Tips for Creating New GSTR1 (upload new invoices/other data for return)

Create and upload the Outward Supplies details in the GSTR 1 using the Returns Offline tool.

1. Before using the GSTR1 excel template for filling outward supply details, delete all sample data from all worksheets.

2. Before importing the excel file in the offline tool for a particular tax period, it is advisable that the user should delete any existing data of that tax period by clicking “Delete All Data” tab in the Offline Tool.

3. If the user imports again the previously imported data in tool, the tool will give the warning and there after previous data are replaced if the invoice number is same in latest imported values.

4. For multiple line items of different rate in single invoice, it is advisable to enter the invoice detail

with multi rate in consecutive row in excel.

5. To facilitate the declaration of date in the specified format “dd-mmm-yyyy”, ensure the system date format of your computer is “dd/mm/yyyy. If the format is different the offline tool will reject the invoices.

6. Avoid uploading duplicate invoice number of the same financial year already uploaded in an earlier filed return in a different sections, otherwise the GST portal will throw a duplicate error when the data is uploaded to the portal

7. Avoid entering wrong/ unregistered GSTIN else the GST portal will throw error “The GSTIN is invalid. Please enter a valid GSTIN” while uploading the json to the GST portal.

8. In case of credit/debit/refund voucher, original invoice number and date should be correct and declared in the same return or an earlier return, else the GST portal will throw error “Invalid Original Invoice Details. Original invoice cannot be tracked. Please enter correct invoice number and date”

9. Avoid entering duplicate HSN-UQC in the HSN Summary table

10. Please do not enter exempt supplies details and issued documents details in the excel workbook template. These details have to be entered directly on GST portal.

11. Do not change excel/csv headers and excel worksheet name or the csv file name packed with zip file

12. Review the summary as well as he details filled in offline tool to ensure their correctness before Generating Json and uploading to GST portal.

13. To Generate json file, click VIEW SUMMARY->GENERATE FILE->Save

14. To Upload Json, login to www.gst.gov.in. IN GSTR1 Tile, Click PREPARE OFFLINE -> Upload-> Choose File, Select the Json payload generated using offline tool to prepare GSTR1 in one go.

15. If one uploads the JSON file for a tax period with the same invoice number but differing details again, the later invoice details will overwrite the earlier details on portal.

Tips for Downloading Return file from GST Portal and modifying/deleting earlier uploaded details

The GSTR-1 return file can be downloaded from GST portal and viewed in the Offline tool to modify, add

or delete invoice details uploaded earlier by you on GST Portal

1. User can download the saved invoices/details from online portal

2. To generate file for download GSTR1 click PREPARE OFFLINE -> Download->GENERATE FILE, If

any previously downloaded request done it will show the download link to download file.

3. To generate latest GSTR1 file click again on GENERATE FILE button and it will take 20-30 minutes

to generate file.

4. To Download generate file, click on Click here to download link. Return file is downloaded in the

zip format.

5. In offline tool, OPEN button is for view/modify/delete/add invoices/details in Downloaded GSTR1

file

6. After opening the downloaded file in offline tool, user can modify the invoices/details in any

section.

7. To modify Click the EDIT ( Pencil Icon) button under Action column to edit the invoices and make

the required corrections in the invoices/details uploaded/added earlier by you in GST Portal

8. To modify the details or records at rate level, click on the’ +’ button and navigate to the rate level

records. Do the necessary corrections and click the UPDATE button.

9. A success message is displayed. The status is changed to Modified (M). Similarly, user can modify

the other invoice and other returns data from other sections.

10. To delete invoices, select the checkbox at left side for the invoice to be deleted. Click the DELETE

button.

11. To delete all invoices in one go, select the top left checkbox for all invoice to be deleted in the

particular section. Click the DELETE button.

12. After clicking DELETE button, a success message is displayed. The status is changed to Deleted (D).

Similarly, user can delete the other invoice and other returns data from other sections.

13. Note: DELETE functionality does not delete the invoices/details from offline. It changes the status

flag to “D”. Invoices get deleted online after uploading the json.

14. Once all the corrections are done generate json to upload on portal, click the VIEW SUMMARY –

> GENERATE FILE->save button.

15. To Upload Json, login to www.gst.gov.in. IN GSTR1 Tile, Click PREPARE OFFLINE -> Upload->

Choose File, Select the Json payload generated using offline tool to prepare GSTR1 in one go.

16. To Verify the addition/deletion/modification done on portal, re generate and download the

GSTR1 ( Step 2 to 5 )

Important Note: If user encountered with slowness in offline tool or with script error ( see figure

1) while opening GSTR, open the offline tool in Firefox or Google Chrome browser by typing

localhost:3010 into browser’s address bar and press enter.

Tips for Downloading Error file from GST Portal and making Corrections

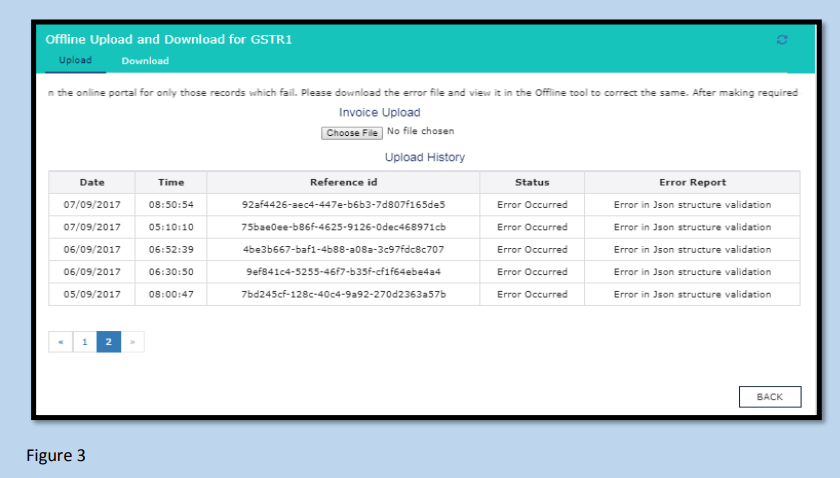

In case data uploaded through JSON on the portal (invoice data or other record) fails validation as

defined in the portal, an Error File will be created on the online portal for only those records which

failed.

1. If any json upload shows status “Processed with Error” it generate a link Generate error report

2. To generate error report click on Generate error report link which will usually take 20-30 minutes to generate error file and create a Download error report link. During this period the message displayed will be “Error report generation requested”.

3. To download the error report, click on Download error report link and save the file. Error file is

downloaded in the zip format.

4. To open and correct the error file in offline tool, Click OPEN button in Open Downloaded Error file

from GST portal tab

5. The error message is displayed against each Invoice number. Read each error message carefully

and then click the EDIT (Pencil icon) button under Action column to edit the invoices and make

the required corrections in the invoices/details.

6. After you have modified the invoices, click the SAVE button.

7. Note: User can click the Delete button to delete the invoice.

8. To modify the details or records at rate level, click on the’ +’ button and navigate to the rate level

records. Do the necessary corrections and click the UPDATE button.

9. A success message is displayed. The status of the error message is changed to Modified (M).

10. Similarly, user can modify the other invoice data from other sections.

11. Once all the corrections are done generate Json to upload on portal, click the VIEW SUMMARY –

> GENERATE FILE->save button.

12. To Upload Json, login to www.gst.gov.in. IN GSTR1 Tile, Click PREPARE OFFLINE -> Upload->

Choose File, Select the Json payload generated using offline tool to prepare GSTR1 in one go.

13. To verify the changes done correctly, Click PREPARE ONLINE in GSTR1 tab and click on particular

section to see the changes.

14. If the particular has more than 500 invoices, User can verify from the summaries displayed in the

different section tiles. To view the details he/she has to download GSTR1 and view in offline tool.

15. Note: Following field in various section cannot be modified/corrected. User has to delete and

create new entry for the same.

• B2B, CDNR – Receiver GSTIN/UIN

• B2CL – Invoice No.

• EXP – Export Type and Invoice No.

• AT, ATADJ – POS

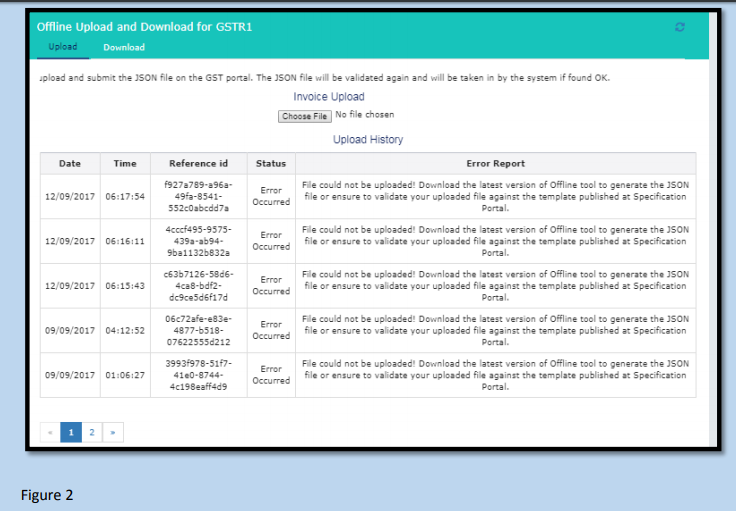

Checklist to avoid json error (for figure 2,3 below ) especially point 4 & 8 (below):

1. GSTIN should be valid and 15 alphanumeric characters,

2. Invoice length should not be more than 16 characters and only characters allowed are numeric,

alphabets , / and –

3. In b2cl, invoice value should be more than 250000,

4. Invoice Date, Note date, and shipping bill Date format should be dd-mmm-yyyy in excel/csv (

For eg: 04-Jul-2017)

5. In case of CDNR (Credit/Debit Note Registered)/CDNUR (Credit/Debit Note unregistered), Invoices and Note number are only allowed with the numeric, alphabets, / and – No other character is allowed.

6. In case of export, if shipping bill is mentioned then shipping date is mandatory.

7. Shipping bill date should be on or after the invoice date.

8. Only 2 decimal digit (eg: 1234.89) is allowed in values entered in excel/csv.

Directorate of Commercial Taxes, West Bengal

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |