Notification No 31/2018 Central Tax

Seeks to lay down the special procedure for completing migration of taxpayers who received provisional IDs but could not complete the migration process.

[ GSTR 3B Due date Extended for newly migrated Taxpayers as per Notification No 31/2018 Central Tax , from July, 2017 to November, 2018 vide Notification No 45/2018 Central Tax Dated 10th September, 2018 : , Notification No 46/2018 Central Tax Dated 10th Sep 2018 :, Notification No 47/2018 Central Tax Dated 10th Sep 2018

Video Analysis of Notification by CA Satbir Singh in Hindi

Read Notification No 31/2018 Central Tax

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section

(i)]

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

Notification No. 31/2018 – Central Tax

New Delhi, the 6th August, 2018

G.S.R……(E).- In exercise of the powers conferred by section 148 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby specifies the persons who did not file the complete FORM GST REG26 of the Central Goods and Services Tax Rules, 2017 but received only a Provisional Identification Number (PID) (hereinafter referred to as “such taxpayers”) till the 31st December, 2017 may now apply for Goods and Services Tax Identification Number (GSTIN)

2. The special procedure to be followed for registration of such taxpayers is as detailed below:-

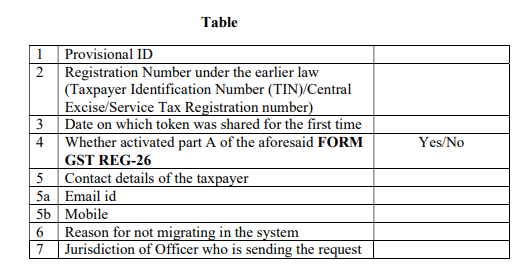

(i) The details as per the Table below should be furnished by such taxpayers to the jurisdictional nodal officer of the Central Government or State Government on or before the 31st August, 2018.

(ii) On receipt of an e-mail from the Goods and Services Tax Network (GSTN), such taxpayers should apply for registration by logging onto https://www.gst.gov.in/) in the “Services” tab and filling up the application in FORM GST REG-01 of the Central Goods and Services Tax Rules, 2017.

(iii) After due approval of the application by the proper officer, such taxpayers will receive an email from GSTN mentioning the Application Reference Number (ARN), a new GSTIN and a new access token.

(iv) Upon receipt, such taxpayers are required to furnish the following details to GSTN by email, on or before the 30th September, 2018, to migration@gstn.org.in:–

(a) New GSTIN;

(b) Access Token for new GSTIN;

(c) ARN of new application;

(d) Old GSTIN (PID).

(v) Upon receipt of the above information from such taxpayers, GSTN shall complete theprocess of mapping the new GSTIN to the old GSTIN and inform such taxpayers.

(vi) Such taxpayers are required to log onto the common portal www.gstn.gov.in using the old GSTIN as “First Time Login” for generation of the Registration Certificate

3. Such taxpayers shall be deemed to have been registered with effect from the 1st July, 2017.

[F. No.349/58/2017-GST(Pt.)]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India