Circular No. 192/02/2016-Service Tax

F.No. 334/8/2016-TRU

Government of India

Ministry of Finance

Department of Revenue

(Tax Research Unit)

Dated- April 13, 2016

To

Principal Chief Commissioners of Customs and Central Excise (All)

Principal Chief Commissioners of Central Excise & Service Tax (All)

Principal Director Generals of Goods and Service Tax/System/CEI

Director General of Audit/Tax Payer Services

Principal Commissioners/ Commissioners of Customs and Central Excise (All) Principal Commissioners/Commissioners of Central Excise and Service Tax (All) Principal Commissioners/Commissioners of Service Tax (All)

Principal Commissioners/Commissioners LTU/Central Excise/Service Tax (Audit)

Subject: – Clarification on issues regarding levy of Service Tax on the services provided by Government or a local authority to business entities – reg.

Madam/Sir,

Any service provided by Government or a local authority to a business entity has been made taxable w.e.f 1st April 2016. Post Budget 2016, representations have been received from several quarters including business and industry associations in respect of various aspects pertaining to the taxation of such services. Accordingly, the following clarifications are issued:-

[table id=23 /]

2. Illustration explaining how the CENVAT Credit is to be availed on Service Tax paid for assignment of right to use natural resources:

Government of India assigns right to use spectrum for a period of 20 years in an auction held in May 2016. The Notice Inviting Application (NIA) for auction of spectrum specifies that the successful bidders would have two payment options –

(a) Full upfront payment:

to make full upfront payment of full auction price (bid amount) by, let’s say, 25.6.2016; or

(b) Deferred payment:

(i) An upfront payment of 33% of the final bid amount shall be made by 25.6.2016;

(ii) There shall be a moratorium of 2 years for payment of balance amount of one time charges for the spectrum, which shall be recovered in 10 equal annual instalments of Rs. 131.94 including interest for deferred payment.

(iii) The 1st instalment of the balance due shall become due on the third anniversary of the scheduled date of the first payment. Subsequent instalment shall become due on the same date of each following year.

(iv) The applicable rate of interest under deferred payment option shall be 10%.

CASE 1:

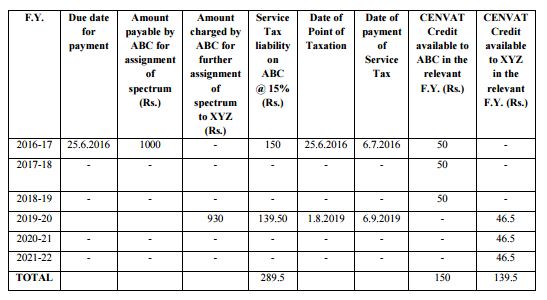

Company ABC becomes the successful bidder. The spectrum is assigned to ABC for a total consideration of Rs. 1000/-. ABC chooses to make full upfront payment on the due date. The Service Tax liability and eligibility of the CENVAT Credit in this case would be as follows:

(i) The amount of Rs. 1000/- will become due on 25.6.2016. Thus, according to rule 7 of the Point of Taxation Rules, 2011 the point of taxation shall be 25.6.2016.

(ii) According to rule 6(1) of the Service Tax Rules, 1994, the liability to pay Service Tax liability of Rs. 150/- on the consideration of Rs. 1000/- paid or payable would be required to be discharged by 6.7.2016.

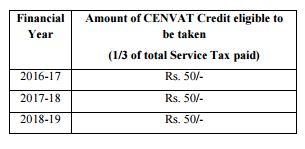

(iii) According to the sixth proviso to rule 4(7) of the CENVAT Credit Rules, the CENVAT Credit in respect of the Service Tax paid would be spread over 3 years as Follows

CASE 2:

In the above example, ABC assigns the right to use the spectrum to Company XYZ on 1.8.2019 (and issues invoice dated 1.8.2019) for a consideration of Rs. 930/-. The Service Tax liability and eligibility of CENVAT Credit would be as follow

CASE 3:

