Place of Supply in GST with Examples

Place of Supply in GST has to be determined as per IGST Act 2017 notified by Govt of India

Why Place of Supply in GST is Important ?

Place of Supply’ under GST is an important factor as it defines

i) The taxable event under GST is the ‘Supply’ of Goods or Services.

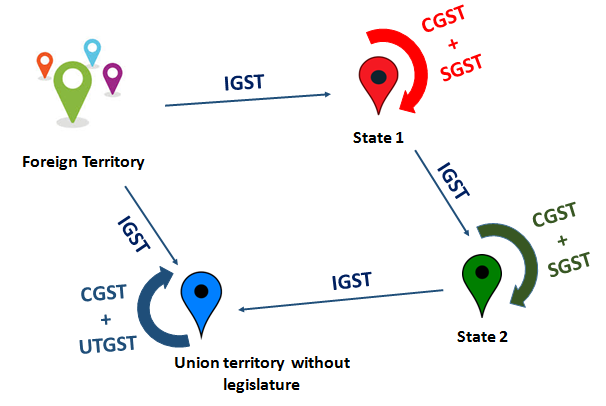

ii) whether the transaction will be counted as intra-state(i.e within the same state) or inter-state(i.e. between two states) and accordingly the changeability of tax, i.e levy of IGST , CGST & SGST/UTGST will be determined.

IGST :- There shall be levied a tax called the integrated goods and services tax on all inter-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 of the Central Goods and Services Tax Act [ Section 9 of IGST Act 2017 ]

CGST :- There shall be levied a tax called the central goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 of the Central Goods and Services Tax Act [ Section Section 9 of CGST Act 2017 ]

SGST /UTGST:- There shall be levied a tax called the State (Name of the State / UT of India] goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 of the SGST/ UTGST Act 2017.

( Note UTGST Will be Charged in case of Union Territory without legislature)

How to Determine Supply in GST ?

Nature of Supply is to be determined as per IGST Act 2017 ( Integrated Goods and Service Tax Act 2017 ) – Chapter IV of Determination of Nature of Supply

Inter-State supply [ section 7 of IGST Act 2017 ]

Inter-State supply.

7. (1) Subject to the provisions of section 10, supply of goods, where the location of the supplier and the place of supply are in––

(a) two different States;

(b) two different Union territories; or

(c) a State and a Union territory,

shall be treated as a supply of goods in the course of inter-State trade or commerce.

(2) Supply of goods imported into the territory of India, till they cross the customs frontiers of India, shall be treated to be a supply of goods in the course of inter-State trade or commerce.

(3) Subject to the provisions of section 12, supply of services, where the location of the supplier and the place of supply are in––

(a) two different States;

(b) two different Union territories; or

(c) a State and a Union territory,

shall be treated as a supply of services in the course of inter-State trade or commerce.

(4) Supply of services imported into the territory of India shall be treated to be a supply of services in the course of inter-State trade or commerce.

(5) Supply of goods or services or both,––

(a) when the supplier is located in India and the place of supply is outside India;

(b) to or by a Special Economic Zone developer or a Special Economic Zone unit; or

(c) in the taxable territory, not being an intra-State supply and not covered elsewhere in this section,

shall be treated to be a supply of goods or services or both in the course of inter-State trade or commerce.

Intra-State supply. [ Section 8 of IGST Act 2017 ]

8. (1) Subject to the provisions of section 10, supply of goods where the location of the supplier and the place of supply of goods are in the same State or same Union territory shall be treated as intra-State supply:

Provided that the following supply of goods shall not be treated as intra-State supply, namely:––

(i) supply of goods to or by a Special Economic Zone developer or a Special Economic Zone unit;

(ii) goods imported into the territory of India till they cross the customs frontiers of India; or

(iii) supplies made to a tourist referred to in section 15.

(2) Subject to the provisions of section 12 , supply of services where the location of the supplier and the place of supply of services are in the same State or same Union territory shall be treated as intra-State supply:

Provided that the intra-State supply of services shall not include supply of services to or by a Special Economic Zone developer or a Special Economic Zone unit.

Explanation 1.––For the purposes of this Act, where a person has,––

(i) an establishment in India and any other establishment outside India;

(ii) an establishment in a State or Union territory and any other establishment outside that State or Union territory; or

(iii) an establishment in a State or Union territory and any other establishment being a business vertical registered within that State or Union territory,

then such establishments shall be treated as establishments of distinct persons.

Explanation 2.––A person carrying on a business through a branch or an agency or a representational office in any territory shall be treated as having an establishment in that territory.

Supplies in territorial waters.[ Section 9 of IGST Act 2017 ]

9. Notwithstanding anything contained in this Act,––

(a) where the location of the supplier is in the territorial waters, the location of such supplier; or

(b) where the place of supply is in the territorial waters, the place of supply,

shall, for the purposes of this Act, be deemed to be in the coastal State or Union territory where the nearest point of the appropriate baseline is located.

Place of Supply of Goods or Service or Both

IGST Act 2017– Chapter V explains Place of Goods or Services or Both ( Section 11 to Section 14 )

10. Place of supply of goods other than supply of goods imported into, or exported from India.

11. Place of supply of goods imported into, or exported from India.

12. Place of supply of services where location of supplier and recepient is in India.

13. Place of supply of services where location of supplier or location of receipient is outside India.

14. Special provision for payment of tax by a supplier of online information and database access or retrieval services.

Summary of Place of Supply of Goods Other than imports and Exports – Goods ( Section 10 IGST Act 2017)

| Where Supply | Place of supply Shall be |

| Involves movement of goods | location of the goods at the time at which the movement of goods terminates for delivery to the recipient ( See Example 1 to 3 below) |

| Delivery of goods is directed by a third person , whether acting as an agent or otherwise, before or during movement of goods,,either by way of transfer of documents of title to the goods or otherwise | Principal place of such third person ( See Example 4 below and Table 4A) |

| Does not involve movements | Location of such goods at the time of delivery to recipient. ( See Example 5 below) |

| of goods are assembled or installed at site | Place of installation or assembly ( See Example 6 below) |

| of goods on board, a vessel, aircraft, train, motor vehicle | Location at which such goods are taken on board ( See Example 7 below) |

| Where place supply cannot be determined then it shall be determined as prescribed | |

Examples of Place of Supply and GST in case supply involve Movement of Goods

When a Supply involves Movements of Goods, Place of supply is the location at which the movement of goods terminates for delivery to the recipient.

- Ludhiana Electronics in Punjab , supplies 10 computers to Patiala Electronics in Punjab .

Location of the supplier: Ludhiana , Punjab

Place of supply: The place of business of Patiala Electronics is in Patiala , Punjab and the movement of the computers terminates here for delivery. Hence, the place of supply is Punjab in Punjab .

GST Payable :- This is an intrastate supply. The taxes applicable are CGST and SGST.

2. Ludhiana Electronics in Punjab , supplies 10 computers to Ambala Electronics in Haryana .

Location of supplier: Ludhiana , Punjab

Place of supply: Ambala , Haryana

GST Payable : This is an inter state supply. The tax applicable on this supply is IGST.

3. Ludhiana Electronics in Punjab, receives an order for 50 computers from Ambala Electronics in Haryana . Ambala Electronics also informed Ludhiana Electronics that they will take delivery of the computers ex-factory, at the premises of Ludhiana Electronics. Let us determine the charge of tax here.

Location of supplier: Ludhiana , Punjab

Place of Supply: The place of business of the recipient, Ambala Electronics, is in Haryana. It must be noted however, that Ambala Electronics, has agreed to take delivery of the computers ex-factory of the supplier, Ludhiana Electronics. This implies that the termination of the movement of the computers to Ambala Electronics takes place ex-factory of Ludhiana Electronics, i.e., in Ludhiana , Punjab . Hence, the place of supply is Ludhiana , Punjab

GST Payable :- This is an intra-state supply and the taxes applicable are CGST and SGST.

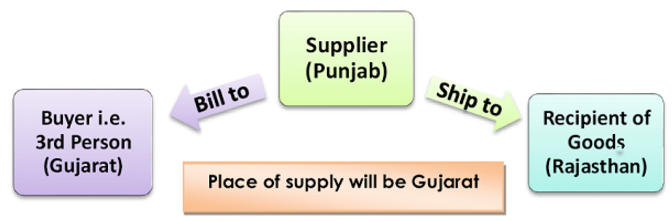

4. Ludhiana Electronics in Punjab, receives an order for 50 computers from Guajarat Electronics in Gujarat. Guajarat Electronics also informed Ludhiana Electronics that computer needs to be delivered at Rajashtan Office of Guajarat Electronics . Let us determine the charge of tax here.

GST Payable : This is an inter state supply. The tax applicable on this supply is IGST.

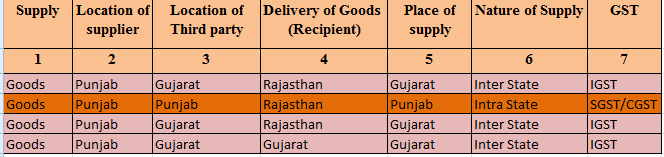

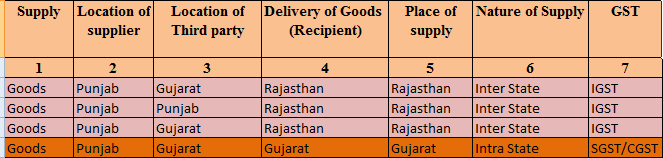

Table 4A

Transaction Between Supplier and Third Party :- Place of Supply and GST

Suppose Location of Supplier (column No 2) and Location of Third Party (Column No 3) are as per Table below and deliver is to be made to the recipient at place mentioned in Column No 4 on direction of Third party (Column no 3) , then Place of Supply (column No 5) for transactions between Supplier and Third Party will be Principal Place of Third Party as per Column No 3.

Transaction Between Third Party and Recipient :- Place of Supply and GST

Location of Third Party (Column No 3) are as per Table below and deliver is to be made to the recipient at place mentioned in Column No 4 on direction of Third party (Column no 3) , then Place of Supply (column No 5) for transactions between Third party and Recipient will be location of the goods at the time at which the movement of goods terminates for delivery to the recipient as per Column No 4.

5. Where goods does not involve movements – Place of Supply will be Location of such goods at the time of delivery to recipient.

Example :- Job worker develops a mould for the production of goods for the principal and retains the mould in his place itself for production of goods. The mould developed by the job worker is sold to the principal but the same is retained by the job worker without causing the movement of mould from job worker’s premises to the principal’s premises. In this case the place of supply would be job worker’s premises.

6. If goods are assembled or installed at site – Place of Supply is the Place of installation or assembly

| Particulars | Location of supplier | Location of recipient | Site of installation/ assembly | Place of supply |

| “A” of Delhi supplied Machinery to “B” of Haryana which is to installed in UP by “A” | Delhi | Haryana | UP | UP (site of installation) |

GST Payable : This is an inter state supply. The tax applicable on this supply is IGST.

7. Supply of goods on board, a vessel, aircraft, train, motor vehicle – Place of Supply is Location at which such goods are taken on board

Example 1 :- Hotel Delhi of Delhi has provided on board meal to a Delhi Mumbai Train, in this case place of supply of goods will be the place where goods are taken on board i.e. Delhi.

Example 2, if an aircraft departs from Bangalore to Mumbai after taking onboard food for consumption on board, the place of supply will be Bangalore.

Summary of Place of Supply of Goods in case of Imports and Exports ( section 11 IGST Act 2017)

| Situations | Place of supply of goods |

| Goods Imported into India | Location of Importer |

| Goods Exported from India | Location outside India |

Summary of Place of supply of services where the location of supplier of services and the location of the recipient of services is in India. ( Section 12 IGST Act 2017 )

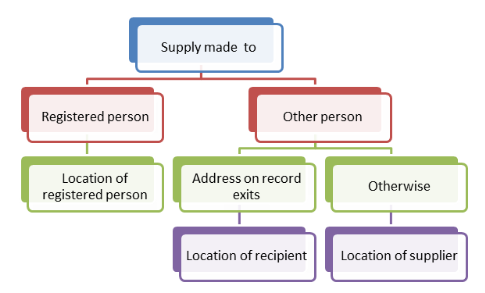

Place of Supply of Services – General Rule -Sr No 2 of below Table

Place of Supply of Services – Specific Rule ( Sr No 3 to 14 of below Table)

Sr No | Where Supply (Name of services) | Place of supply will be |

| 2 | of services if not covered by sl no 3 to 14 and if it is made to registered person | Location of such person |

| of Services if not covered by sl no 3 to 14and if it is made to other than Registered person | i ) location of recipient where the address on record exists; and (ii) the location of the supplier of services in other cases. ( See Picture above – General Rule of Place of Supply of Services) | |

| 3 | is provided a) directly in relation to an immovable property, including services provided by architects, interior decorators, surveyors, engineers and other related experts or estate agents, any service provided by way of grant of rights to use immovable property or for carrying out or co-ordination of construction work | Location of such immovable property or boat or vessel. If the location of the immovable property or boat or vessel is located or intended to be located outside India, the place of supply shall be the location of the recipient. Where the immovable property or boat or vessel is located in more than one State or Union territory, the supply of services shall be treated as made in each of the respective States or Union territories, in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed. ( See Example 1 and 1A below) |

| b) by way of lodging accommodation by a hotel, inn, guest house, home stay, club or campsite, by whatever name called, and including a house boat or any other vessel | ||

| c) by way of accommodation in any immovable property for organising any marriage or reception or matters related thereto, official, social, cultural, religious or business function including services provided in relation to such function at such property | ||

| d) any services ancillary to the services referred to in clauses (a), (b) and (c), | ||

| 4 | Restaurant and catering services, personal grooming, fitness, beauty treatment, health service including cosmetic and plastic surgery | Location where such services are actually performed. ( See Example 2 and 2A Below) |

| 5 | In relation to training and performance appraisal to | a) Registered person then location of such person. B) Other than Registered person then location where the services are actually performed. ( See example 3A , 3B and 3C below) |

| 6 | Admission to a cultural, artistic, sporting, scientific, educational, entertainment event or amusement park or any other place and services ancillary thereto | Place where the event is actually held or where the park or such other place is located. ( See Example 4 below ) |

| 7 | a) Organisation of a cultural, artistic, sporting, scientific, educational or entertainment event including supply of services in relation to a conference, fair, exhibition, celebration or similar events b) services ancillary to organisation of any of the events or services referred to in clause (a), or assigning of sponsorship to such events | a)To a Registered person then location of such person. b) Other than Registered person then the location where the event is actually held and if the event is held outside India, the place of supply shall be the location of the recipient. c) Where the event is held in more than one State or Union territory and a consolidated amount is charged for supply of services relating to such event, the place of supply of such services shall be taken as being in each of the respective States or Union territories in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed. ( See Example 5A , 5B , 5C and 5D below) |

| 8 | Transportation of Goods by mail or courier | a) To Registered person then location of such person b) To Other than Registered person, then the location where goods are handed over for transportation( See Example 6 below) |

9 | Passenger transportation service | a) To Registered person then location of such person b) To other than Registered person, place where the passenger embarks on the conveyance for a continuous journey:c) where the right to passage is given for future use and the point of embarkation is not known at the time of issue of right to passage, the place of supply of such service shall be determined in accordance with SR No 2 d) Return journey shall be treated as a separate journey, even if the right to passage for onward and return journey is issued at the same time.( See Example 7 below) |

| 10 | On board a conveyance, including a vessel, an aircraft, a train or a motor vehicle | Location of the first scheduled point of departure of that conveyance for the journey. ( See Example 8 below ) |

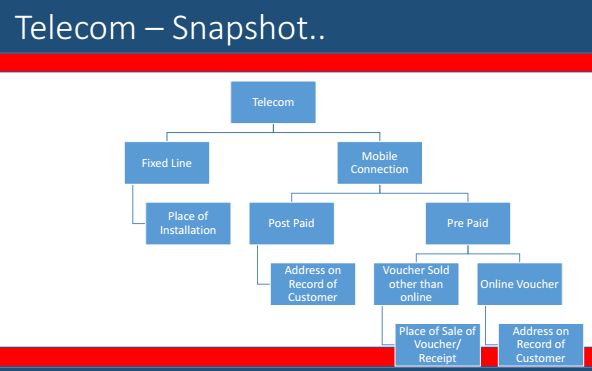

| 11 | Telecommunication services including data transfer, broadcasting, cable and direct to home television services to any person | (a) in case of services by way of fixed telecommunication line, leased circuits, internet leased circuit, cable or dish antenna, be the location where the telecommunication line, leased circuit or cable connection or dish antenna is installed for receipt of services; (b) In case of mobile connection for telecommunication and internet services provided on post-paid basis, be the location of billing address of the recipient of services on the record of the supplier of services; (c) in cases where mobile connection for telecommunication, internet service and direct to home television services are provided on pre-payment basis through a voucher or any other means,–– (i) through a selling agent or a re-seller or a distributor of subscriber identity module card or re-charge voucher, be the address of the selling agent or re-seller or distributor as per the record of the supplier at the time of supply; or (ii) by any person to the final subscriber, be the location where such prepayment is received or such vouchers are sold; (d) in other cases, be the address of the recipient as per the records of the supplier of services and where such address is not available, the place of supply shall be location of the supplier of services. Note i) where the address of the recipient as per the records of the supplier of services is not available, the place of supply shall be location of the supplier of services: ii) if such pre-paid service is availed or the recharge is made through internet banking or other electronic mode of payment, the location of the recipient of services on the record of the supplier of services shall be the place of supply of such services. iii) Where the leased circuit is installed in more than one State or Union territory and a consolidated amount is charged for supply of services relating to such circuit, the place of supply of such services shall be taken as being in each of the respective States or Union territories in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed. ( See example 9 below) |

