of the age of 60 years or more but less than 80 years at any time during the financial year 2016-17-

(iii) In case of resident individual who is of the age of 80 years or more at any time during the financial year 2016-17 –

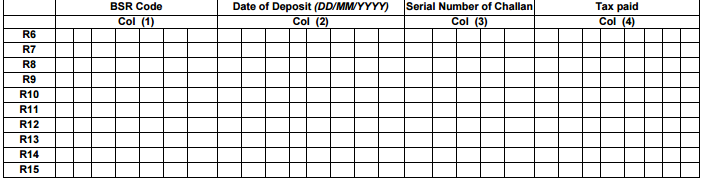

Schedule IT

Please enter details of tax payments, i.e., advance tax and self-assessment tax made by you.

NOTE: If you have more than Five Self-Assessment and Advance Tax Details to be entered, then fill the following table and tear and attach the same with the return (in case return is filed in paper form):

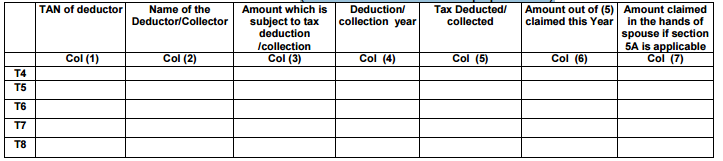

Schedule TDS

Please furnish the details in accordance with Form 16 issued by the employer(s) in respect of salary income and details in accordance with on Form 16A issued by a person in respect of interest income and other sources of income. Also details of TCS in accordance with Form 27D issued by the tax collector may be furnished.

Further in order to enable the Income Tax Department to provide accurate, quicker and full credit for taxes deducted at source, the taxpayer must ensure to quote complete details of every TDS/TCS transaction.

Enter the amount of tax deducted which is claimed in this return of income in column (6) of the said Schedule. For example, if any income is not chargeable to tax in this year then the corresponding TDS deducted on such income, if any, will be allowable in the year in which such income is chargeable to tax.

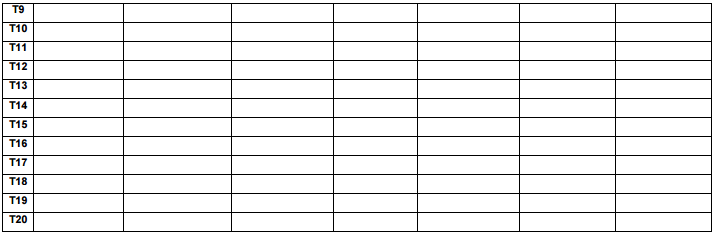

Note: If you have more details to be entered in this table, then fill the following table and tear and attach the same with the return (in case return is filed in paper form)

Verification

Please complete the Verification Section, fill date and Sign in the space given. Without a valid signature, your return will not be accepted by the Income- tax Department.