Payment Process under GST of India

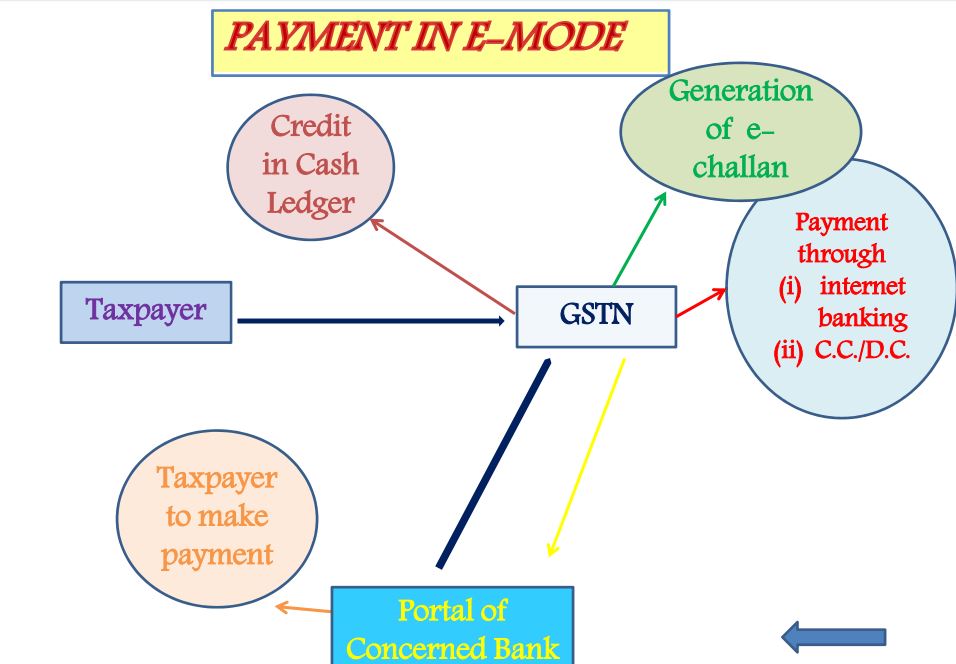

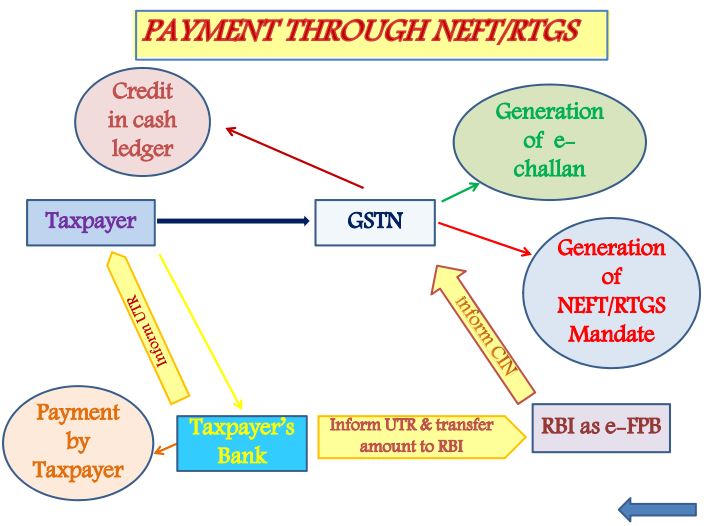

- Section 35 of the Model GST Act deals with payment of tax, interest, penalty and other amounts. It provides that every deposit made by internet banking or by using credit/debit cards or NEFT/RTGS or by any other mode, shall be credited to the electronic cash ledger to be maintained in the manner prescribed. Further, the amount of input tax credit as self-assessed in the return shall be credited to electronic credit ledger etc. – See more at: http://taxguru.in/goods-and-service-tax/highlights-draft-gst-rules-formats-approved-gst-council.html#sthash.DQZe1241.dpuf

- 4 Rules for Payment Prescribed- The Draft Payment Rules have 4 Rules viz. Electronic Tax Liability Register, Electronic Credit Ledger, Electronic Cash Ledger and Identification number for each transaction.

Download GST Draft Payment Rules Released by CBEC

- Forms of various electronic register/ledger- The electronic tax liability register shall be maintained in FORM GST PMT-1, the electronic credit ledger in FORM GST PMT-2 and the electronic cash ledger in FORM GST PMT-3.

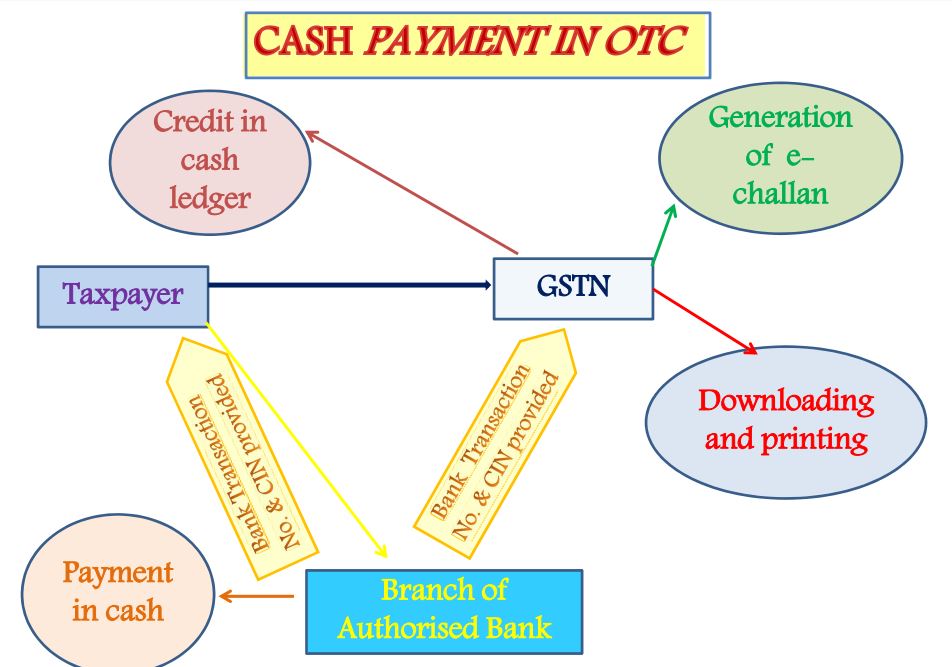

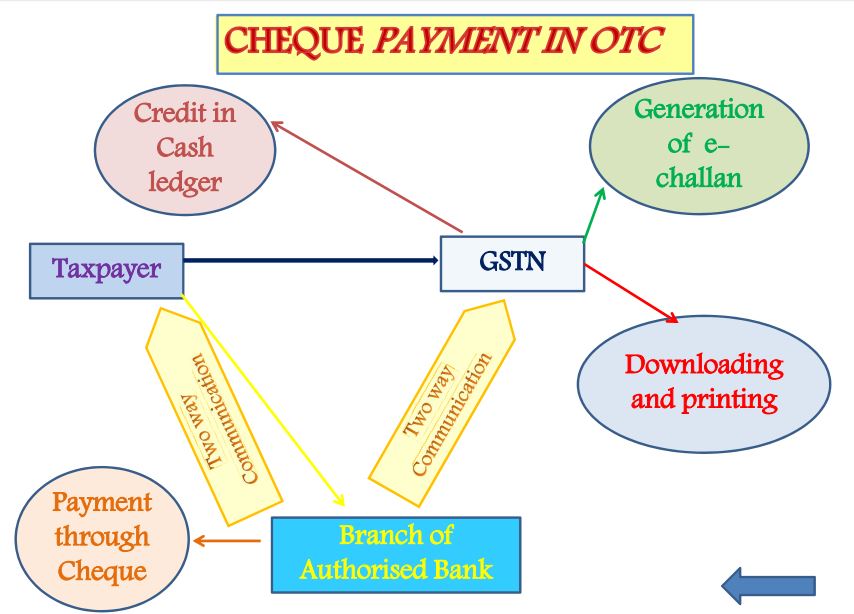

- Mode of Payment of tax- Tax can be paid either through net banking, credit or debit card, NEFT/RTGS, Over the Counter (“OTC”) [OTC payment only up to Rs. 10,000 per challan per tax period].

- Unique Identification Number (UIN)- A UIN shall be generated at the Common Portal for each debit or credit to the electronic cash or credit ledger. Generation of UIN for every transaction – to be correlated with tax liability register.

- 7 Forms for Payment prescribed -7 Forms for payment has been prescribed (Form GST PMT-1 to Form GST PMT -6 and Form GST PMT-2A), namely-

Download GST Draft Payment formats Released by CBEC

Download GST -Draft Registration formats released by CBEC

Download GST -Draft Registration Rules Released by CBEC

Download Draft GST Refund Rules released by Govt

Download Draft GST Refund Forms released by CBEC

Download Draft GST Return Rules Released by Govt

Download Draft GST Return Formats released by Govt

Education Guide on Goods & Service Tax (GST)