Mistakes in GST Monthly return Can’t be rectified in GST Annual return

Q If some errors or mistakes is committed in GST Monthly return/ Quarterly Return whether it can be rectified in GST Annual return ?

The CBIC has notified Annual Return Form GSTR 9 for registered persons [ GSTR 9 of Annual Return format Notified : Download /Print ] and GSTR 9A for persons opting composition scheme. [GSTR 9A of Annual Return format Notified : Download /Print]

Video Tutorials by CA Satbir Singh explaining the provisions of GST Annual return

It is important to note that annual return contains details

- whichever are already declared in the returns + Supplies which are amended in the same financial year +

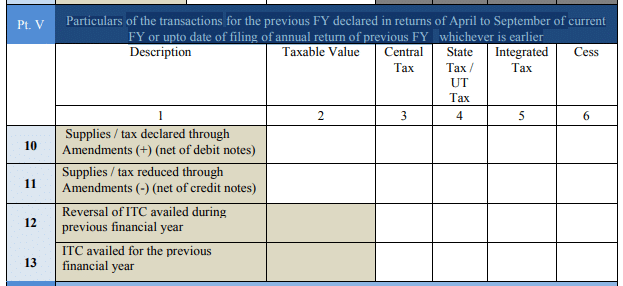

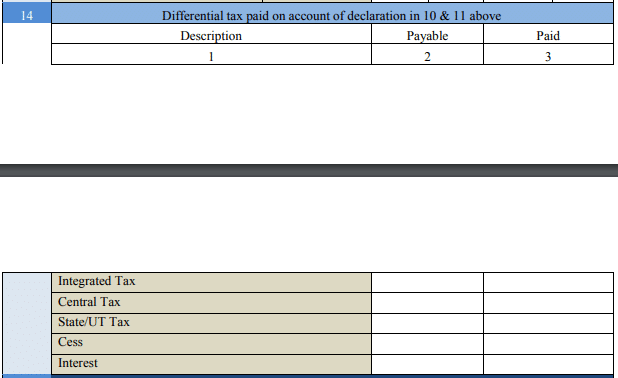

- Particulars of the transactions for the previous FY declared in returns of April to September of current FY or upto date of filing of annual return of previous FY whichever is earlier

Thus if any errors or mistakes committed in the returns of Financial Year then it can not be rectified in the Annual return.

Form GSTR 9 made it clear that any errors in the filed returns CANNOT be corrected/ rectified in annual return but should be corrected in the return filed upto the month of September after end of Financial year or upto date of filing of annual return of previous FY whichever is earlier

Example : If any errors or mistakes committed in the returns of FY 2017-18 then it can rectified in the return filed upto the month of September 2018[ i.e from April to September 2018] or upto date of filing of annual return of FY 2017-18 whichever is earlier

Suppose you have filed anuual return of FY 2017-18 on 5th sept 2018 and GST monthly return for FY 2018-19 for the month of August 2018 on 2nd September 2018 Then you can rectifiy mistakes of FY 2017-18 in GST monthly returns filed for the period April 2018 to August 2018.

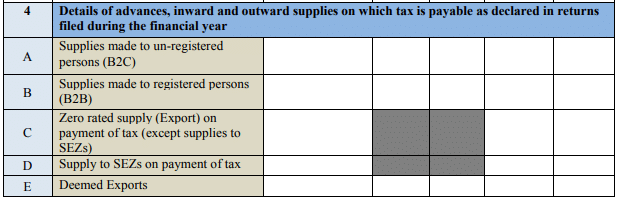

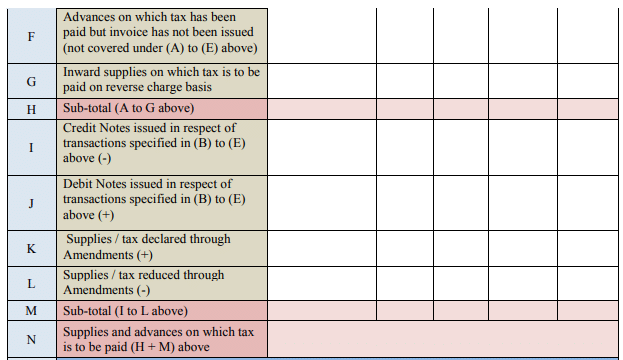

Details to be furnished in Annual Return of GSTR 9 ( Part II- Table 4 and Table 5)

Details of Outward Supplies (Part II) :-

Details of advances, inward and outward supplies on which tax is payable as declared in returns filed during the financial year (Table 4)

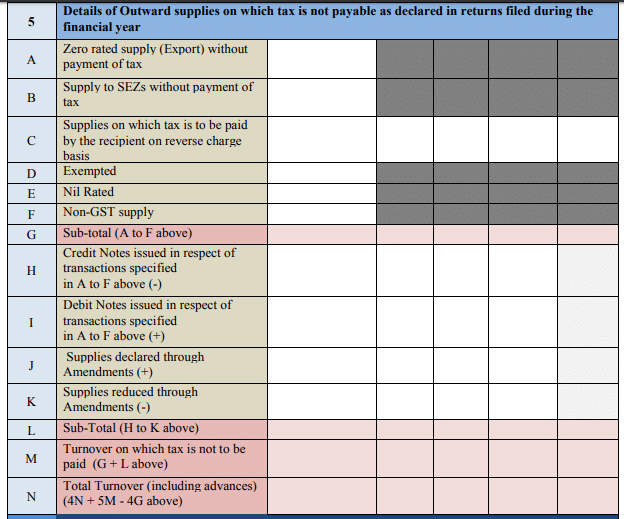

Details of Outward supplies on which tax is not payable as declared in returns filed during the financial year (Table 5)

Supplies of Previous Year declared in Next Year (Part V) :-

Particulars of the transactions for the previous FY declared in returns of April to September of current FY or upto date of filing of annual return of previous FY whichever is earlier