SBI Pay: A simplified payments’ channel

SBI Unified Payment Interface App (SBI UPI App)

UPI is the short form of the Unified payment interface.

SBI has come with its own UPI app. The name of SBI UPI app is the ‘ SBI Pay ’. Surprisingly, SBI has avoided the word UPI in this app. However, the SBI Pay is specially designed for the UPI payments system. The SBI should have incorporated the word UPI with this app as people were eagerly waiting for SBI UPI app.

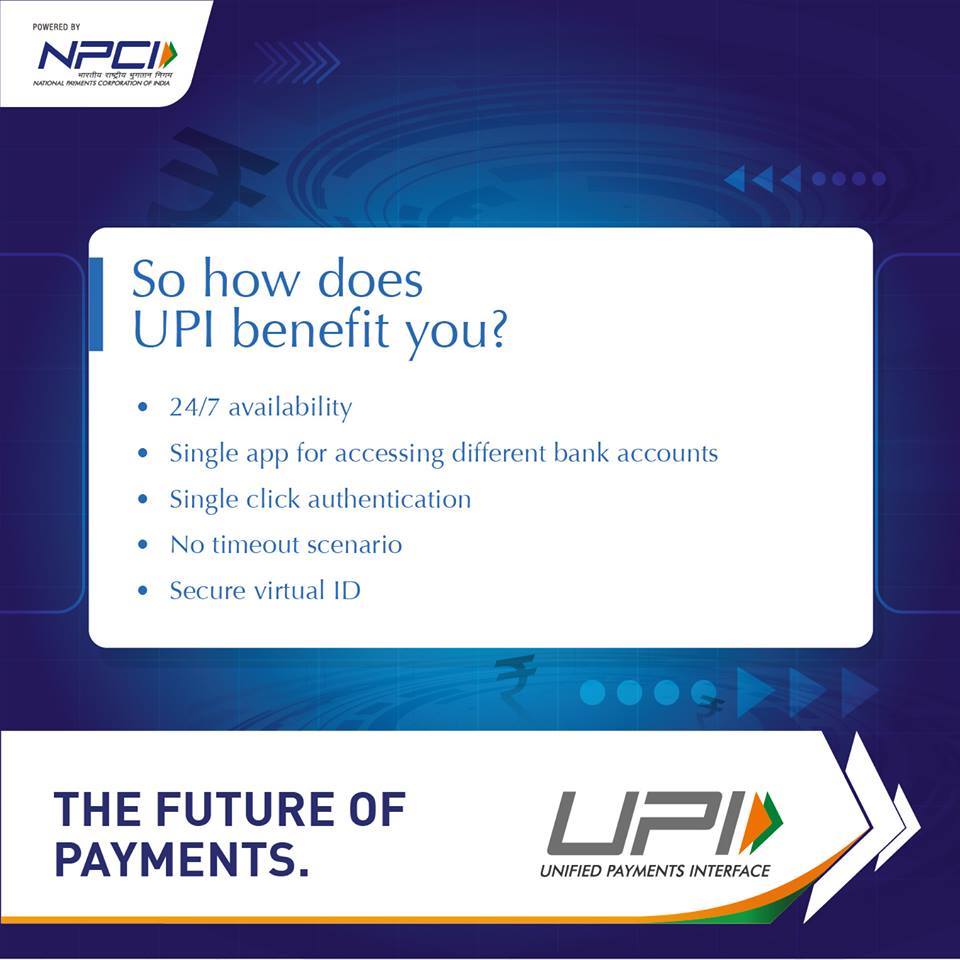

Benefits of using SBI UPI Pay app

- Non-SBI account holder can also use the SBI UPI app. It is not mandatory to use the App promoted by your bank. Your bank account may be with the ICICI Bank, but you can use the UPI app of the SBI bank However, you must have a bank account to use the UPI apps. and Your Mobile number should be registered/ linked with the bank account.