| 12 | Banking and other financial services, including stock broking services to any person | a) Location of the recipient of services on the records of the supplier of services: b)if the location of recipient of services is not on the records of the supplier, the place of supply shall be the location of the supplier of services.( See Example 10 below) |

| 13 | Insurance services | a) To a registered person, location of such person b) Other than registered person, location of the recipient of services on the records of the supplier of services.( See Example 11 below) |

| 14 | Advertisement services to the Central Government, a State Government, a statutory body or a local authority meant for the States or Union territories identified in the contract or agreement | shall be taken as being in each of such States or Union territories and the value of such supplies specific to each State or Union territory shall be in proportion to the amount attributable to services provided by way of dissemination in the respective States or Union territories as may be determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed. |

| Against sl no 3,7,11 and 14 the Government foresees circumstances where place of supply could still not be defined, the term “as may be prescribed” is inserted under explanation clause | ||

Examples of Place of Supply and GST in case of Supply of Services

- Place of supply of service in relation to an immovable property will be Location of such immovable property or boat or vessel.

- If ‘A’ of Ahmadabad, is constructing a house in Mumbai and appoints ‘B’ of

Delhi to provide architectural services with regard the proposed construction of house located in Mumbai, then the place of supply of such architectural services shall be Mumbai.

- If ‘A’ of Ahmadabad, is constructing a house in Mumbai and appoints ‘B’ of

1A . Where the immovable property or boat or vessel is located in more than one State or Union territory, the supply of services shall be treated as made in each of the respective States or Union territories, in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed

Example :- ZOYO Rooms, based out of Bangalore, takes reservation for accommodationin its hotels across India from ABC airlines, based out of New Delhi, for overnight stay of its crew members. The place of accommodation services shall be the location of the hotel where the crew members stayed.

In case, the agreement between ZOYO rooms and ABC airlines is per night per room basis, then the value of service separately collected for each hotel shall be treated as the value of service for the respective State.

In case, the agreement between ZOYO rooms and ABC airlines is on a lump sum basis for a month

then the place of supply shall be determined as may prescribed in the rules.

2. Restaurant and catering services – Place of supply will be Location where such services are actually performed

Mani Caterers in Mumbai, Maharashtra, provides catering services to Goa Automobiles of Goa for their annual sales event in Mumbai.

Location of supplier: Mumbai, Maharashtra

Place of supply: The catering service is performed in Mumbai, Maharashtra

GST Payable :- This is an intrastate supply and the taxes applicable are CGST +SGST

2A .Personal grooming, fitness, beauty treatment and health services, including cosmetic and plastic surgery – Place of supply will be Location where such services are actually performed

A Chartered Accountant registered in Haryana, takes an Ayurveda treatment at Dev Ayurveda Centre in Kerala.

Location of supplier: Kerala

Place of supply: The Ayurveda treatment is performed in Kerala ( i.e Location where the service is rendered)

GST Payable : This is an intrastate supply and the taxes applicable are CGST + SGST

If ‘X’, a resident of Delhi , goes to Punjab for plastic surgery then the place of supply of plastic surgery services shall be Punjab .

Location of supplier: Punjab

Place of supply : Plastic surgery performed in Punjab

GST Payable : This is an intrastate supply and the taxes applicable are CGST + SGST

3.Services in relation to training and performance appraisal

3A Ambala Institute of Fashion Designing in Haryana, provides fashion designing training to Ram Apparel, registered in Delhi . The training is conducted at Chandigarh Institute’s premises.

Location of supplier: Ambala , Haryana

Place of supply: Ram Apparel is registered in Delhi. (In case of Services in relation to training and performance appraisal to Registered Person then Location of the recipient)

GST Payable : This is an Interstate supply and the tax applicable is IGST.

3B Ambala Institute of Fashion Designing in Haryana, provides an undergraduate course in fashion designing to students at its premises.

Location of supplier: Ambala , Haryana

Place of supply: The training is provided in Ambala , Haryana (In case of Services in relation to training and performance appraisal to unregistered Person then Location where the service is rendered )

GST Payable : Hence, this is an intrastate supply and the taxes applicable are CGST and SGST

3C If ‘A’, a resident of Shimla (Himachal Pradesh), conducts training for employees of Software Ltd, a company based out of Punjab, in Shimla Resort located in Shimla, then the place of

supply of training service shall be

Location of supplier : Shimla (Himachal Pradesh)

Place of Supply for training services : Punjab , if Software Ltd is a registered person under GST

GST Payable : Hence, this is an inter state supply and the taxes applicable are IGST

Location of supplier : Shimla (Himachal Pradesh)

Place of Supply for training services : Shimla (Himachal Pradesh) , if Software Ltd is unregistered person under GST

GST Payable : Hence, this is an intrastate supply and the taxes applicable are CGST and SGST

4. Admission to a cultural, artistic, sporting, scientific, educational, entertainment event or amusement park or any other place and services ancillary thereto – Place of supply is the Place where the event is actually held or where the park or such other place is located.

Example :- A person in Ambala , Haryana buys tickets for the Tourism Festival in Goa from the Department of Tourism of Goa.

Location of supplier: Goa Tourism

Place of supply: The Tourism Festival is held in Goa i.e the Place where the event is actually held or where the park or such other place is located

GST Payable :- This is an intra-state supply and the taxes applicable will be CGST+ SGST

Example :- When Book My Ticket online Private Limited, a company based out of Chandigarh providing online ticketing services for admission to various events, sells online tickets for IPL tournament to be held across India, then the place of supply of services for admission to each cricket match shall be the location where the match is actually played

5. Services provided through Organisation of a cultural, artistic, sporting, scientific, educational or entertainment event including supply of services in relation to a conference, fair, exhibition, celebration or similar events and services ancillary to organisation of any of the these events or services or assigning of sponsorship to such events .

Place of supply will be :-

a) location of such person (If person is registered under GST)

b) The location where the event is actually held (Other than Registered person )

c) If the event is held outside India, the place of supply shall be the location of the recipient

5A Ram Event Organizers, registered in Mumbai, provides event management services to Shyam Automobiles, registered in Delhi, for their annual sales event in Mumbai.

Location of supplier: Mumbai

Place of supply: Shyam Automobiles is registered in Delhi. ( i.e Service to registered person than Location of the recipient )

GST Payable This is an interstate supply and the tax applicable is IGST.

5B Ram Event Organizers, registered in Mumbai, provides event management services to a customer located in Rajasthan, for her wedding reception in Mumbai.

Location of supplier: Mumbai

Place of supply: The wedding is held in Mumbai ( i.e Service to unregistered person than Location where the event is held )

GST Payable :- This is an intrastate supply and the taxes applicable are CGST + SGST

5C Cars Limited, an automobile company based out of Punjab, appoints Events Private Limited, a company based out of Mumbai providing event organization services, to provide services for organizing an event for launching their new vehicle in the Indian market. The launch event is organized at Mumbai, Delhi, Calcutta, Chennai by the Event Private Limited.

The place of supply of organizing such events shall be the location of Cars Limited, that is Punjab, if Cars Limited is a registered person.

If Cars Limited is not a registered person, then the place of supply of such event organization services shall be the location where the events are actually held.

5D IPL limited located in India Organises IPL matches. If an IPL cricket match is played in South Africa, then the place of supply of service in relation to organizing the cricket match shall be the location of IPL limited because If the event is held outside India, the place of supply shall be the location of the recipient .

6. Transportation of Goods by mail or Courier, Place of Supply will be

a) Location of registered person (In case supplied to Registered person )

b) Location where goods are handed over for transportation ( In case supplied to Other than Registered person)

Express limited, a goods transport company based out of Punjab, provides transportation services to Cars Limited, an automobile company based out of Haryana, for movement of their cars from the warehouse of Cars Limited at Chandigarh (Union Territory) to Delhi,

Place of supply of transportation services : Haryana , if Cars Limited is a registered person.

Place of supply of transportation services : Chandigarh ,If Cars Limited is not a registered person

7. Transportation of Passengers , Place of Supply will be :-

a) Location of registered person (In case supplied to Registered person )

b) The place where the passenger embarks (begins) on the conveyance for a continuous journey. ( In case Services provided to other than Registered person)

Note : Return journey shall be treated as a separate journey, even if the right to passage for onward and return journey is issued at the same time.

Example A :- Mr ‘A’, person based out of Mumbai, purchases air ticket from Airlines Ltd, an airline company based out of Chennai, for travel from New Delhi to NEW YORK via Dubai,

Place of supply of passenger transportation : Mumbai. ( If Mr ‘A’ is registered person )

Place of supply of passenger transportation : New Delhi.(If Mr ‘A’ is not a registered person )

Example B : A unregistered person Books a Tickets as well as return ticket for train ” Palace on wheels ” , a train running from Jaipur (Rajashtan) to Kanyakumari (Kerela)

Place of supply of onward journey: Jaipur Rajashtan ((As Mr ‘A’ is not a registered person).

Place of supply for return journey : Kanyakumari. (Kerela ) . Note : – Return journey shall be treated as a separate journey, even if the right to passage for onward and return journey is issued at the same time.

8 Supply of Services on board a conveyance, including a vessel, an aircraft, a train or a motor vehicle , Place of Supply will be Location of the first scheduled point of departure of that conveyance for the journey.

When Palace on wheels, a train running from Jaipur (Rajashtan) to Kanyakumari (Kerela) , provides on-board entertainment services to its passengers,

Place of supply of such on-board entertainment services : Jaipur Rajashtan (first scheduled point of departure).

9..Telecommunication services including data transfer, broadcasting, cable and direct to home television services to any person

Fixed Line – Example – if ‘A’, a, resident of Bangalore purchases dish antenna from Tata sky, a company providing DTH cable services based out of Mumbai, then the place of supply of DTH services shall be the location where the dish antenna is installed i.e. Bangalore.(Karnataka)

Post Paid – Example – ‘A’, resident of Bangalore, takes services from Airtel Limited, a company based out of New Delhi, for his postpaid mobile connection. The place of supply of services in relation to the postpaid

mobile connection shall be the billing address of ‘A’ as per the records of Airtel Limited, regardless of where ‘A’ utilises the mobile services.

Pre Paid :-Example – if ‘A’, a resident of Bangalore has a prepaid mobile connection from Airtel Limited and while travelling to Mumbai, he purchases a recharge coupon from a local distributor, then the place of supply of such services would be the location of the local distributor.

Where the leased circuit is installed in more than one State or Union territory and a consolidated amount is charged for supply of services relating to such circuit, the place of supply of such services shall be taken as being in each of the respective States or Union territories in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed.

Example, if Software Ltd, a company based out of Bangalore (Karnataka) procures services of leased circuit lines for its branches in Mumbai and Calcutta and Chennai from DTH limited, a company based out of New Delhi, the place of supply of service of leased circuit lines shall be proportionately at each branch where the installation is done.

In case, Software Ltd pays a lump sum amount for the latest circuit lines services of all branches, then the apportionment between States shall be done on reasonable basis as may be prescribed in this regard.

10. In case of supply of Banking and other financial services, including stock broking services to any person , Place of supply will be :-

a) Location of the recipient of services on the records of the supplier of services:

b)if the location of recipient of services is not on the records of the supplier, the place of supply shall be the location of the supplier of services.

