New GST Registration

The following FAQ on new GST registration will help the users of the GST System Portal to understand and easily use the GST System Portal.

2. New GST Registration: What, Who,When, Where, How

2. 1 What is a GST Registration?

GST Registration of a business with the tax authorities implies obtaining a unique, 15-digit Goods and Service Tax Identification Number (GSTIN) from the GST authorities so that all the operations of and the data relating to the business can be collected and correlated. In any tax system this is the most fundamental requirement for identification of the business for tax purposes or for having any compliance verification program.

Read also How to Apply for GST New Registration – Explained with Screenshots & Examples

2.2 Why should I obtain a GST Registration?

Registration under Goods and Services Tax (GST) regime will confer the following advantages to

a business:

Legally recognised as supplier of goods or services.

Proper accounting of taxes paid on the input goods or services which can be utilised for payment of GST due on supply of goods and/or services by the business.

Pass on the credit of the taxes paid on the goods and/or services supplied to purchasers or recipients.

Authorization to a taxpayer to collect tax on behalf of the Government.

2.3 Do I need to register under the GST Act ?

Registration under the GST Act is mandatory if your aggregate annual PAN-based turnover exceeds INR 20,00,000 (Rupees Twenty Lakhs) however the threshold for registration is INR 10,00,000 (Rupees Ten Lakhs) if you have a place of business in Arunachal Pradesh, Assam, Himachal Pradesh, Jammu & Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, or Uttarakhand.

Regardless of your turnover, registration is mandatory if

– You make Inter-State Supplies

– You supply goods through an E-commerce portal

– You are a/an

o Service Provider

o Agent for Registered Principal

o Liable to Pay Reverse Charge

o Non-resident Taxable Person

o Casual Taxable Person

o Input Service Distributor

o TDS/TCS Deductor

o E-commerce Operator

o An online data access and retrieval service provider

2.4 When do I need to register under the GST Act ?

Within 30 days from the date when your liability arose.In case of a Casual Taxpayer or Nonresident taxable person, 5 days prior to the commencement of the business

2.5 Where and How can I apply for registration under the GST Act?

You can apply online for a GST Registration using the GST web portal. No physical application is required.

Alternatively, you may use the offline utility to be provided on the GST Website .

It is important to note, even though you are using the Offline Utility for Registration, the process is still paperless and online since you are uploading the application online.

2.6 My internet connection is poor/unstable and I get disconnected often. Can I apply for the GST Registration offline? If yes, how?

Yes, you can apply using the Registration Offline Utility to be provided by GSTN.

The form can be filled offline but it must be uploaded online. All requirements and form-filling instructions are available in the utility.

2.7 Where are the prerequisites for registration on the GST Portal?

To apply for a new registration, you must have

– PAN card/details of your business

– Valid and accessible e-mail ID and Mobile Number

– Documentary proof of constitution of your business

– Documentary proof of promoters/partners

– Documentary proof of principal place of business

– Details of additional places of business, if applicable

– Details of Authorised Signatories including photographs and proof of appointment

– Details of Primary Authorised Signatory

– Business bank account details along with bank statement or first page of bank passbook

– Valid Class II or Class III DSC of authorised signatory in case of companies and LLPs;

valid Class II or Class III DSC or Aadhaar(for E-Sign option) in case of other entities.

Note: Your mobile number should be updated with the Aadhaar authorities otherwise you cannot use E-Sign option because OTP will be sent to the number in the Aadhaar database.

2.8 I don‟t have a Permanent Account Number (PAN). What should I do?

Before you apply for a GST Registration as a normal taxpayer, it is mandatory to obtain a PAN except for TDS registration which is possible through TAN. Click here to apply for PAN.

2.9 Is the new registration application available in any language other than English?

Yes, the new registration application is available in 18 Indian languages. The default language is English however you can click on English and a drop down will appear from where you can select your preferred language.

Please note that while all the fields and descriptions will appear in your preferred language, form filling can only be done in English.

2.10 Will I need to upload my photograph?

Yes, you are required to upload your photograph, and the photographs of all promoters / partners / kartas / directors /authorised signatories. The photographs must be in JPEG format and the file size should not exceed 100 KB.

2.11 Do I need to submit hard copies of any documents?

No, you do not as the new registration is paperless.

2.12 If the entire registration process is paperless, how will I sign my application?

You will sign your application using a Digital Signature Certificate (DSC) or the Aadhaar-based ESign facility. Please note DSC is mandatory for (i) Public Limited Company, (ii) Private Limited Company, (iii) Unlimited Company; (iv) Foreign Company; (v) LLP; (vi) Foreign LLP; (vii) Public Sector Undertaking.

2.13 I don‟t have a DSC or an Aadhaar card, can I print the registration application and submit the duly signed hard copies via speed post or in person?

No paper-based application will be accepted under the GST regime. It is mandatory for you to use obtain a DSC or an Aadhaar card for E-Sign. Refer to reply to question above for more information.