- Limit of fund transfer : upper limit per UPI transaction is Rs. 1 Lakh.

- No need to share your Bank Account number :- No need to share your Bank Account number and IFSC code to person you are making payment or from person collecting payment.

- Immediate Registration of Payee :The registration of new payee for the online fund transfer through any other mode like net banking etc often takes some time. This time varies form half an hour to 24 hours. However, the UPI doesn’t have such waiting period. You can instantly transfer fund to a new payee.

- Immediate Fund Transfer :– UPI is an immediate fund transfer service.

- Available 24 Hours :- It is always available, 24 hours in a day and 365 days in a year.

- One UPI App Many Accounts : After the UPI mobile app, you do not need multiple apps for multiple bank account. A single UPI would serve for many bank accounts. You can link many bank accounts in a UPI based app. Because of the multiple accounts at one place, you can pay by using any of the account. You can also set the default account for the payment.It is not mandatory to use the App promoted by your bank. Your bank account may be with the ICICI Bank, but you can use the UPI app of the axis bankPayment to any Bank :- With the launch of SBI UPI app you can pay money to almost every bank account of any bank of India.

- Pre-registration of Beneficiary not required :- You can pay the money with virtual payment address (the virtual payment address is similar to our email ID. e. g Ramesh45@icicibank, 9876543220@axis) . You don’t need the bank account number of the beneficiary if you have virtual payment address of beneficiary .No Pre-registration is required for the beneficiary. If you dont have virtual payment address of beneficiary , you can pay to Bank account number and IFSC code of the beneficiary.

- Beneficiary is not required to have UPI App :- you don’t need UPI app to receive money through the UPI app.Thus beneficiary is not required to have UPI app to receive money.

- Secure :-In the transaction through the UPI, you never share you bank account details. You do not enter your credit card number or CVV. You only give a virtual payment address which does not give any clue about your bank account.

- Cheapest method of fund transfer:- UPI Apps are free for everyone. The UPI Enabled banks can charge for the fund transfer. However, there is no such charge till date. So UPI is free now. But it does not mean that UPI would be free in future as well. As there is no in-principle decision to keep it free forever. However, NPCI would try to keep it low cost. It has given an indication that UPI transaction cost would be in the range of 50 paise. This is a negligible amount and none would have a problem to pay this amount. So, don’t worry and adopt the UPI payments as soon as possible. [Note The UPI is the cheapest method of fund transfer. The NEFT charges minimum Rs 2.5 for a transfer, the IMPS charges minimum Rs 5 ]

- It Makes you Free from Cash : we rarely use the card or netbanking for small transactions such as payment to your neighborhood grocery or payment to a vegetable vendor. In fact, it is not feasible for the consumer as well as the shopkeeper. But, the UPI makes small transactions feasible. The smooth and low cost transaction had made it feasible for small shopkeeper and consumer as well. Once, you start using the UPI, you need less visits to the ATM.You can go for the cash on delivery but you are not required to keep cash at your home. You can pay it instantly using the UPI fund transfer.The Online seller would use the fund collection facility of UPI. Subsequently, You would get a message for the payment approval. You can hold the approval till the delivery. As you get the product, Approve the payment.

- Money Collection Facility : If you have given a service or product to someone and want the payment.The money collection facility of the UPI sends a message directly to the party. This message is sent via the bank. It only asks approval for the payment. If the client approves, the money would be remitted instantly.

- Cheaper Alternative of Point of Sale Machine :It is difficult to pay through the card in small cities. Most of the merchants don’t have the card swiping machine small merchant don’t keep POS terminal because it is costly. They have to pay for the machine. Along with this they have to pay the service charge for each transaction. It varies from 1.25% to 2.5% of the transaction value.You would have also faced the situation when vendor ask the service charge from you.UPI would do the same work with negligible cost.[the transaction cost may be mere 50 paise ]

- UPI would Replace Many Digital Wallets ;Paytm, Freecharge, Flipkart and IRCTC, Everyone want you to keep the digital wallet. So it become hassle to maintain more than one wallet.The UPI would end this hassle as well. UPI does not ask money in advance. Rather, your money remains in the bank account and keeps earning the interest. Digital wallets don’t give any interest.

