Structure of GSTIN

[Also Refer GSTIN Number : Free Study Material ]

1. GSTIN stands for “Goods and Services Tax Identification Number” unique to a legal person (Individual, Partnership, LLP, AOP/BOI, Company etc.,). Each tax payer who is obligated or volunteered to register

shall/may, as the case may be, apply for registration under GST Law as per the procedures prescribed under the Law. Subsequent to such application, the tax payer will be assigned a 15-digit GSTIN on completion of the registration. No doubt, a taxpayer can seek multiple registration in a State

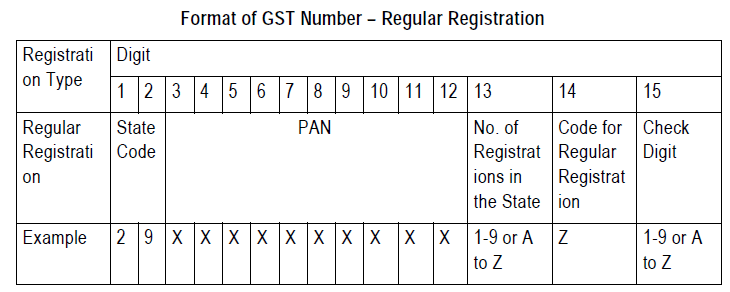

2. The first two digits of GSTIN will represent the State Code according to Indian Census 2011. Each State has a unique two-digit code like “29” for Karnatakaand “27” for Maharashtra

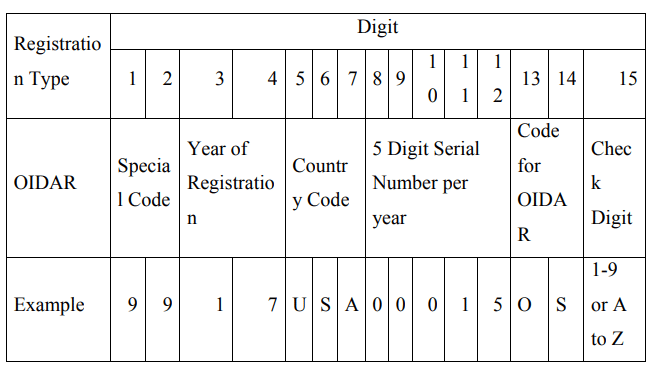

3. The next ten digits of GSTIN will be the PAN/ TAN of the taxpayer which emphasizes the fact that a PAN is compulsory for any person who is required to take registration under GST.The only exception to this is registration in case of a non-resident taxable person (NRTP) wherein registration is granted even in the absence of PAN being allotted to such person. Registration to such person shall be granted based on the tax identification number or unique number on the basis of which the entity is identified by the foreign Government where the said entity is based.

4. The 13th digit indicates the number of registrations entity/person has within a State for the same PAN.It is an alpha-numeric number, first 1 to 9 and then A to Z,which will be assigned on the basis of number of registrations an entity,with the same PAN, has within one State.For example, if an entity has one registration only within a State then “1” will be assigned as the 13th digit of the GSTIN. If the same entity obtains another registration for say a business vertical or an SEZ within the same State, then the 13th digit of GSTIN assigned to this entity will become “2”

so on and so forth.

5. The 14th digit is assigned based on the nature of the business of the assessee.Eg.“Z” is used as a default 14th digit in case of a regular tax payer.

6. The last digit (15th) is a check code which can be analpha-numeric character.

7. The GSTIN must be verified and checked with a Certificate of Registration in Form GSTR REG-06 issued in terms of Rule 10(1) of the CGST Rules, 2017.

8. One must ensure that the name as appearing on the PAN card is the same as that appearing on the “Certificate of Registration”. If there is any discrepancy, the same should be reported to the GSTN immediately or alternatively, if possible, corrected through amendment to the registration obtained

9. The validation of GSTIN of any tax payer can be done on the GST portal to ensure whether the GSTIN quoted by such person, on various documents or correspondences, really belong to him.

An illustration of the structure of GSTIN

i. Regular Registration

ii. NRTP (Non Resident Taxable Person)

Source – Indirect Taxes Committee of ICAI

Acknowledgements

We thank CA. Vinamar Gupta for drafting this article and CA. Jatin Harjai for reviewing the same. For any queries, you may connect with CA. Vinamar Gupta at idtc@icai.in .

DISCLAIMER

The views expressed in this article are of the author(s). The Institute of Chartered Accountants of India may not necessarily subscribe to the views expressed by the author(s).

The information cited in this article has been drawn from various sources. While every effort has been made to keep, the information cited in this article error free, the Institute or any office of the same does not take the responsibility for any typographical or clerical error which may have crept in while compiling the information provided in this article.

Related Post

How to easily find Contact details of any GSTIN

Search GSTIN based on PAN : GST News 489

GST Tip : Why to check GSTIN of Purchaser before Sale

GSTIN declaration mandatory for all Importer and Exporters w.e.f 01.07.2017

GSTIN and password not received or not working ? Solution

Provisional GSTIN and final GSTIN will be same

GSTIN Number given Late to Supplier ? B2C can’t be converted into B2B

GST ITC if GSTIN number not given to supplier

GST ITC If I have two different business under same GSTIN no

Penalty for not displaying GSTIN number &; issuing Incorrect Invoice : Trade Circular No 43T of 2017

GST State code List and TIN number of each State for GSTIN under GST

Can there be duplicate invoice series in financial year for particular GSTIN ?

How to add additional place of business under existing GSTIN ?