Taxable Event in GST

Key Points about Taxable Event in GST

- As per proposed Article 366 (12A) of Constitution of India, Goods and Services Tax means a tax on supply of goods or services, or both, except taxes on supply of alcoholic liquor for human consumption

- Note that the word used is ‘supply’ and not ‘sale’. Thus two separate legal entities are not required. One branch or division or depot can ‘supply’ goods or services to another branch, division or depot.

- ‘Consideration’ is not required for supply.A supply specified in Schedule I, made or agreed to be made without a consideration is ‘supply’ – clause 3(1)(c) of GST Model Law, 2016. Thus the transactions specified in Schedule I are subject to GST, even if there is no consideration.The valuation for purpose of GST will be as per GST Valuation Rules.

- Stock transfers, branch transfers will also get covered under GST net

- Even free samples will be ‘supply’ of goods.

- Supply of goods by a registered taxable person to a job-worker in terms of section 43A shall not be treated as supply of goods.

- Deemed’ supply of goods and services and will be subject to GST . These are mentioned in Schedule II

- The definition of ‘supply’ in clause 3 of GST Model Law, 2016 is inclusive definition. Thus, any supply of goods or services would get covered, even if not specified in clause 3 of GST Model Law, 2016.

- If business assets are sold by Banks, Financial Institution to recover debts, the goods part of assets will be treated as ‘supply’ by the taxable person to Bank or Financial Institution and will be subject to GST.

- Clause 3(2A) of GST Model Law, 2016 states as follows – Where a person acting as an agent who, for an agreed commission or brokerage, either supplies or receives any goods and/or services on behalf of any principal, the transaction between such principal and agent shall be deemed to be a supply.Thus, agent will be liable for GST on value goods or services only if he either supplies or receives any goods and/or services on behalf of any principal (like consignment agent). However, if he does not supply or receive goods or services, he is not liable for GST on value of goods or services. He will be liable for GST only on his commission.

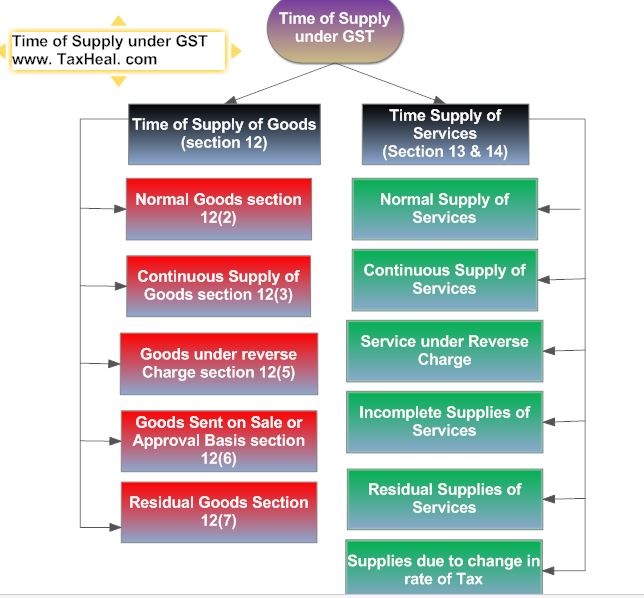

- Time of Supply under GST Read Time of Supply under GST- Analysis

Provisions of Model GST Law 2016 on Taxable Event in GST

Charging section for CGST and SGST

Clause 7(1) of GST Model Law, 2016 is the charging section for CGST and SGST. It reads as follows :-

There shall be levied a tax called the Central/State Goods and Services Tax (CGST/SGST) on all intra-State supplies of goods and/or services at the rate specified in the Schedule . . . to this Act and collected in such manner as may be prescribed.

Charging section for IGST

Clause 4(1) of IGST Model Law, 2016 is the charging section for IGST. It reads as follows –

There shall be levied a tax called the Integrated Goods and Services Tax on all supplies of goods and/or services made in the course of inter-State trade or commerce at the rate specified in the Schedule to this Act and collected in such manner as may be prescribed.

Supply as per Model GST law

Clause 3 of Model GST Law, 2016, reads as follows—

(1) Supply includes

| (a) | all forms of supply of goods and/or services such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business, | |

| (b) | importation of service, whether or not for a consideration and whether or not in the course or furtherance of business, and | |

| (c) | a supply specified in Schedule I, made or agreed to be made without a consideration. |

(2) Schedule II, in respect of matters mentioned therein, shall apply for determining what is, or is to be treated as a supply of goods or a supply of services.

(2A) Where a person acting as an agent who, for an agreed commission or brokerage, either supplies or receives any goods and/or services on behalf of any principal, the transaction between such principal and agent shall be deemed to be a supply.

(3) Subject to sub-section (2), the Central or a State Government may, upon recommendation of the Council, specify, by notification, the transactions that are to be treated as—

(i) a supply of goods and not as a supply of services; or

(ii) a supply of services and not as a supply of goods; or (iii) neither a supply of goods nor a supply of services.

(4) Notwithstanding anything contained in sub-section (1), the supply of any branded service by an aggregator, as defined in section 43B, under a brand name or trade name owned by him shall be deemed to be a supply of the said service by the said aggregator.

Schedule I – Matters to be treated as supply without consideration

The Schedule I of Model GST Law, 2016 reads as follows –

Schedule I – Matters to be treated as supply without consideration

| 1. | Permanent transfer/disposal of business assets. | |

| 2. | Temporary application of business assets to a private or non-business use. | |

| 3. | Services put to a private or non-business use. | |

| 4. | Assets retained after deregistration. | |

| 5. | Supply of goods and/or services by a taxable person to another taxable or non-taxable person in the course or furtherance of business. |

Provided that the supply of goods by a registered taxable person to a job-worker in terms of section 43A shall not be treated as supply of goods.

Schedule II – Matters to be treated as supply of goods or services

| 1. | Transfer |

| (1) | Any transfer of the title in goods is a supply of goods. | |

| (2) | Any transfer of goods or of right in goods or of undivided share in goods without the transfer of title thereof, is a supply of services. | |

| (3) | Any transfer of title in goods under an agreement which stipulates that property in goods will pass at a future date upon payment of full consideration as agreed, is a supply of goods. |

| 2. | Land and Building |

| (1) | Any lease, tenancy, easement, licence to occupy land is a supply of services. | |

| (2) | Any lease or letting out of the building including a commercial, industrial or residential complex for business or commerce, either wholly or partly, is a supply of services. |

| 3. | Treatment or process | |

| Any treatment or process which is being applied to another person’s goods is a supply of services. | ||

| 4. | Transfer of business assets | |

| (1) Where goods forming part of the assets of a business are transferred or disposed of by or under the directions of the person carrying on the business so as no longer to form part of those assets, whether or not for a consideration, such transfer or disposal is a supply of goods by the person. | ||

| (2) Where, by or under the direction of a person carrying on a business, goods held or used for the purposes of the business are put to any private use or are used, or made available to any person for use, for any purpose other than a purpose of the business, whether or not for a consideration, the usage or making available of such goods is a supply of services. | ||

| (3) Where any goods, forming part of the business assets of a taxable person, are sold by any other person who has the power to do so to recover any debt owed by the taxable person, the goods shall be deemed to be supplied by the taxable person in the course or furtherance of his business. | ||

| (4) Where any person ceases to be a taxable person, any goods forming part of the assets of any business carried on by him shall be deemed to be supplied by him in the course or furtherance of his business immediately before he ceases to be a taxable person, unless— (a) the business is transferred as a going concern to another person; or (b) the business is carried on by a personal representative who is deemed to be a taxable person. | ||

| 5. | The following shall be treated as “supply of service” — |

| (a) | renting of immovable property | |

| (b) | construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or before its first occupation, whichever is earlier. – Explanation.– For the purposes of this clause- (1) the expression “competent authority” means the Government or any authority authorized to issue completion certificate under any law for the time being in force and in case of non-requirement of such certificate from such authority, from any of the following, namely – (i) an architect registered with the Council of Architecture constituted under the Architects Act, 1972; or (ii) a chartered engineer registered with the Institution of Engineers (India); or (iii) a licensed surveyor of the respective local body of the city or town or village or development or planning authority (2) the expression “construction” includes additions, alterations, replacements or remodeling of any existing civil structure. | |

| (c) | temporary transfer or permitting the use or enjoyment of any intellectual property right | |

| (d) | development, design, programming, customisation, adaptation, upgradation, enhancement, implementation of information technology software | |

| (e) | agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act | |

| (f) | works contract including transfer of property in goods (whether as goods or in some other form) involved in the execution of a works contract | |

| (g) | transfer of the right to use any goods for any purpose (whether or not for a specified period) for cash, deferred payment or other valuable consideration; and | |

| (h) | supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service is for cash, deferred payment or other valuable consideration. |

| 6. | The following shall be treated as supply of goods |

| (a) | supply of goods by any unincorporated association or body of persons to a member thereof for cash, deferred payment or other valuable consideration. |

Meaning of business

Clause 2(17) of GST Model Law defines ‘business’ as follows—

“Business” includes—

| (a) | any trade, commerce, manufacture, profession, vocation or any other similar activity, whether or not it is for a pecuniary benefit; | |

| (b) | any transaction in connection with or incidental or ancillary to (a) above; | |

| (c) | any transaction in the nature of (a) above, whether or not there is volume, frequency, continuity or regularity of such transaction; | |

| (d) | supply or acquisition of goods including capital assets and services in connection with commencement or closure of business; | |

| (e) | provision by a club, association, society, or any such body (for a subscription or any other consideration) of the facilities or benefits to its members, as the case may be; | |

| (f) | admission, for a consideration, of persons to any premises; and | |

| (g) | services supplied by a person as the holder of an office which has been accepted by him in the course or furtherance of his trade, profession or vocation |

Meaning of Principal as per Model GST Law 2016

“Principal” means a person on whose behalf an agent carries on the business of supply or receipt of goods and/or services – clause 2(77) of GST Model Law, 2016.

Meaning of Agent as per Model GST Law 2016

“Agent” means a person who carries on the business of supply or receipt of goods and/or services on behalf of another, whether disclosed or not and includes a factor, broker, commission agent, arhatia, del credere agent, intermediary or an auctioneer or any other mercantile agent, by whatever name called, and whether of the same description as herein before mentioned or not – clause 2(5) of GST Model Law, 2016.