2.14 Is there any prescribed format for documents/photographs that need to be uploaded when applying for a new registration on the GST Portal?

Yes, all documents must be in either PDF or JPEG format and the file size should NOT exceed 1 MB (500 KB in case of bank statements/first page of passbook)

All photographs must be in JPEG format and the file size should not exceed 100 KB.

2.15 My document/photograph is not in the prescribed format. What should I do?

You can use online tools available on the internet to convert the document/photograph into the prescribed format.

2.16 My document/photograph exceeds the permitted file size. What should I do?

You can use online tools available on the internet to reduce the file size for a document/photograph

2.17 Is there any verification while filing the new registration application?

Yes, you will be sent One Time Passwords (OTP) on your mobile number as well as your e-mail ID that you give in PART A of the New Registration Application (refer to 3.5 for more details). Please ensure you have access to both when you apply online.

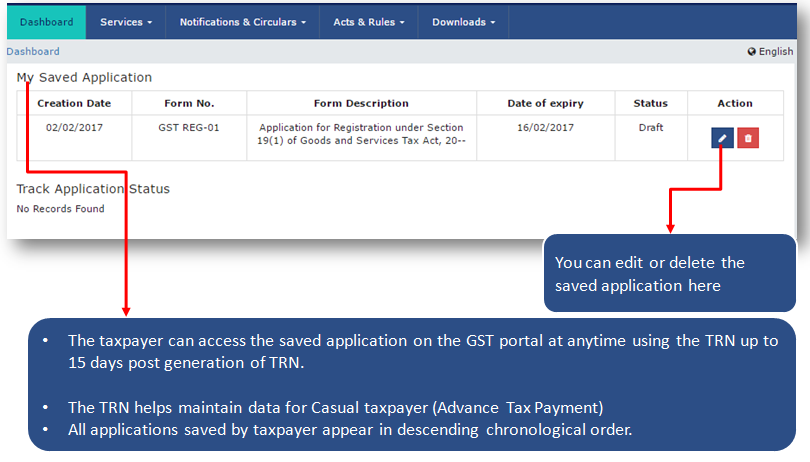

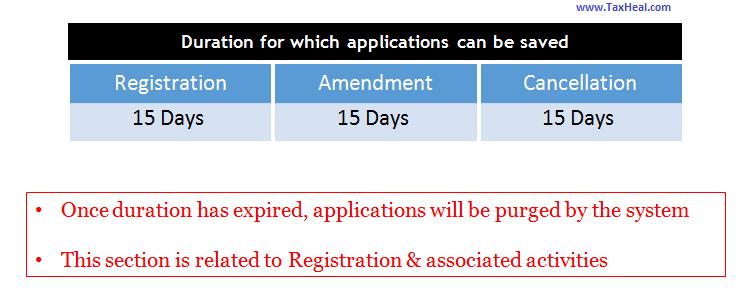

2.18 Can I save my new registration application?

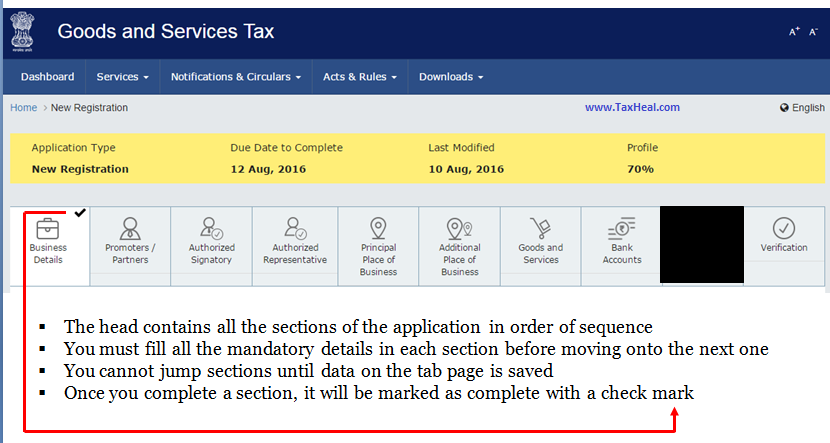

Yes, new registration applications can be saved in the system for 15 days from the moment the Transaction Reference Number (TRN) is generated. Sections of the applications will only be saved once you fill in all the mandatory details within a section and click SAVE & CONTINUE

2.19 For how long can I access a previously saved new registration application?

You can access a previously saved new registration application for a period of 15 days from

the day your Transaction Reference Number (TRN) is generated. The date of expiry of

theapplication is also clearly mentioned in the yellow band on your screen at all times when filling

the application.

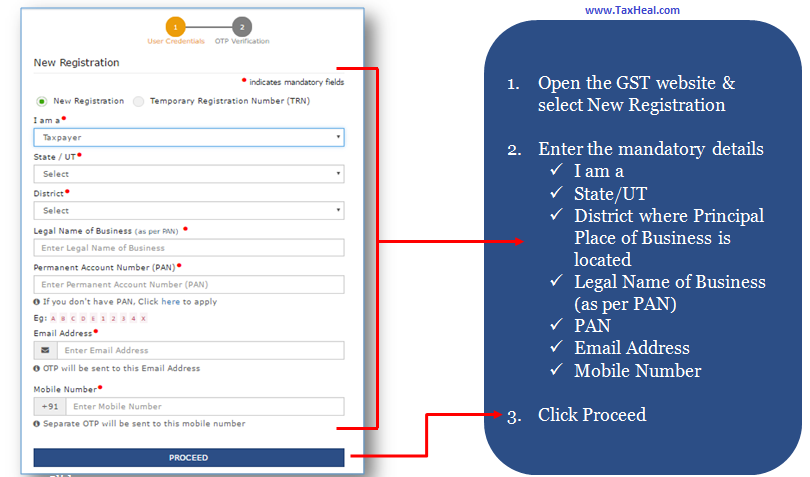

3. New GST Registration Application: PART A (Landing Page)

Read also How to Apply for GST New Registration – Explained with Screenshots & Examples

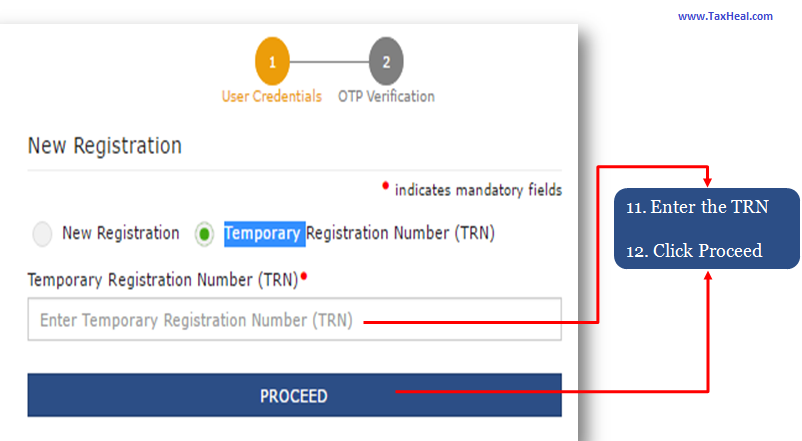

3.1 I am on the landing page of the New Registration Application and there are two radio buttons – New Registration and Temporary Reference Number (TRN). Which one do I need to select?

Select the New Registration Application to begin applying for GST Registration .

If you have already filled Part A of the Registration Application and have a valid TRN, select Temporary Reference Number.

3.2 I am applying for a new registration. Which state should I select?

Select the state in which you are applying for the registration.

Once you select a state in Part A of the Registration Application, it cannot be changed at a later stage.

3.3 My principal place of business is in State X but I am applying for a new registration for State Y. Which state should I select?

Select the state in which you are applying for the registration (registration is state-specific).

3.4 In the field for PAN, do I need to put my own PAN or the PAN of the business?

Please enter the PAN of your business. In case of proprietor, please provide your personal PAN.

3.5 Whose e-mail ID and mobile number should I give?

Please give details of the Primary Authorised Signatory in the Part A of the Registration Application

3.6 What is Captcha Code? Why do I need to fill it?

Captcha Code is anumeric code that must be filled every time a taxpayer login to the GST Portal. It has been added as an additional security measure.

3.7 The Captcha Code provided is not legible. What should I do?

You can click the refresh icon next to the code and the system will generate a new code for you.

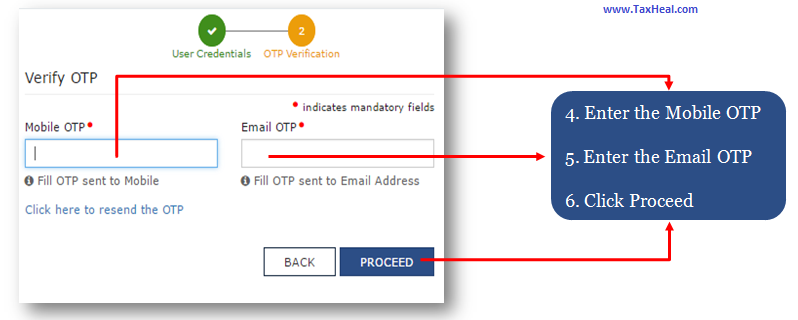

3.8 I clicked the SUBMIT button and now the system is asking me for a mobile OTP and an e-mail OTP but I haven’t received either. What do I do? / I have received my mobile OTP but not my e-mail OTP or vice versa. How long should I wait?

Please wait for at least 180 seconds after generating the OTPs.

In case you have still not received the OTP/s, make sure you are checking the correct mobile phone and e-mail inbox. For e-mail OTP, you must also check the spam folder of your e-mail account.

In case you have still not received one or both the OTPs, please click the Click to Resend OTPoption available on the screen. Both the OTPs will be sent again.

3.9 How long are the OTPs valid? OR Are the OTPs valid for a limited period of time? OR What is the validity of the OTP?

The validity period of each OTP is clearly mentioned in the SMS and e-mail. They are valid for at least 10 minutes.

3.10 I have received my mobile OTP but not my e-mail OTP or vice versa.

Refer to 3.8.

3.11 I have entered both OTPs correctly but the system is saying the OTPs are not valid.

It is possible your OTPs have expired. Click the Click to Resend OTP option available on the screen. Both the OTPs will be sent again. Please wait for at least 180 seconds after generating the OPTs.

Please note, when you generate fresh OTPs, both previous OTPs (mobile as well as e-mail) become invalid. You will now need to enter both mobile and e-mail OTP again.

3.12 How long should I wait for the OTPs before clicking on the resend OTP button?

Please wait for at least 180 seconds.

In case you have still not received the OTP/s, make sure you are checking the correct mobile phone and e-mail inbox. For e-mail OTP, you must also check the spam folder of your e-mail account.

In case you have still not received one or both the OTPs, please click on Click to Resend OTP option available on the screen.

Please note, when you generate fresh OTPs, both previous OTPs (mobile as well as e-mail) become invalid.

3.13 When I click the resend OTP button, do the previous OTPs become invalid?

Yes. For more details, refer to 3.8

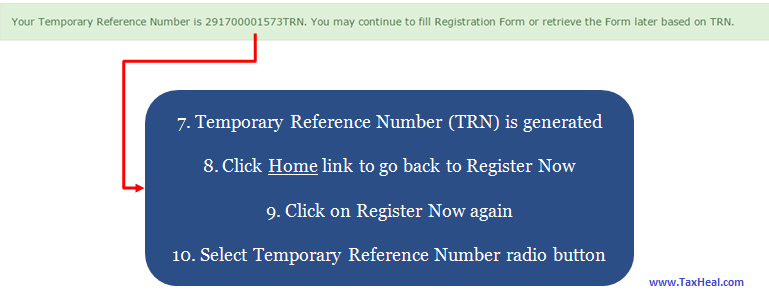

3.14 What is a TRN?

TRN or Temporary Reference Number is a unique 15-digit reference number that allows you to access your new registration application on the GST Portal in the pre-login mode (without valid login credentials).

TRN is generated when you successfully submit all the fields of PART A (first page) of the new registration application and successfully validate your mobile number and e-mail ID by correctly entering the respective OTPs.

Your TRN is sent to you via SMS and e-mail. It is valid for 15 days from the date of creation.

3.15 Now that I have generated my TRN, how do I begin filling PART B of my new registration application?

Please go to the New Registration page and select the radio button Temporary Reference Number. Now enter your TRN and click PROCEED. A new page will open where you will have to enter the Mobile OTP and e-mail OTP which will be sent to you when you click PROCEED. Enter the respective OTPs and you will be directed to the landing page of PART B of the New Registration Application (Business Details section).

3.16 I did not write my TRN or I have forgotten my TRN?

Your TRN is also sent to you via SMS and e-mail.

3.17 I did not write my TRN and I also deleted the SMS and the e-mail that were sent to me. What do I do now?

In such a case, you will have to fill in all the details in PART A of the Registration Application again. Upon completing the process, a message will be displayed ‘You already have a TRN generated <TRN number> with this combination’.

Be sure to save the TRN this time!

3.18 It has been more than 15 days since I generated a TRN. Can I still access my new registration application?

In such a case, you will have to fill in all the details in PART A of the Registration Application again. Upon completing the process, a message will be displayed ‘You already have a TRN generated <TRN number> with this combination’.

3.19 Does the TRN expire 15 days after I generate it or 15 days after my last login?

The TRN expires 15 days after it is generated regardless of any number of logins by you.

3.20 I have logged into my new registration application successfully using my TRN, Mobile OTP, and E-mail OTP. What now?

Please click on the blue box with the pencil icon inside it to continue filling your Registration Application.

4. New GST Registration Application: PART B: Business Details

4.1 I am unable to change my State. Why?

GST Registration is state-wise and since you have selected the state in PART A of the Registration Application, you cannot change it.

4.2 I don‟t know my Ward/Circle/Sector No

Please refer your state website, a GST Practitioner, or your jurisdictional officer.

4.3 I don‟t know my Center Jurisdiction.

Please refer to https://www.aces.gov.in/STASE/ui/jsp/common/statelocation.do

4.4 I want to/don‟t want to Opt for Composition

There is a YES/NO button to choose whether you wish to Opt for Composition or not. Please make the appropriate choice.

4.5 What is my Date of Commencement of Business ?

The date of commencement of business is the day you officially started supplying/receiving goods and/or services.

4.6 What document do I need to provide as Proof of Constitution of Business?

Documents for Proof of Constitution of Business are different for different types of entities. Please refer to the user manual for a detailed list of documents for each type of entity.

