Registration requirements under GST

- Turnover for GST Registration of New taxable person :– Every supplier shall be liable to be registered under GST in the State from where he makes a taxable supply of goods and/or services if his aggregate turnover in a financial year exceeds Rs 20 lakhs. (as per GST Council decision). However, if supplier is engaged in business from North Eastern States including Sikkim then this threshold will be Rs. 10 lakhs.

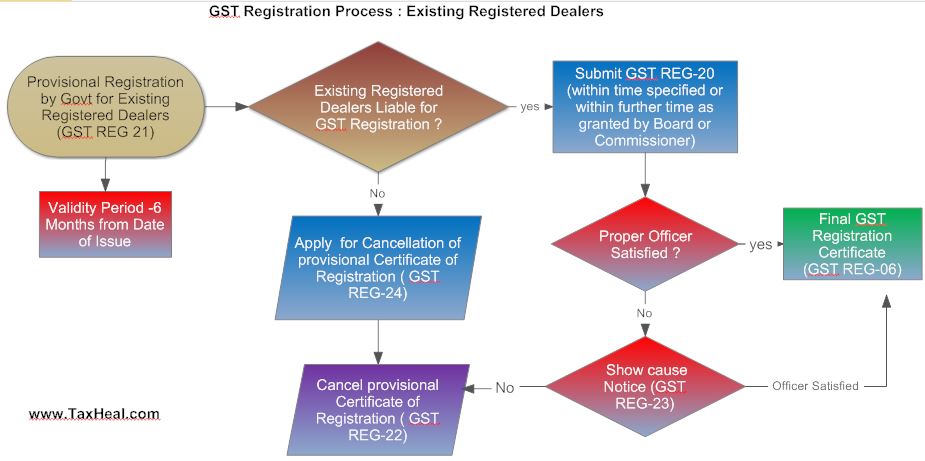

- GST Registration of Existing registered person:- Every person who, on the day immediately preceding the appointed day, is registered or holds a license under an earlier law, shall be liable to be registered under this Act with effect from the appointed day. Such person is not required to get fresh registration under this act. He can follow the procedure as may be prescribed in this behalf.

- No GST Registration for an agriculturist :- An agriculturist shall not be considered as a taxable person and shall not be liable to take registration. (As per section 9 (1)).

- GST Registration in case of succession /Transfers :- Where a business carried on by a taxable person registered under this Act is transferred, whether on account of succession or otherwise, to another person as a going concern, the transferee, or the successor, as the case may be, shall be liable to be registered with effect from the date of such transfer or succession.

- GST Registration in case of Amalgamation :- In a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, de-merger of two or more companies by an order of a High Court, the transferee shall be liable to be registered, where required, with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court.

- Mandatory GST Registration irrespective of Turnover:– Following categories of suppliers shall mandatory required to get registered under this Act irrespective of the threshold limit:

1. Persons making any inter-State taxable supply.

2. Casual taxable persons.

3. Persons who are required to pay tax under reverse charge.

4. Non-resident taxable persons.

5. Persons who are required to deduct tax under section 37.

6. Persons who supply goods and/or services on behalf of other registered taxable persons whether as an agent or otherwise.

7. Input service distributor.

8. Persons who supply goods and/or services, other than branded services, through electronic commerce operator.

9. Every electronic commerce operator.10. An aggregator who supplies services under his brand name or his trade name.

11. Such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council.

Note 1: Taxable threshold for GST Registration

The taxable threshold shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals.

Note 2: Supply of goods to Job worker

The supply of goods, after completion of job-work, by a registered job worker shall be treated as the supply of goods by the “principal” referred to in section 43A, and the value of such goods shall not be included in the aggregate turnover of the registered job worker.

Note 3:Agriculturist

An agriculturist shall not be considered as a taxable person and shall not be liable to take registration. (As per section 9 (1)).

Note 4 : Separate Registration for each state

Every person who is liable to take a Registration will have to get registered separately for each of the States where he has a business operation.

Read : Flow Chart for GST Registration in India

Download GST -Draft Registration formats released by CBEC

GST Registration:- Forms

26 Forms for Registration prescribed-26 Forms for Registration have been prescribed (Form GST REG-01 to Form GST REG-26), namely-GST REG 01, GST REG 02, GST REG 03, GST REG 04, GST REG 05, GST REG 06, GST REG 07, GST REG 08, GST REG 09, GST REG 10, GST REG 11, GST REG 12, GST REG 13, GST REG 14, GST REG 15, GST REG 16, GST REG 17, GST REG 18, GST REG 19, GST REG 20, GST REG 21, GST REG 22, GST REG 23, GST REG 24, GST REG 25,

| Sr. No | Form Number | Content |

| 1 | GST REG 01 | Application for Registration under Section 19(1) of Goods and Services Tax Act, 20– |

| 2 | GST REG 02 | Acknowledgement |

| 3 | GST REG 03 | Notice for Seeking Additional Information/ Clarification/ Documents relating to Application for<<Registration/Amendment/Cancellation>> |

| 4 | GST REG 04 | Application for filing clarification/additional information/ document for <<Registration/Amendment/Cancellation/ Revocation of Cancellation>> |

| 5 | GST REG 05 | Order of Rejection of Application for <<Registration /Amendment / Cancellation/ Revocation of Cancellation>> |

| 6 | GST REG 06 | Registration Certificate issued under Section 19(8A) of the Goods and Services Tax Act, 20– |

| 7 | GST REG 07 | Application for Registration as Tax Deductor or Tax Collector at Source under Section 19(1) of the Goods and Service Tax Act, 20– |

| 8 | GST REG 08 | Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source under Section 21 of the Goods and Service Tax Act, 20–. |

| 9 | GST REG 09 | Application for Allotment of Unique ID to UN Bodies/Embassies /any other person under Section 19(6) of the Goods and Service Tax Act, 20–. |

| 10 | GST REG 10 | Application for Registration for Non Resident Taxable Person. |

| 11 | GST REG 11 | Application for Amendment in Particulars subsequent to Registration |

| 12 | GST REG 12 | Order of Amendment of existing Registration |

| 13 | GST REG 13 | Order of Allotment of Temporary Registration/ Suo Moto Registration |

| 14 | GST REG 14 | Application for Cancellation of Registration under Goods and Services Tax Act, 20–. |

| 15 | GST REG 15 | Show Cause Notice for Cancellation of Registration |

| 16 | GST REG 16 | Order for Cancellation of Registration |

| 17 | GST REG 17 | Application for Revocation of Cancelled Registration under Goods and Services Act, 20–. |

| 18 | GST REG 18 | Order for Approval of Application for Revocation of Cancelled Registration |

| 19 | GST REG 19 | Notice for Seeking Clarification/Documents relating to Application for << Revocation of Cancellation>> |

| 20 | GST REG 20 | Application for Enrolment of Existing Taxpayer |

| 21 | GST REG 21 | Provisional Registration Certificate to existing taxpayer |

| 22 | GST REG 22 | Order of cancellation of provisional certificate |

| 23 | GST REG 23 | Intimation of discrepancies in Application for Enrolment of existing taxpayer |

| 24 | GST REG 24 | Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Services Tax Act 20– |

| 25 | GST REG 25 | Application for extension of registration period by Casual / Non-Resident taxable person. |

| 26 | GST REG 26 | Form for Field Visit Report |

Download GST -Draft Registration formats released by CBEC

Free Education Guide on Goods & Service Tax (GST)