- What if Mobile is Lost ? A third person would not be able to send money using your mobile or SIM. Because to transact through the UPI app, you have to use the Password/PIN (normally 6 digit password) to open the app. Only you should know your PIN. It is similar to your debit card.A third person can’t use your debit card without using the PIN.

- What if a transaction does not complete? When will I get back the money?If money gets debited from your account and don’t credit to the beneficiary account, you would get it back within few minutes. However, if you still don’t get it, raise a complaint through the UPI app.

- Simple :- The payment through the UPI is simplest. the virtual payment address is similar to our email ID. e. g Ramesh45@icicibank, 9876543220@axis. It is easy to remember this ID. than Bank Account number and IFSC code

Requirements of using SBI UPI Pay app

- You should have a bank account.

- Your Mobile number should be registered/ linked with the bank account.The app can work only on the registered mobile number.

- Smart Phone with active internet connection on your mobile phone.

- Debit card mandatory to Use the UPI app.At the time of app registration, you are authenticated through Debit card details.

- The non-SBI account holder can also use the SBI UPI app. However, you must have a bank account to use the UPI apps. and Your Mobile number should be registered/ linked with the bank account.

- Till date, only android phone users can use the UPI app. In future, you can also download the UPI app for the iOs and windows.

- Can I use UPI App outside India? N0 ,The UPI app is only available in India, for Indian mobile numbers at this time.

Watch Video SBI Pay

How to Install SBI Pay App

To get the SBI Pay you can search “ SBI pay ” in quotes within the google playstore. You can also use direct link of SBI Pay. There would be many apps but head to the exact ‘ SBI Pay ’. It is a new app, therefore lists somewhere down. Download the ‘ SBI Pay ’ and install in your smartphone. Note, the non-SBI account holder can also use the SBI UPI app. However, you must have a bank account to use the UPI apps.

The UPI app of iOs is not available yet. In the near future, the NPCI would enable the UPI for ios and windows as well.

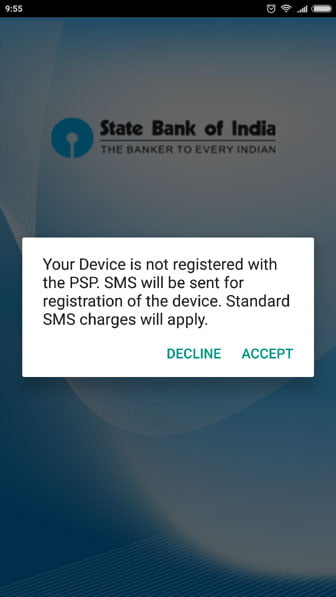

Step-1: SBI Pay App Registration

The SBI UPI app needs your mobile number for the registration. To get it and authenticate it would ask the permission for send an SMS from your number. Thus you must have enough balance to send the SMS. Also, you should choose the SIM/number which is register with the bank account. Give permission of sending SMS and making a call.

The SBI pay would capture your number and ask it to verify. Click ‘Yes’.

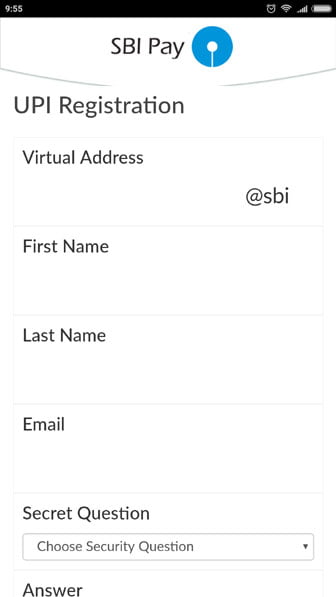

Step-2 : SBI Pay App: VPA Registration

Now you have to fill details for the VPA registration. It starts with the setting desired virtual payment address. You can choose the VPA of your choice subject to availability. To create a VPA, you have to click on add a bank account. In the next step, you are asked to choose a VPA. The VPA has two parts like an Email ID for example ramram@SBI, 95678490@SBI. The suffix would be fixed word i. e. @SBI, while you can choose the Prefix. The prefix can be your name, phone number or anything you want. It is similar to the choosing email ID. The early registrant would certainly get good VPA.

