Finance Bill 2016

Tax Collection at Source (TCS) on sale of vehicles; goods or services

The existing provision of section 206C of the Act, inter alia, provides that the seller shall collect tax at source at specified rate from the buyer at the time of sale of specified items such as alcoholic liquor for human consumption, tendu leaves, scrap, mineral being coal or lignite or iron ore, bullion etc. in cash exceeding two lakh rupees.

In order to reduce the quantum of cash transaction in sale of any goods and services and for curbing the flow of unaccounted money in the trading system and to bring high value transactions within the tax net, it is proposed to amend the aforesaid section to provide that the seller shall collect the tax at the rate of one per cent from the purchaser on sale of motor vehicle of the value exceeding ten lakh rupees and sale in cash of any goods (other than bullion and jewellery), or providing of any services (other than payments on which tax is deducted at source under Chapter XVII-B) exceeding two lakh rupees.

It is also proposed to provide that the sub-section (1D) relating to TCS in relation to sale of any goods (other than bullion and jewellery) or services shall not apply to certain class of buyers who fulfil such conditions as may be prescribed.

This amendment will take effect from 1st June, 2016.

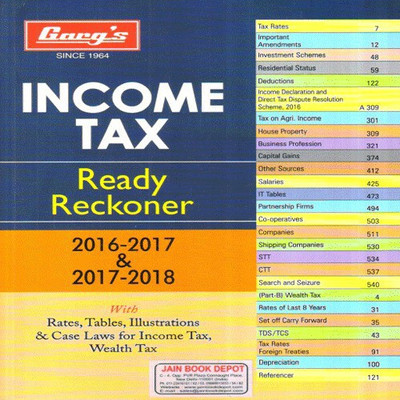

Sponsored Book

Related Post

- TCS on Sale of motor Vehicle above Rs 10 Lakh w.e.f 01.06.2016

- e-TDS / TCS returns through e-filing portal https://incometaxindiaefiling.gov.in

- TCS Penalty as per Income tax Act

- Penalty deleted as the Assessee was not aware of TCS provisions

- TCS on sale of Imported Timber

- TCS Govt A/c : Revised time and mode of Payment

- TDS Rates and Limit revised w.e.f 01.06.2016

- TDS Statement Upload Online -Procedure

- TDS on Commission paid to agent for rendering services abroad

- No TDS on sum paid for services rendered outside india

- NO TDS on VSAT /lease line charges paid to NSE/BSE

- No tds on sale of agricultural land

- NO TDS on Service tax

- Not liable to Deduct TDS in case amendment with retrospective effect

- TDS can not be demanded from deductor if taxes paid by deductee : SC

- No TDS on leasehold rights payment for long period say 99 years

- Employer not liable to deduct TDS @ 20% for non furnishing of PAN by Employees

- No TDS on payment of transmission charges u/s 194J

- Payer not Liable to Deduct TDS if Payee income is exempt

- No TDS on Rent if declaration in 15G/15H w.e.f 01.06.2016

- No TDS on Service Tax Component of Rent

- No TDS on Provision of Interest u/s194A if provision reversed

- No TDs on interest on FDR made on direction of Courts :CBDT

- No TDS on Reimbursement Expenses if separate bills raised

- No TDS on Interest on FCCB issued to foreign investors and utilized for verseas business

- NO TDS liability under Section 195 if Book entry passed reversed Subsequently

- No TDS Under Secction 194LA as Land Acquired by Mutual negotiation and not compulsory acquisition

- No TDS under section 194LA if land owners surrendered their land to municipal corporation for under development right certificates scheme

- No TDS on Compensation paid to evacuate slum dwellers

- No TDS on purchase of negative rights of films

- Section 194I No TDS on Lease payment for allotment of plot for 80 years

- Purchase of software is not payment for royalty, not liable to TDS

- TDS on Purchase of Property : FAQ’s

- Assessee not to be called for TDS deducted but not Deposited by Deductor : CBDT

- Debenture Interest charged in Profit and Loss A/c but not paid would not attract TDS under Section 193

- Sum paid for internet connection not liable for TDS under section 194J

- Additional amount Paid to Purchaser on cancellation of Flat is not interest under section 2(28A) hence No TDS

- Period of default of TDS for Interest recovery is from date of deductibility till date of actual payment of tax

- CBDT clarify TDS issues on payments made by Television channels, Broadcasters and Newspapers

- TDS on Payment to Contractor : section 194C

- TDS Rates and Limit revised w.e.f 01.06.2016

- TDS on Payment to harvester / transporter of Sugarcane from Farmers field

- Payment to intermediaries for hiring of transport for carriage of goods is also liable for TDS u/s 194C

- Even in case of oral contract with transporters TDS is liable to be deducted u/s 194C

- Purchases made after payment of excise duty and availment of credit can not be held as job work, no TDS under section 194C

- TDS on Provision for Expenses

- Section 194C payments to newspaper publishers

- No TDS on Reimbursement Expenses if separate bills raised

- All About 26AS (TDS, Refund , AIR information )

- 40(a)(ia) TDS default based on opinion of CA was bona fide mistake , No Penalty

- section 40(a)(i) No TDS Disallowance if Expenses Capitalised

- section 40(a)(ia) Payer not liable for TDS default due to retrospective amendments

- 40(a)(ia) Disallowance for TDS default if books rejected by AO

- Apply for non deduction of TDS u/s 195 even if person was subjected to concealment penalty