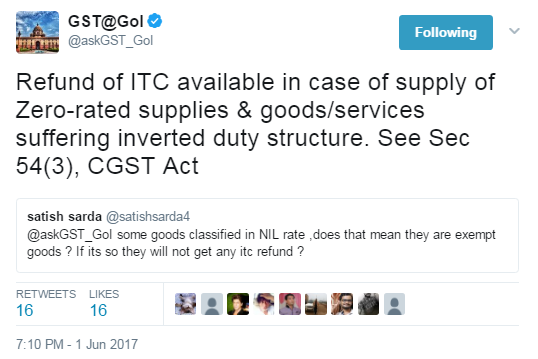

Q : some goods classified in NIL rate ,does that mean they are exempt goods ? If its so they will not get any itc refund ?

Refund of ITC available in case of supply of Zero-rated supplies & goods/services suffering inverted duty structure. See Section 54(3), CGST Act

[ Section 2(47) of CGST Act 2017 “exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply; ]

[ Also Refer Section 17(2) of CGST Act 2017 – Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies. ]

[ Reply as per Twitter Account of Govt of India for GST queries of Taxpayers ]

Read Other related GST Questions / Queries replied

Read other related GST Technical / GST Tech Questions