Purchase Details not required in GSTR 4 ( serial No 4A of Table 4 )

Form GSTR-4 is for Quarterly return for registered person opting for composition levy.

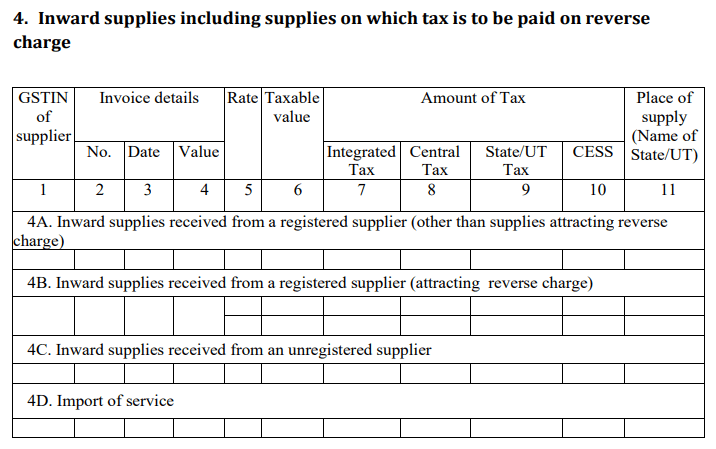

Now composition scheme dealer is not required to give details of Serial No 4A. of Table 4 i.e Inward supplies received from a registered supplier (other than supplies attracting reverse charge) in GSTR 4

Video Explanation by CA Satbir Singh

By Notification No. 60/2018 – Central Tax Dated 30th October, 2018 Govt has amended the Instruction No 10 of Form GSTR 4 as follow :-

“10. Information against the Serial 4A of Table 4 shall not be furnished.”.

Serial No 4A of Table 4 was as follow

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal