Rule 138C CGST Rules 2017

Summary of Rule 138C CGST Rules 2017

( Rule 138C CGST Rules 2017 explains Inspection and verification of goods and is covered in Chapter XVI – E-Way Rules : Inserted by Central Goods and Services Tax (Sixth Amendment) Rules 2017 Amended by Second Amendment (2018) to CGST Rules vide Notification No 12/2018 Central Tax dated 7th March, 2018 and Central Goods and Services Tax (Sixth Amendment) Rules, 2018,)[refer Note 1]

Rule 138C CGST Rules 2017

2[Inspection and verification of goods.

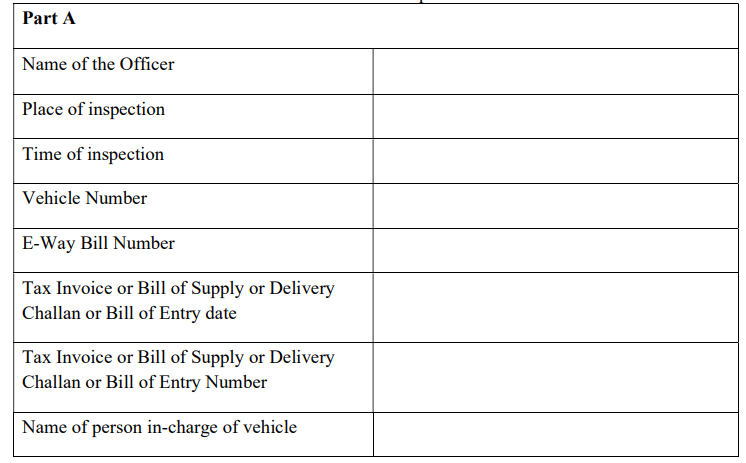

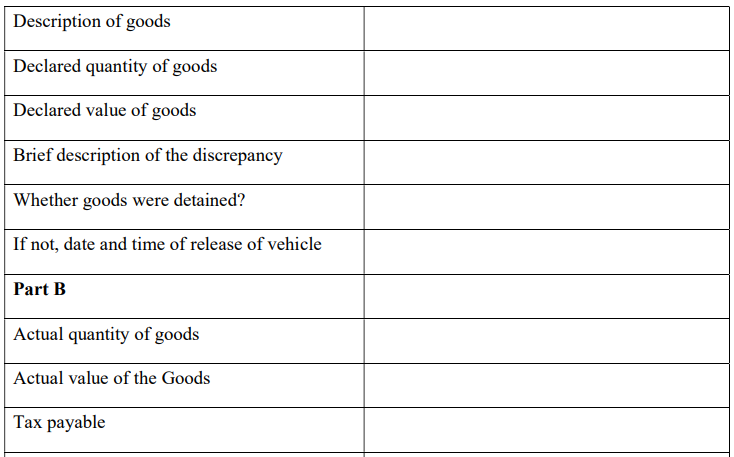

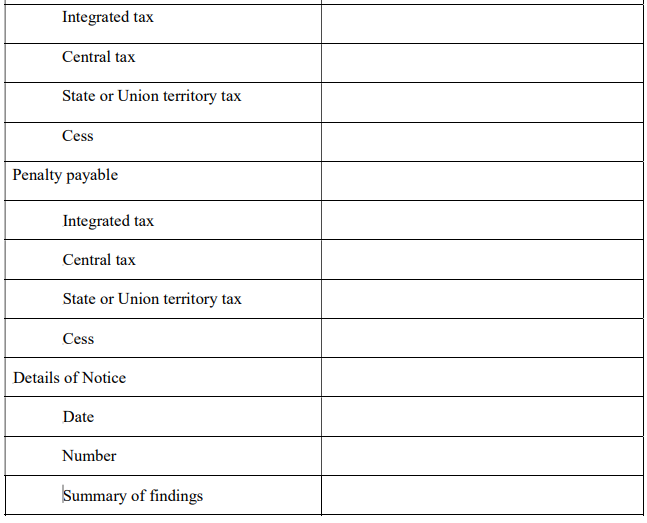

138C. (1) A summary report of every inspection of goods in transit shall be recorded online by the proper officer in Part A of FORM GST EWB-03 within twenty four hours of inspection and the final report in Part B of FORM GST EWB-03 shall be recorded within three days of such inspection.

3 [Provided that where the circumstances so warrant, the Commissioner, or any other officer authorised by him, may, on sufficient cause being shown, extend the time for recording of the final report in Part B of FORM EWB-03, for a further period not exceeding three days.

Explanation.—The period of twenty four hours or, as the case may be, three days shall be counted from the midnight of the date on which the vehicle was intercepted.]

(2) Where the physical verification of goods being transported on any conveyance has been done during transit at one place within the State or Union territory or in any other State or Union territory, no further physical verification of the said conveyance shall be carried out again in the State or Union territory, unless a specific information relating to evasion of tax is made available subsequently.]

FORM GST EWB-03

(See rule138C)

Verification Report

Notes on Amendments in Rule 138C CGST Rules 2017

3 Inserted by the Central Goods and Services Tax (Sixth Amendment) Rules, 2018, w.e.f. 19-6-2018.

2. Rule 138C substituted by the Central Goods and Services Tax (Second Amendment) Rules, 2018, w.e.f. 1-4-2018†. Prior to its substitution, said Rule read as under :

“138C. Inspection and verification of goods.—(1) A summary report of every inspection of goods in transit shall be recorded online by the proper officer in Part A of FORM GST EWB-03 within twenty four hours of inspection and the final report in Part B of FORM GST EWB-03 shall be recorded within three days of such inspection.

(2) Where the physical verification of goods being transported on any conveyance has been done during transit at one place within the State or in any other State, no further physical verification of the said conveyance shall be carried out again in the State, unless a specific information relating to evasion of tax is made available subsequently.”

†NOTIFICATION NO.15/2018-CENTRAL TAX [F.No. 349/58/2017-GST (Pt)], DATED 23-3-2018.— In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government hereby appoints the 1st day of April, 2018, as the date from which the provisions of sub-rules (ii) [other than clause (7)], (iii), (iv), (v), (vi) and (vii) of rule 2 of notification No.12/2018-Central Tax, dated the 7th March, 2018, published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (i), videnumber G.S.R. 204(E), dated the 7th March, 2018, shall come into force.

1 old Rule 138C which was Inserted by the Central Goods and Services Tax (Sixth Amendment) Rules 2017. Notification No 27 /2017 Central Tax Dated 30th August, 2017 )

138C. Inspection and verification of goods.-

(1) A summary report of every inspection of goods in transit shall be recorded online by the proper officer in Part A of FORM GST EWB-03 within twenty four hours of inspection and the final report in Part B of FORM GST EWB-03 shall be recorded within three days of such inspection.

(2) Where the physical verification of goods being transported on any conveyance has

been done during transit at one place within the State or in any other State, no further

physical verification of the said conveyance shall be carried out again in theState, unless a

specific information relating to evasion of tax is made available subsequently

Also refer CBIC Website Click here

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |

Rule 138C CGST Rules 2017 , Print Rule 138C CGST Rules 2017, Rule 138C of CGST Rules 2017, Latest Rule 138C of CGST Rules 2017, updated Rule 138C of CGST Rules 2017,