5. New GST Registration Application: PART B: Promoters / Partners

5.1 How many Promoters/Partners/Directors can I add in the application?

A maximum of 10 Promoters/Partners/Directors can be added in the Registration Application. In case of a Proprietor, there will be always only one Promoters/Partners/Director.

5.2 One (or more) of the Promoters/Partners/Directors is not an Indian National and does not have a PAN Card which, as indicated by the red dot, is a mandatory field. How do I add his/her details?

For foreigners, passport details are mandatory and PAN details are optional.To facilitate the same, there is a YES/NO check-box that asks

Are you a citizen of India?

If you select NO, passport details will become mandatory and PAN details will become optional.

5.3 One (or more) of the Promoters/Partners/Directors does not have a residential address in India but an Indian residential address is mandatory. What do I do ?

Residential address does not need to be in India

5.4 Can more than one Promoters/Partners/Director be an Authorised Signatory?

Yes, you can add up to 10 authorised signatories.

5.5 Do I need to upload passport photographs of ALL the Promoters / Partners / Directors ?

Yes, you need to upload passport photographs of all the Promoters/Partners/Directors whose details you are adding in the application form. Further, each passport photograph must be in JPEG format and not more than 100 KB in size

6. New GST Registration Application: PART B: Authorised Signatory

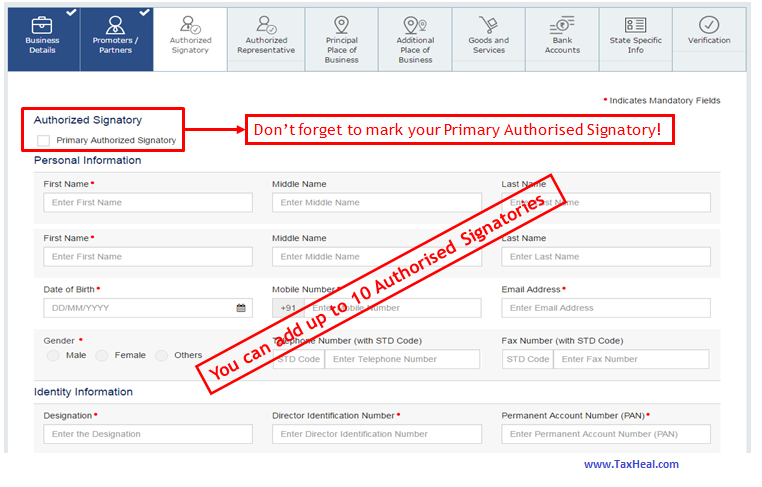

6.1 Is it mandatory to select a Primary Authorised Signatory?

Yes, you cannot submit your New Registration Application without selecting a Primary Authorised Signatory.

6.2 How many Authorised Signatories can I add in the form?

A maximum of 10 authorised signatories can be added.

6.3 Details of the Authorised Signatory are already prefilled based on entries made in the previous section (Promoters/Partners) however I want to add more Authorised Signatories.

If you selected one or more Promoters/Partners/Directors as authorised signatories, their details will be auto populated in the Authorised Signatory section to avoid duplication of work by you. If you wish to add more authorised signatories, you can simply select the ADD NEW option available at the end of the page. You can also view the list of authorised signatories by clicking on SHOW LIST. Don‟t forget, you can only add a maximum of 10 authorised signatories.

6.4 Can more than one Promoters/Partners/Director become the Primary Authorised Signatories?

No, you can have one and only one Primary Authorised Signatory

6.5 Can I add company employees other than promoter/director/partner/proprietor as Authorised Signatories?

Yes, you can.

6.6 Do I need to upload photographs of ALL the authorised signatories ?

Yes.

6.7 Do I need to upload Proof of Appointment of ALL the authorised signatories?

Yes

7. New GST Registration Application: PART B: Authorised Representative

7.1 I don‟t need/want an Authorised Representative.

Authorised representatives are not mandatory. If you do not wish to add, you can simply click on SAVE & CONTINUE and move on to the next section

7.2 My Authorised Representative does not have a GST enrolment ID and I am unable to enter their details in the form.

All authorised representatives must register with the GST Portal and obtain an enrolment ID without which their details cannot be auto populated in the registration application. Furthermore, any unregistered persons will not be given any access to your account, therefore, please ask your authorised representative to register with the GST Portal immediately or select one who is already registered and has an enrolment ID.

7.3 I have an Authorised Representative however I don‟t know their enrolment ID

You can contact your authorised representative and ask them to give you their GST enrolment ID. If you are unable to reach them, you may skip this section and add the details later.

7.4 How is an Authorised Representative different from a GST Practitioner or Authorised Signatory?

Authorised Representative can be any person. He cannot sign an application however he can represent the taxpayer in office. Tax Representativesand GST Practitioners can both be authorised signatories.

8. New GST Registration Application: PART B: Principal Place of Business

8.1 My head office/corporate office, which I assume should be my Principal Place of Business, is in a different state but I am unable to change the state when filling in the form.

Principal place of business needs to be located within the state where you are applying for the new GST registration. Please enter the details of the first/existing place of business within the state where registration is sought.

Note: Principal place of business can be amended at a later date also.

8.2 There are fields for Latitude and Longitude in the form. What are they for?

This is an optional field and is there for the purpose of providing as a feature to add additional details of your place of business (principal or additional).

8.3 I don‟t have an office e-mail address yet, can I give an alternate e-mail address now and update it later once it has been created?

Yes, you can.

8.4 My principal place of business is a co-working space. What should I select as Nature of Possession of Premises?

If your principal place of business is a co-working space, please select Shared as Nature of Possession of Premises unless you have a valid (registered) sub-let agreement with the provider of the co-working space

8.5 I am performing multiple business activities at my principal place of business. Can I select more than one nature of business activity?

Yes, you can select any number of options from the given list as long as you select a minimum of one.

8.6 My Principal Place of Business was leased by my father/mother many years ago through pagdi system and he/she has since passed away so I don‟t have a lease deed my name or in the name of my business. The landlord is also unwilling to register a fresh lease in my name. What should I do?

In all such exceptional cases, provisions have been made. Please contact your jurisdictional officer and they will guide you. In this specific case, a bank statement with the business address will suffice.

9. New GST Registration Application: PART B: Additional Places of Business

9.1 How many additional places of business can I add in the form?

Five Hundred (500).

9.2 I am unable to add additional places of business because the ADD NEW button is disabled.

Please press the BACK button and go back to the previous section (principal place of business). At the bottom of the page there is an option – Have Additional Places of Business with a YES/NO check-box. Select YES and click on SAVE & CONTINUE. Now you will be able to add the additional places of business.

9.3 Do I need to attach documentary proof of Nature of Possession of Premises for ALL the additional places of business?

No.

9.4 I am performing multiple business activities at one of my additional places of business. Can I select more than one nature of business activity for the same?

Yes, you can select any number of options from the given list as long as you select a minimum of one.

10. New GST Registration Application: PART B: Goods and Services

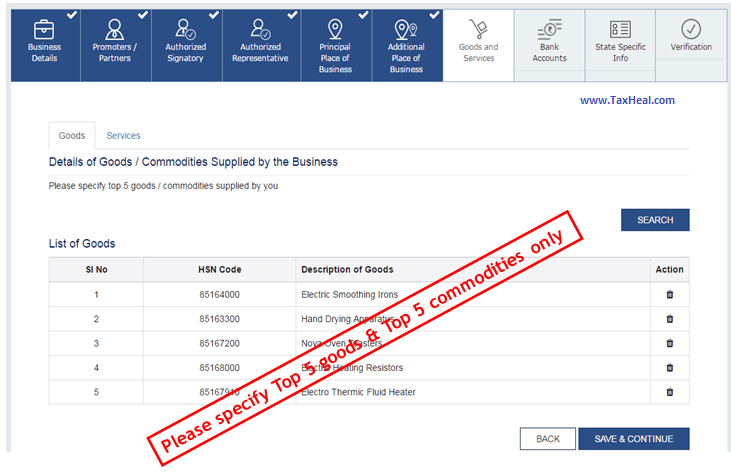

10.1 Is it mandatory to provide HSN/ SAC Codes?

You are required to provide a minimum of just one goods or service (one HSN or SAC Code ).

10.2 I supply multiple goods and/or services but the form is only asking me to specify the top 5 goods and top 5 services. Does this mean I can only supply 5 goods and 5 services?

No, there is no limit to the number of goods you can supply or the number of services you can provide under a single registration.

Since it will be mandatory to enter HSN/SAC details in the line items in invoices under the GST regime, the HSN/SAC information will be readily available to the relevant stakeholders.

10.3 Do I need to take an additional registration if I want to supply more than 5 goods and/or services?

No, you need not take an additional registration if you want to supply more than 5 goods and/or services.

10.4 I don‟t know the HSN Code for any of the products I supply. What do I do?

The Goods and Services section of the new registration application form has a built-in online utility that will help you select the HSN Code. For the Goods section, simply start typing the type of product under Search HSN Chapter by Name or Code and there will be a dropdown from which you can select the relevant chapter. Once you have selected the chapter, start typing in the Search HSN Code field and select the type of product. The HSN Code of the goods will be auto populated in the application. You can repeat the same if you want to enter details for more than one goods.

10.5 How do I search for SAC Codes?

The Goods and Services section of the new registration application form has a built-in online utility that will help you select the SAC code. For the Services section, simply start typing the type of service and there will be a dropdown from which you can select the relevant service. Once you have selected the service, the SAC Code of the service will be auto populated in the application. You can repeat the same if you want to enter details for more than one service.

10.6 I am entering the name of the goods/service but the system is unable to find it.

Please make sure you type slowly. If the online utility can’t find the goods/service, simply move on to the next section if you have added at least one goods/service since there are more than 17000 codes and it may be difficult for you to find the exact code on your own. If you supply only one goods, please contact a tax professional or your jurisdictional officer.

If you provide a single service, you can refer to the CBEC website https://aces.gov.in/ to choose the appropriate SAC since there are only 127.

11. New GST Registration Application: PART B: Bank Accounts

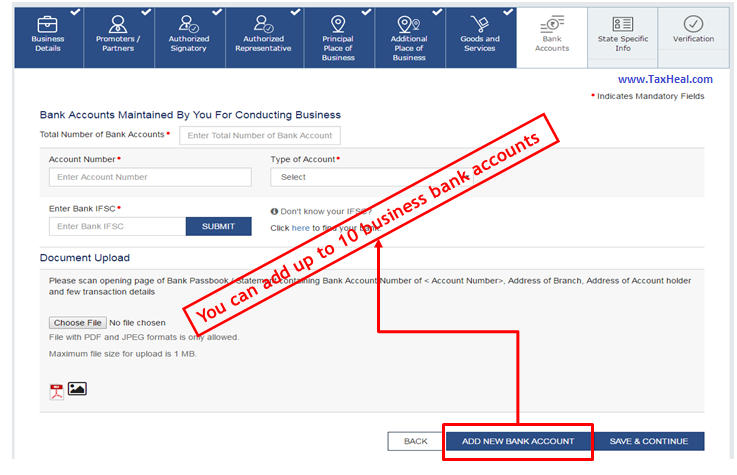

11.1 Is it mandatory to add a bank account?

Yes, you need to add at least one bank account.

11.2 How many bank accounts can I add?

You can add a maximum of 10 bank accounts.

11.3 My business bank account is not open yet. Can I add an alternate bank account?

Yes, you can add your personal bank account and update it once your business bank account is open.

11.4 What document can I upload as a supporting document for proof of bank account?

You can provide your monthly bank statement or the first page of your passbook.

11.5 I don‟t know my branch‟s IFSC Code. Where can I find it?

here is an online utility provided in the application in the Bank Accounts section to help you find your branch’s IFSC Code. Look for the ‘Click here to find your bank’ link.

11.6 I cannot see my bank‟s branch in the online utility provided. Is there any other way to find the IFSC Code?

Your branch IFSC code is also mentioned in the account‟s cheque book on every cheque.

12. New GST Registration Application: PART B: State Specific Information

12.1 Is it mandatory to enter State Specific Information?

No, it is not mandatory if you do not have any of the requested registrations.

12.2 If I have one or more of the requested registrations, is it then mandatory to fill in the State Specific Information?

While the system will permit you to move to the next section since it is an optional field, you are strongly advised to fill any such details to ensure you can comply with the self-verification before submitting your application.

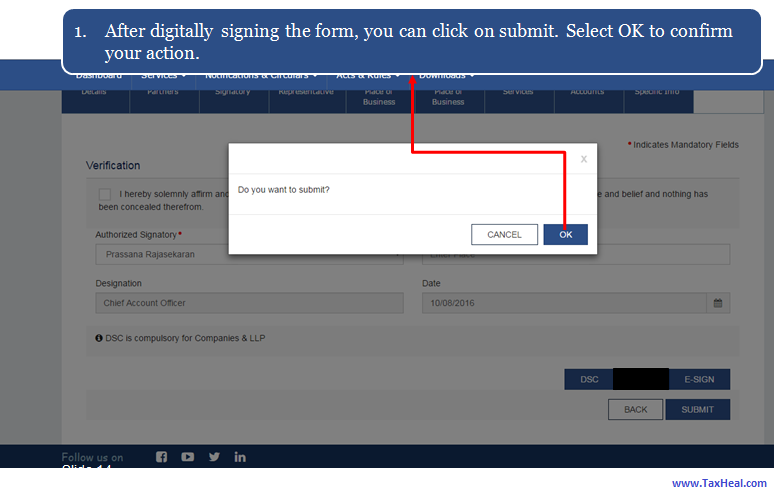

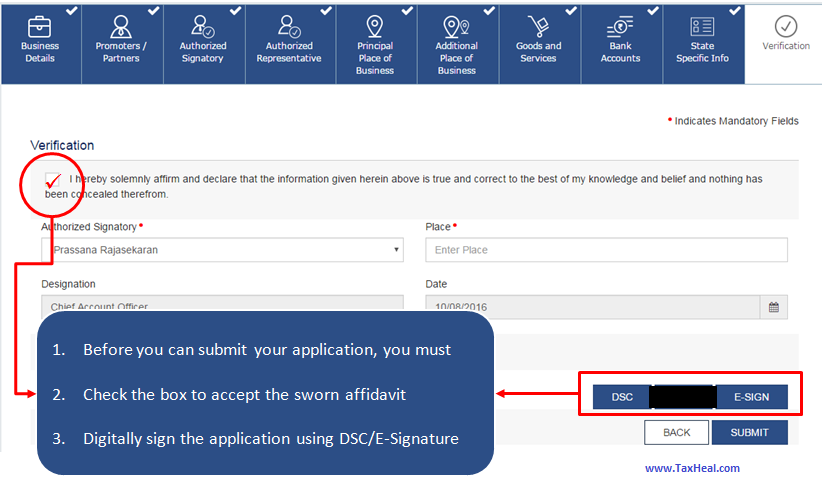

13. New GST Registration Application: PART B: Verification and Submission

Submit

13.1 I am applying for registration in State X but my physical location is State Y. Which location should I mention in Place in the Verification section of the new registration application form?

You need to mention your physical location (City/Town/Village and State)

13.2 Buttons other than SUBMIT WITH DSC are disabled?

Please note DSC is mandatory for (i) Public Limited Company, (ii) Private Limited Company, (iii) Unlimited Company; (iv) Foreign Company; (v) LLP; (vi) Foreign LLP; (vii) Public Sector Undertaking. In such cases, all other modes of submission will be disabled by the system.

13.3 My business is not a Company or an LLP. Can I still submit my new registration application with a DSC?

Yes, anyone can submit their registration application using a DSC provided it is an un-expired and unrevoked, PAN-based Class II or Class III DSC.

13.4 The options to SUBMIT WITH DSC and SUBMIT WITH E-SIGN are both disabled even though I have selected the Authorised Signatory and Place?

Have you checked the check-box under Verification? If not, please do.

13.5 I have opted to SUBMIT with E-SIGN but I am not getting the OTP despite multiple attempts. What should I do?

This happens in case your current mobile number is different from the number registered with Aadhaar authority (UIDAI). Since E-Sign uses UIDAI data for authentication, the OTP will only go to the mobile number registered with UIDAI.

In such a case, you will have to update your mobile number with UIDAI or use the SUBMIT WITH DSC option.

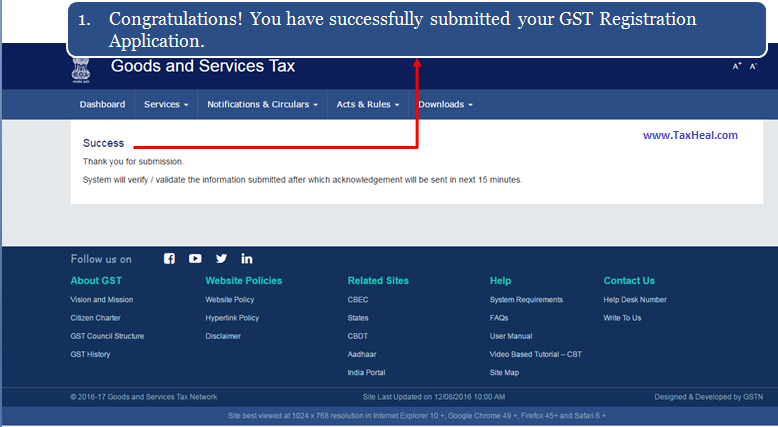

13.6 I have submitted my registration application successfully and I have received an Acknowledge Reference Number (ARN). Now what?

You will receive a response from the tax authorities within 3 common working days on the status of your application. It will either be approved or the assessing officer will raise a Notice Seeking Clarification in case they have any queries w.r.t. the application and/or documents provided. Either way, it will be communicated to you via e-mail.

13.7 Can the assessing officer reject my application?

Your application cannot be rejected after the first assessment as principle of natural justice mandates that the you get an opportunity to be heard, hence, the Tax Official may only raise a Notice Seeking Clarification to provide you with the said opportunity. If your response is satisfactory, your application will be approved. If you provide an unsatisfactory response or fail to respond, your application will be rejected. You have seven (7) common working days within which to respond to the Notice Seeking Clarification.

14. New GST Registration Application: Track Application Status

14.1 How do I track the status of my registration application?

This is a pre-login option available to users who have applied for registration and want to know the status of their registration application.

1. On the GST website, go to Services > Registration > Track Application Status

2. Click on Track Application Status

3. The landing page will have a single field in which you need to enter your ARN

4. When you enter the ARN, an additional field will appear where you need to enter the given Captcha Code

5. Click SEARCH

6. The system will display the status your registration application

GST Application submission through DSC , EVC and E Sign – Process

How to Apply for GST New Registration – Explained with Screenshots & Examples

GST Registration as Tax Deductor on GST Potal : Steps to Register with screenshots

GST Registration as Tax Deductor or collector – FAQ’s

Related Topic on GST

| Topic | Link |

| GST Acts | Central GST Act and States GST Acts |

| Rules | GST Rules |

| Rates | GST Rates |

| Notifications | GST Act Notifications |

| Press Release | GST Press Release |

| Commentary | Topic wise Commentary on GST Act of India |