Two different dates for Tax Invoice and Eway bill allowed ?

Video Tutorial by CA Satbir Singh on whether Two different dates for Tax Invoice and Eway bill Allowed

[ Join online GST Course by CA Satbir Singh ]

If Tax Invoice is prepared today but goods are cleared from factory after 13 days,

1) The date of e-way bill will be Tax Invoice date or date of clearance from factory

2) if date of clearance from factory is mentioned on Eway bill then is it allowed to have two different dates?

3) Is there any maximum time limit within which e-way bill must be generated from the date of tax invoice?

Comment :

1.you can have different dates for Tax Invoice and Eway bill because Tax Invoice and Eway bill can be generated before commencement of movement of goods . There is no requirement that these have to be generated at the time commencement of movement of goods .

2. You should mention the date of clearance from factory on Eway bill so that Validity period of Eway Bill does not expire. Otherwise you will not get sufficient time for transporting goods.

3.There is no maximum time limit specified in CGST Act , within which e-way bill must be generated from the date of tax invoice but you may have to justify why you did not despatch goods for such a along period.

Relevant portion of Section 31 of CGST Act 2017 : Tax invoice .

31. (1) A registered person supplying taxable goods shall, before or at the time of,—

| (a) | removal of goods for supply to the recipient, where the supply involves movement of goods; or | |

| (b) | delivery of goods or making available thereof to the recipient, in any other case, issue a tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as may be prescribed: |

Provided that the Government may, on the recommendations of the Council, by notification, specify the categories of goods or supplies in respect of which a tax invoice shall be issued, within such time and in such manner as may be prescribed.

Relevant portion of Rule 138 of CGST Rules 2017

[Information to be furnished prior to commencement of movement of goods and generation of e-way bill.

138. (1) Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees—

| (i) | in relation to a supply; or | |

| (ii) | for reasons other than supply; or | |

| (iii) | due to inward supply from an unregistered person, |

shall, before commencement of such movement, furnish information relating to the said goods as specified in Part A of FORM GST EWB-01, electronically, on the common portal along with such other information as may be required on the common portal and a unique number will be generated on the said portal:

Relevant portion of Rule 138 (10) of CGST Rules 2017 Validity period of Eway bill

An e-way bill or a consolidated e-way bill generated under this rule shall be valid for the period as mentioned in column (3) of the Table below from the relevant date, for the distance, within the country, the goods have to be transported, as mentioned in column (2) of the said Table:-

| Sl. No. | Distance | Validity period |

| (1) | (2) | (3) |

| 1. | Upto 100 km. | One day in cases other than Over Dimensional Cargo |

| 2. | For every 100 km. or part thereof thereafter | One additional day in cases other than Over Dimensional Cargo |

| 3. | Upto 20 km. | One day in case of Over Dimensional Cargo |

| 4. | For every 20 km. or part thereof thereafter | One additional day in case of Over Dimensional Cargo: |

……..

Explanation 1.—For the purposes of this rule, the “relevant date” shall mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as the period expiring at midnight of the day immediately following the date of generation of e-way bill.

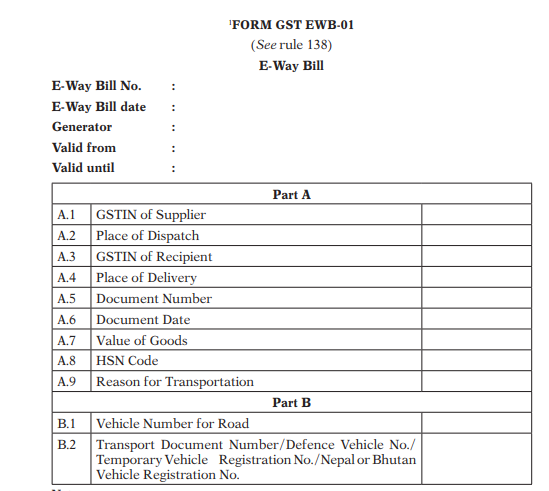

Format of Eway bill

. Substituted by the Central Goods and Services Tax (Second Amendment) Rules, 2018, w.e.f.

1-4-2018. Earlier, Form GST EWB-01, was amended by the Central Goods and Services Tax

(Amendment) Rules, 2018, Central Goods and Services Tax (Sixth Amendment) Rules, 2017

and Central Goods and Services Tax (Seventh Amendment) Rules, 2017.

Notes:

1. HSN Code in column A.8 shall be indicated at minimum two digit level for taxpayers

having annual turnover upto five crore rupees in the preceding financial year and

at four digit level for taxpayers having annual turnover above five crore rupees in

the preceding financial year.

2. Document Number may be of Tax Invoice, Bill of Supply, Delivery Challan or Bill of Entry.

3. Transport Document number indicates Goods Receipt Number or Railway Receipt

Number or Forwarding Note number or Parcel way bill number issued by railways

or Airway Bill Number or Bill of Lading Number.

4. Place of Delivery shall indicate the PIN Code of place of delivery

5. Place of dispatch shall indicate the PIN Code of place of dispatch.

6. Where the supplier or the recipient is not registered, then the letters “URP” are to be

filled-in in column A.l or, as the case may be, A.3.

7. Reason for Transportation shall be chosen from one of the following:—

Code Description

1 Supply

2 Export or Import

3 Job Work

4 SKD or CKD

5 Recipient not known

6 Line Sales

7 Sales Return

8 Exhibition or fairs

9 For own use

10 Others

Eway Bill : Free Video Lectures and Study Material

Hope this Article will help you on following topics

e way bill generate time limit after invoice date ,

can we make e way bill after invoice date ,

time gap between invoice date and e way bill ,

can we generate e way bill after invoice date,

can e way bill be generated after invoice date,

invoice date and eway bill date,

invoice date and e way bill date should be same,

can invoice date and e way bill date be different,

can e way bill be generated in back date,

is e way bill date and invoice date should be same,