Example:

If ‘A’, a resident of Mumbai opens a bank account in Mumbai with Bank Ltd, and submits his Mumbai residence address, the place of supply of banking services shall be

Mumbai.

If ‘B’ goes to bank in Bangalore not having an account with the bank to take a demand draft, the place of supply shall be the location of the supplier i.e. bank in Bangalore issuing the demand draft

11. In case of Insurance services , Place of supply will be :-

a) Location of registered person ( If Services to registered person )

b) Location of the recipient of services on the records of the supplier of services. (If services provided to other than registered person)

| Particulars | Location of supplier | Location of recipient | Place of supply |

| LIC office of Delhi is providing health insurance service for employees of “ABC Ltd“ registered in Haryana | Delhi | Haryana | Haryana ( Location of Registered Person) |

| Tata AIG, Mumbai providing life insurance service to “X” of Ahmedabad | Mumbai, Maharashtra | Ahmedabad, Gujarat | Ahmedabad, Gujarat (Location of the recipient of services on the records of the supplier of services) |

Summary of Place of supply of services where location of supplier or location of recipient is outside India ( Section 13 of IGST Act 2017 )

Services Other Than Specified Services (Other than List 3 to 13 below)

| Condition | Place of Supply |

| Location of recipient of services available | Location of the recipient of services |

| Location of recipient of services not available in the ordinary course of business | Location of the supplier of services |

Specified Services ( as per List 3 to 13 below)

| Sr No | Condition | Place of Supply |

| 3(a) | Services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services (Note -It will not apply to services supplied in respect of goods which are temporarily imported into India for repairs and are exported after repairs without being put to any other use in India, than that which is required for such repairs) | Location where services actually performed (see Example 1 below ) |

| Location where goods are situated at the time of supply of services ( if services are provided from a remote location by way of electronic means)( See Example 2 below) | ||

| 3(b) | Services supplied to an individual, represented either as the recipient of services or a person acting on behalf of the recipient, which require the physical presence of the recipient or the person acting on his behalf, with the supplier for the supply of services | Location where services actually performed |

| 4 | Services supplied directly in relation to an immovable property, including services supplied in this regard by experts and estate agents, supply of accommodation by a hotel, inn, guest house, club or campsite, by whatever name called, grant of rights to use immovable property, services for carrying out or co-ordination of construction work, including that of architects or interior decorators, | where the immovable property is located or intended to be located. ( See Example 3 below) |

| 5 | Services supplied by way of admission to, or organisation of a cultural, artistic, sporting, scientific, educational or entertainment event, or a celebration, conference, fair, exhibition or similar events, and of services ancillary to such admission or organisation | where the event is actually held ( See Example 4 below) |

| 6 | Services referred to in Sr No 3(a), 3(b) , 4 and 5 is supplied at more than one location including a location in the taxable territory | Location in the taxable territory |

| 7 | Services referred to in Sr No 3(a), 3(b) , 4 and 5 are supplied in more than one State or Union territory | Such services shall be taken as being in each of the respective States or Union territories and the value of such supplies specific to each State or Union territory shall be in proportion to the value for services separately collected or determined in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other basis as may be prescribed |

| 8(a) | Services supplied by a banking company, or a financial institution, or a non-banking financial company, to account holders; | Location of the supplier of services ( See Example 5 below) |

| 8(b) | Intermediary services | |

| 8(c) | Services consisting of hiring of means of transport, including yachts but excluding aircrafts and vessels, up to a period of one month | |

| 9 | Services of transportation of goods, other than by way of mail or courier | Place of destination of such goods ( See Example 6 below ) |

| 10 | Passenger transportation services | where the passenger embarks on the conveyance for a continuous journey |

| 11 | Services provided on board a conveyance during the course of a passenger transport operation, including services intended to be wholly or substantially consumed while on board | First scheduled point of departure of that conveyance for the journey ( See Example 7 below) |

| 12 | Online information and database access or retrieval services | Location of the recipient of services ( See Example 8 below) |

| 13 | If the Government notify any description of services or circumstances, In order to prevent double taxation or non-taxation of the supply of a service, or for the uniform application of rules | Place of effective use and enjoyment of a service. |

Example on Place of supply of services where location of supplier or location of recipient is outside India

- Services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services , Place of Supply is Location where services actually performed

Example – If ‘A’ of New York, is constructing a house in New York and appoints ‘B’ of Delhi(India) to provide architectural services with regard to the proposed construction of house located in New York(USA), then

Location of supplier of Service : Delhi(India)

Location of recipient of Service : New York.(USA)

Place of supply of such architectural services : New York.(USA) ( i.e Location where services actually performed )

2.Services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services and if services are provided from a remote location by way of electronic means then Place of Supply will be Location where goods are situated at the time of supply of services

Example :- If Software Ltd, a company based out of Bangalore (Karnataka, India) awards online maintenance contract of its servers located in Mumbai (Maharashtra , India) office to X INC, a company based out of USA, and as per the terms of the online maintenance X INC shall be required to perform regular maintenance from USA using Internet.

Location of supplier of Service : USA

Location of recipient of Service : Bangalore (Karnataka, India)

Place of supply of maintenance services : Mumbai (Maharashtra , India) i.e Location where goods are situated at the time of supply of services

3. Services supplied directly in relation to an immovable property, including services supplied in this regard by experts and estate agents, supply of accommodation by a hotel, inn, guest house, club or campsite, by whatever name called, grant of rights to use immovable property, services for carrying out or co-ordination of construction work, including that of architects or interior decorators, then Place of Supply is where the immovable property is located or intended to be located.

Example – If ‘A’ of New York, is constructing a house in New York and appoints ‘B’ of Delhi(India) to provide architectural services with regard to the proposed construction of house located in New York(USA), then

Location of supplier of Service : India

Location of recipient of Service : New York.(USA)

Place of supply of such architectural services : New York.(USA) ( i.e Location of immovable property )

4. Services supplied by way of admission to, or organisation of a cultural, artistic, sporting, scientific, educational or entertainment event, or a celebration, conference, fair, exhibition or similar events, and of services ancillary to such admission or organisation then place of supply is where the event is actually held.

