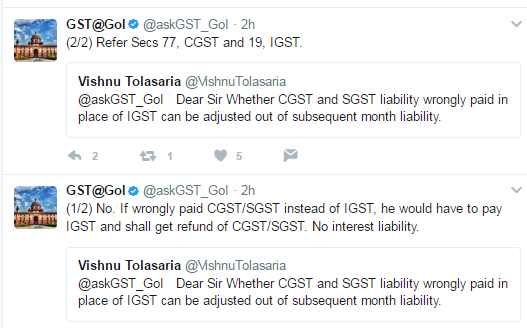

Q Dear Sir Whether CGST and SGST liability wrongly paid in place of IGST can be adjusted out of subsequent month liability.

No. If wrongly paid CGST/SGST instead of IGST, he would have to pay IGST and shall get refund of CGST/SGST. No interest liability.

Refer Section 77. CGST and section 19 IGST.

Section 77 of CGST Act 2017 Tax wrongfully collected and paid to Central Government or State Government.

Section 19 of IGST Act 2017 Tax wrongfully collected and paid to Central Government or State Government

[ Reply on 05.06.2017 at 1.24 am as per Twitter Account of Govt of India for GST queries of Taxpayers ]