Give your name, email address, security question-answer and choose the bank which has your account. Click on the checkbox of terms and condition. Submit the form.

In the next page, you would be shown the last few digits of your account number. Be assured and click on ‘Register’ With this your registration of VPA is successful. Virtual payment address is used in place of bank account and IFSC to get the money.

Step 3 SBI Pay App :Set MPIN

- To make a payment you require a MPIN. You have to set the MPIN by giving your debit card details.

- Go to the account management page, and select the desired account, if there is many. Click on Set MPIN.

- Give the last 6 digits of your debit card and expiry date.

- You would get an OTP to your registered mobile number. Enter this OTP into the given box.

- Input your desired MPIN. With this, you set the MPIN for an account

How To Transfer Money Using SBI UPI APP

Transferring money through the SBI UPI App is as easy as sending an SMS. Follow these steps.

- Open the UPI-based app SBI Pay by entering 6 digit password. This is the same password which you have set at the time of SBI pay registration.

- Go to the ‘Pay’ section

- Select an account from the drop-down list. There can be many accounts if you have added more than one account.

- Select the payee address type. It can be a VPA or bank account number. If you choose the bank account, you must have the bank account number and IFSC code

- Input the VPA of a payee. It will take the payee name automatically. This also verifies the VPA.

- Enter remarks and payment amount. Click on the ‘Pay’

- In the next page, you have to enter the MPIN. Submit the MPIN.

- It is over, you have transferred the money.

- you can check transaction history – Login to the SBI UPI app and go to my My UPI Transactions

It is very easy to send money through the UPI-based apps. The process is similar to all the UPI apps.

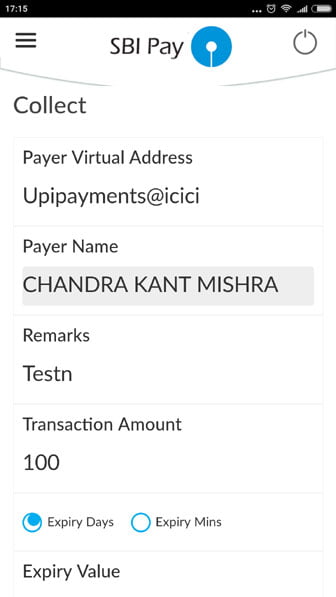

How To Collect Money using SBI Pay App

You can also ask money from anyone using the UPI app. It is a unique feature among many other benefits of UPI. To ask or collect money through the SBI Pay, you have to follow these steps.

- Login into the SBI UPI app

- Go to the ‘Collect’ section

- Enter the VPA of the person to whom you want money. The system will automatically take the name. Enter the remarks and amount. [ If you have multiple accounts/virtual payment addresses, choose the address to which you want money. ]

- You can also choose the expiry days or expiry minutes if required.

- Click on ‘Initiate request’.

- Submit the details and wait for the approval

- When the person approves your asking amount, you would get it.

- You would get a confirmation of the collect request.

How To Pay For Online Shopping

You can also pay for online shopping using the UPI app. At the time of the payment, you would have the option to choose the payment through the UPI. For such transaction, you have to give only your VPA.

The online shopping site would ask money through the ‘ Receive money ’ facility of UPI. You can approve such payment after getting the product. It will also work as the Cash on delivery.

The Flipkart, Myntra and Jabong are working over this. Within few days you can see this payment option.

So, With the launch of SBI UPI app you can pay money to almost every bank account of India