Notification No. 2/2017 – Union Territory Tax Dtd 27th June, 2017

Seeks to notify the turnover limit for Composition Levy for UTGST vide Notification No. 2/2017 – Union Territory Tax Dtd 27th June, 2017

[ Seeks to amend above notification No. 2/2017-Union Territory Tax vide Notification No 16/2017 Union Territory Tax Dated 13th October, 2017

Union Territory Tax seeks to further amend notification No. 2/2017 – Union Territory Tax so as to prescribe effective rate of tax under composition scheme for manufacturers and other suppliers vide Notification No 1/2018 Union Territory Tax Dated 1st January, 2018 ]

]PUBLISHED IN PART II, SECTION 3, SUB-SECTION (i) OF THE GAZETTE OF INDIA, EXTRAORDINARY

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(Department of Revenue)

Notification No. 2/2017-Union Territory Tax

New Delhi, the 27th June, 2017

G.S.R. 648(E).- In exercise of the powers conferred by sub-section (1) and sub-section (2) of section 10 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereinafter referred to as the said Act) read with section 21 of the Union Territory Goods and Services Tax Act, 2017 (14 of 2017), the Central Government, on the recommendations of the Council, hereby prescribes that an eligible registered person, whose aggregate turnover in the preceding financial year did not exceed seventy five lakh rupees, may opt to pay, in lieu of the tax payable by him, an amount calculated at the rate of,––

(i) one per cent. of the turnover in Union territory in case of a manufacturer,

(ii) two and a half per cent. of the turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II of the said Act, and

(iii) half per cent. of the turnover in Union territory in case of other suppliers:

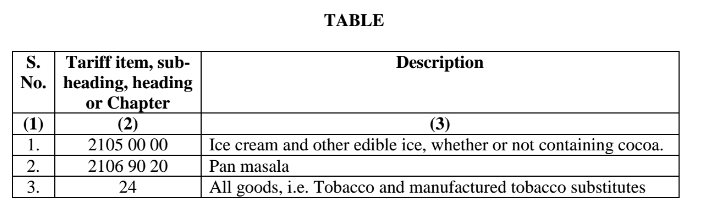

Provided that a registered person shall not be eligible to opt for composition levy under sub-section (1) of section 10 of the said Act read with section 21 of the Union Territory Goods and Services Tax Act, 2017 if such person is a manufacturer of the goods, the description of which is specified in column (3) of the Table below and falling under the tariff item, sub-heading, heading or Chapter, as the case may be, as specified in the corresponding entry in column (2) of the said Table:-

Explanation. –

(1) In this Table, “tariff item”, “sub-heading”, “heading” and “chapter” shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

(2) The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

[F.No.354/117/2017-TRU]

(Mohit Tewari)

Under Secretary to the Government of India

Download PDF Notification No. 2/2017 – Union Territory Tax Dtd 27th June, 2017 in Hindi and English

( Refer page 4 and 5 of enclosed PDF )

Related Topic on GST

| Topic | Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | Central Tax Circulars / Orders |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |