Securities and Exchange Board of India

CIRCULAR

CIR/CDMRD/DMP/2/2016 January 15, 2016

To,

The Managing Directors / Chief Executive Officers National Commodity Derivatives Exchanges

Sir / Madam,

Sub.: Reduction in Daily Price Limits & Near month Position Limits for Agricultural Commodity Derivatives and Suspension of Forward Segment

1. With aviewto curb the speculative participation and consequent volatility in prices of agricultural commodities derivatives, the following have been decided:

a. Reduction in Daily Price Limits (DPL):

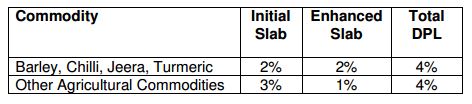

i. DPL for agricultural commodity derivatives contracts shall be revised as given below:

ii. DPL shall have two slabs- Initial and Enhanced Slab. Once the initial slab limit is reached in any contract, then after a period of 15 minutes this limit shall be increased further by enhanced slab, only in that contract. The trading shall be permitted during the 15 minutes period within the initial slab limit. After the DPL is enhanced, trades shall be permitted throughout the day within the enhanced total DPL of 4%.

iii. The above slab-wise DPL norm shall be applicable uniformly on all trading days.

iv. The revised DPL norms shall be applicable with effect from February 1, 2016

b. Reduction in Near month Position Limits:

i. Currently in case of agricultural commodity derivatives, client level and member level near month position limits in any commodity are 50% of their overall position limits for that commodity. This near month position limit has now been revised from 50% to 25%.

ii. The revised near month position limits shall be applicable for all the contracts expiring in month of March-2016 and onwards.

2. Suspension of Forward Segment: It has been decided that participants in Forward Segment shall not be allowed to enter into fresh contracts till further orders. However, the existing contracts shall be allowed to be settled as per the terms of the contracts.

3. The other related norms stipulated by FMC to the extent not covered in this circular shall continue to remain in force.

4. The Exchanges are advised to:

i. take steps to make necessary amendments to the relevant bye-laws, rules and regulations for the implementation of the same.

ii. bring the provisions of this circular to the notice of the members of the Exchange and also to disseminate the same on their website.

iii. communicate to SEBI, the status of the implementation of the provisions of this circular.

5. This circular is issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992, to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

6. This circular is available on SEBI website at www.sebi.gov.in.

Yours faithfully,

Vikas Sukhwal

Deputy General Manager

Division of Market Policy

Commodity Derivatives Market Regulation Department

vikass@sebi.gov.in