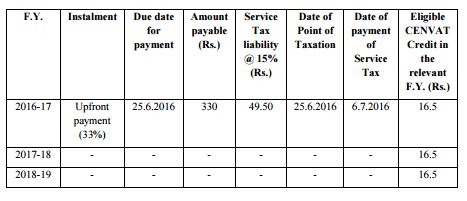

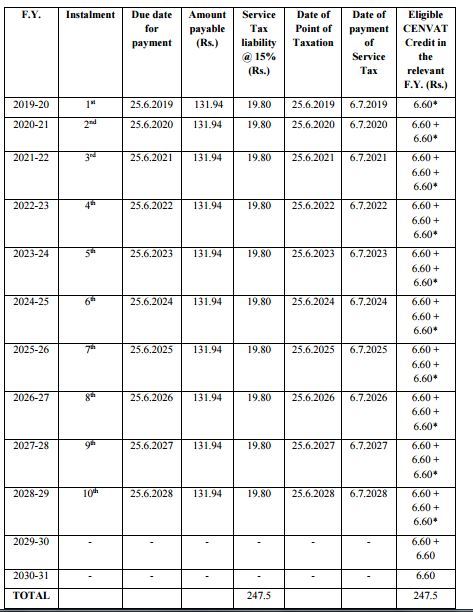

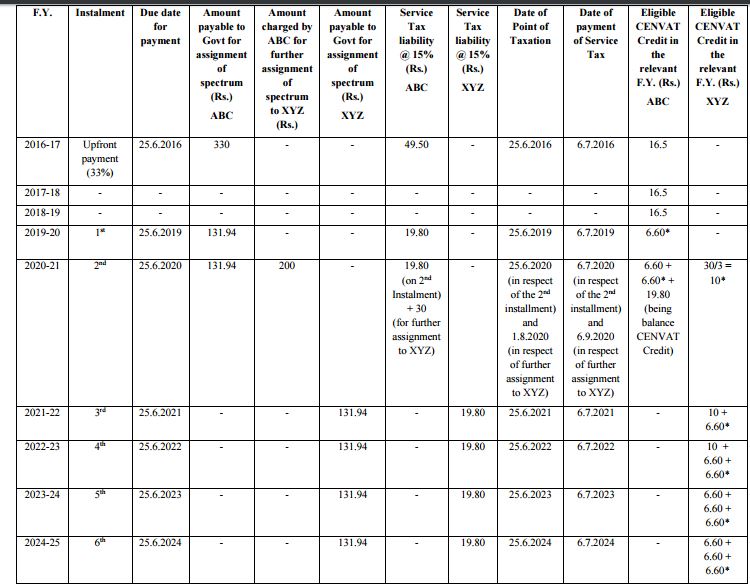

Company ABC becomes the successful bidder. The spectrum is assigned to ABC for a total consideration of Rs. 1000/-. ABC chooses the deferred payment option. The payment schedule, Service Tax liability and eligibility of CENVAT Credit would be as follows:

Note: Figures with * indicate the amount of CENVAT credit available against Service Tax paid during that year.

CASE 4:

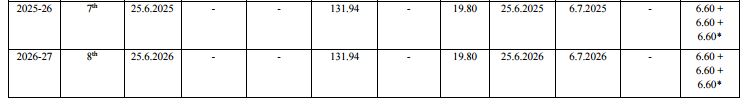

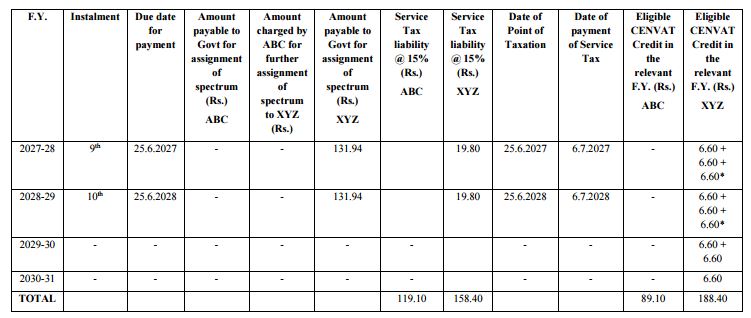

In the above example, if ABC further assigns the right to use the spectrum to Company XYZ on 1.8.2020 for a consideration of Rs. 200/-. The Service Tax liability and eligibility of CENVAT Credit would be as follows:

Note: Figures with * indicate the amount of CENVAT credit available against Service Tax paid during that year.

3. All concerned are requested to acknowledge the receipt of this Circular.

4. Wide publicity may be given so that the assessees and public are aware of the above. All the major industry and Trade Associations may be informed accordingly. Difficulty if any, in the implementation of the Circular should be brought to the notice of the Tax Research Unit.

5. Hindi version would follow.

Yours faithfully,

(Abhishek Verma)

Technical Officer (TRU)