Example: If Company X in India pays to Hotel of London for conference to be attended by its CEO held in London

Location of supplier : London

Location of recipient : India

Place of supply of service : London. (i.e where the event is actually held )

5. Place of supply of service is Location of the supplier of services for the following services

a) Services supplied by a banking company, or a financial institution, or a non-banking financial company, to account holders;

b) Intermediary services

c) Services consisting of hiring of means of transport, including yachts but excluding aircrafts and vessels, up to a period of one month

Example: If XY Bank in USA charges loan processing charges to AB Co. located in India,

Location of supplier : USA

Location of recipient : India

Place of supply of service : USA (Location of the supplier of services)

6. In case of Services of transportation of goods, other than by way of mail or courier , Place of supply will be Place of destination of such goods

PQ Shipping Co. located in Singapore charges ocean freight charges for transport of goods to Germany for a customer located in India,

Location of supplier : Singapore

Location of recipient : India

Place of supply of service : Germany ( i.e Place of destination of such goods )

7. In case of services provided on board a conveyance during the course of a passenger transport operation, including services intended to be wholly or substantially consumed while on board, Place of Supply shall be First scheduled point of departure of that conveyance for the journey

Example: When Singapore Airlines departing from Mumbai (Maharashtra , India) to Paris provides food to its passengers,

Location of supplier : Singapore

Location of recipient : Passengers on Board of Conveyance (Aircraft ) in Mumbai (Maharashtra , India)

Place of supply : Mumbai (Maharashtra , India) i.e first scheduled point of departure.

8. Place of supply of online information and database access or retrieval services shall be the location of the recipient of services.

However person receiving such services shall be deemed to be located in the taxable territory (India), if any 2 of the following conditions are satisfied :––

(a) the location of address presented by the recipient of services through internet is in the taxable territory;

(b) the credit card or debit card or store value card or charge card or smart card or any other card by which the recipient of services settles payment has been issued in the taxable territory;

(c) the billing address of the recipient of services is in the taxable territory;

(d) the internet protocol address of the device used by the recipient of services is in the taxable territory;

(e) the bank of the recipient of services in which the account used for payment is maintained is in the taxable territory;

(f) the country code of the subscriber identity module card used by the recipient of services is of taxable territory;

(g) the location of the fixed land line through which the service is received by the recipient is in the taxable territory

Examples of such services are advertising on the internet; providing cloud services; provision of e-books, movie, music, software and other intangibles via telecommunication networks or internet; providing data or information, retrievable r otherwise, to any person, in electronic form through a computer network; online supplies of digital content (movies, television shows, music, etc.); digital data storage; online gaming.

FAQs on Place of Supply of Goods and Service under GST by CBEC on 31.03.2017

Q 1. What is the need for the Place of Supply of Goods and Services under GST?

Ans. The basic principle of GST is that it should effectively tax the consumption of such supplies at the destination thereof or as the case may at the point of consumption. So place of supply provision determines the place i.e. taxable jurisdiction where the tax should reach. The place of supply determines whether a transaction is intra-state or inter-state. In other words, the place of Supply of Goods or services is required to determine whether a supply is subject to SGST plus CGST in a given State or union territory or else would attract IGST if it is an inter-state supply.

Q 2. Why are place of supply provisions different in respect of goods and services?

Ans. Goods being tangible do not pose any significant problems for determination of their place of consumption. Services being intangible pose problems w.r.t determination of place of supply mainly due to following factors:

(i) The manner of delivery of service could be altered easily. For example, telecom service could change from mostly post-paid to mostly pre-paid; billing address could be changed, billers address could be changed, repair or maintenance of software could be changed from onsite to online; banking services were earlier required customer to go to the bank, now the customer could avail service from anywhere;

(ii) Service provider, service receiver and the service provided may not be ascertainable or may easily be suppressed as nothing tangible moves and there would hardly be a trail;

(iii) For supplying a service, a fixed location of service provider is not mandatory and even the service recipient may receive service while on the move. The location of billing could be changed overnight;

(iv) Sometime the same element may flow to more than one location, for example, construction or other services in respect of a railway line, a national highway or a bridge on a river which originate in one state and end in the other state. Similarly, a copy right for distribution and exhibition of film could be assigned for many states in single transaction or an advertisement or a programme is broadcasted across the country at the same time. An airline may issue seasonal tickets, containing say 10 leafs which could be used for travel between any two locations in the country. The card issued by Delhi metro could be used by a person located in Noida, or Delhi or Faridabad, without the Delhi metro being able to distinguish the location or journeys at the time of receipt of payment;

(v) Services are continuously evolving and would thus continue to pose newer challenges. For example, 15-20 years back no one could have thought of DTH, online information, online banking, online booking of tickets, internet, mobile telecommunication etc.

Q 3. What proxies or assumptions in a transaction can be used to determine the place of supply?

Ans. The various element involved in a transaction in services can be used as proxies to determine the place of supply. An assumption or proxy which gives more appropriate result than others for determining the place of supply, could be used for determining the place of supply. The same are discussed below:

(a) location of service provider;

(b) the location of service receiver;

(c) the place where the activity takes place/ place of performance;

(d) the place where it is consumed; and

(e) the place/person to which actual benefit flows

Q 4. What is the need to have separate rules for place of supply in respect of B2B (supplies to registered persons) and B2C (supplies to unregistered persons) transactions?

Ans. In respect of B2B transactions, the taxes paid are taken as credit by the recipient so such transactions are just pass through. GST collected on B2B supplies effectively create a liability for the government and an asset for the recipient of such supplies in as much as the recipient is entitled to use the input tax credit for payment of future taxes. For B2B transactions the location of recipient takes care in almost all situations as further credit is to be taken by recipient. The recipient usually further supplies to another customer. The supply is consumed only when a B2B transaction is further converted into B2C transaction. In respect of B2C transactions, the supply is finally consumed and the taxes paid actually come to the government.

Q 5. What would be the place of supply where goods are removed?

Ans. The place of supply of goods shall be the location of the goods at the time at which the movement of goods terminates for delivery to the recipient. ( section 10 of IGST Act)

Q 6. What will be the place of supply if the goods are delivered by the supplier to a person on the direction of a third person?

Ans. It would be deemed that the third person has received the goods and the place of supply of such goods shall be the principal place of business of such person. ( Section 9 of IGST Act)

Q 7. What will be the place of supply where the goods or services are supplied on board a conveyance, such as a vessel, an aircraft, a train or a motor vehicle?

Ans. In respect of goods, the place of supply shall be the location at which such goods are taken on board. (Section 9 of IGST Act)

However, in respect of services, the place of supply shall be the location of the first scheduled point of departure of that conveyance for the journey. (Section 12 and 13 of IGST Act).

Q 8. What is the default presumption for place of supply in respect of B2B supply of services?

Ans. The terms used in the IGST Act are registered taxpayers and non-registered taxpayers. The presumption in case of supplies to registered person is the location of such person. Since the recipient is registered, address of recipient is always there and the same can be taken as proxy for place of supply.

Q 9. What is the default presumption for place of supply in respect of unregistered recipients?

Ans. In respect of unregistered recipients, the usual place of supply is location of recipient. However, in many cases, the address of recipient is not available, in such cases, location of the supplier of services is taken as proxy for place of supply.

Q 10. The place of supply in relation to immovable property is the location of immovable property. Suppose a road is constructed from Delhi to Mumbai covering multiple states. What will be the place of supply?

Ans. Where the immovable property is located in more than one State, the supply of service shall be treated as made in each of the States in proportion to the value for services separately collected or determined, in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf. (The Explanation clause to section 12(3) of the IGST Act, for domestic supplies)

Q 11. What would be the place of supply of services provided for organizing an event, say, IPL cricket series which is held in multiple states?

Ans. In case of an event, if the recipient of service is registered, the place of supply of services for organizing the event shall be the location of such person.

However, if the recipient is not registered, the place of supply shall be the place where event is held. Since the event is being held in multiple states and a consolidated amount is charges for such services, the place of supply shall be taken as being in each state in proportion to the value of services so provided in each state. (The Explanation clause to section 12(7) of the IGST Act)

Q 12. What will be the place of supply of goods services by way of transportation of goods, including mail or courier?

Ans. In case of domestic supply: If the recipient is registered, the location of such person shall be the place of supply.

However, if the recipient is not registered, the place of supply shall be the place where the goods are handed over for transportation (section 12 of the IGST Act.)

For international supplies: The place of supply of transport services, other than the courier services, shall be the destination of goods. For courier, the place of supply of services is where goods are handed over to courier. However, if the courier services are performed even partially in India, the place of supply shall be deemed as India (section 13(3),13(6) and 13(9) of the IGST Act).

Q 13. What will be the place of supply of passenger transportation service, if a person travels from Mumbai to Delhi and back to Mumbai?

Ans. If the person is registered, the place of supply shall be the location of recipient. If the person is not registered, the place of supply for the forward journey from Mumbai to Delhi shall be Mumbai, the place where he embarks.

However, for the return journey, the place of supply shall be Delhi as the return journey has to be treated as separate journey. (The Explanation clause to section 12(9) of the IGST Act).

Q 14. Suppose a ticket/ pass for anywhere travel in India is issued by M/s Air India to a person. What will be the place of supply?

Ans. In the above case, the place of embarkation will not be available at the time of issue of invoice as the right to passage is for future use. Accordingly, place of supply cannot be the place of embarkation. In such cases, the default rule shall apply. (The proviso clause to section 12(9) of the IGST Act)

Q 15. What will be the place of supply for mobile connection? Can it be the location of supplier?

Ans. For domestic supplies: The location of supplier of mobile services cannot be the place of supply as the mobile companies are providing services in multiple states and many of these services are inter-state. The consumption principle will be broken if the location of supplier is taken as place of supply and all the revenue may go to a few states where the suppliers are located.

The place of supply for mobile connection would depend on whether the connection is on postpaid or prepaid basis. In case of postpaid connections, the place of supply shall be the location of billing address of the recipient of service.

In case of pre-paid connections, the place of supply shall be the place where payment for such connection is received or such pre-paid vouchers are sold. However, if the recharge is done through internet/e-payment, the location of recipient of service on record shall be the taken as the place of service.

For international supplies: The place of supply of telecom services is the location of the recipient of service.

Q 16. A person in Goa buys shares from a broker in Delhi on NSE (in Mumbai). What will be the place of supply?

Ans. The place of supply shall be the location of the recipient of services on the records of the supplier of services. So Goa shall be the place of supply.

Q 17. A person from Mumbai goes to Kullu-Manali and takes some services from ICICI Bank in Manali. What will be the place of supply?

Ans. If the service is not linked to the account of person, place of supply shall be Kullu i.e. the location of the supplier of services. However, if the service is linked to the account of the person, the place of supply shall be Mumbai, the location of recipient on the records of the supplier.

Q 18. A person from Gurgaon travels by Air India flight from Mumbai to Delhi and gets his travel insurance done in Mumbai. What will be the place of supply?

Ans. The location of the recipient of services on the records of the supplier of insurance services shall be the place of supply. So Gurgaon shall be the place of supply. (proviso clause to section 12(13) of the IGST Act)

Source- GST FAQ by CBEC- 2nd Edition. 31.03.2017 – Download -Print

Place of Supply and Time of Supply under GST – Webinar /Video CA Bimal Jain

on 21.04.2017

Supply Valuation in GST – Webinar

Delivered on 13.04.2017