[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART-II, SECTION-3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

(CENTRAL BOARD OF EXCISE AND CUSTOMS)

New Delhi, the 14th May, 2016

Notification No. 67/2016- Customs (N.T.)

G.S.R. (E) In exercise of the powers conferred by section 157 read with section 60, section 67 and section 69 of the Customs Act, 1962 (52 of 1962), and in supersession of the Warehoused Goods (Removal) Regulations 1963, except as respects things done or omitted to be done before such supersession, the Central Board of Excise and Customs hereby makes the following regulations, namely:-

1. Short title and commencement. – (1) These regulations may be called the Warehoused Goods (Removal) Regulations, 2016.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. Definitions. – In these regulations, unless the context otherwise requires, –

(a) “Act” means the Customs Act, 1962 (52 of 1962);

(b) “bond officer” means an officer of customs in charge of a warehouse;

(c) “Form” means the form appended to these regulations;

(d) “section” means section of the Act;

(e) “warehouse” means a public warehouse licensed under section 57 or a private warehouse licensed under section 58 or a special warehouse licensed under section 58A.

(2) The words and expressions used herein and not defined in these regulations but defined in the Act shall have the same meanings respectively as assigned to them in the Act.

3. Form for transfer of goods from a warehouse.-Where the warehoused goods are to be removed from one warehouse to another warehouse or from a warehouse to a customs station for export, the owner of the goods shall make such request by filing the Form appended to these regulations.

4. Conditions for transport of goods. -Where the goods to be warehoused are removed, from the customs station of import to a warehouse or from one warehouse to another warehouse or from the warehouse to a customs station for export, the transport of the warehoused goods shall be under one-time-lock, affixed by the proper officer or the licensee or the bond officer, as the case may be:

Provided that the Principal Commissioner of Customs or Commissioner of Customs, as the case may be, may having regard to the nature of goods or manner of transport, permit transport of warehoused goods without affixing the one-time-lock.

5. Conditions for due arrival of goods. – The owner of the goods shall produce to the bond officer or proper officer under sub-section (1) of section 60, as the case may be, within one month or within such extended period as such officer may allow, an acknowledgement issued by the licensee or the bond officer of the warehouse to which the goods have been removed or the proper officer at the customs station of export, as the case may be, stating that the goods have arrived at that place, failing which the owner of such goods shall pay the full amount of duty chargeable on account of such goods together with interest, fine and penalties payable under subsection (1) of section 72.

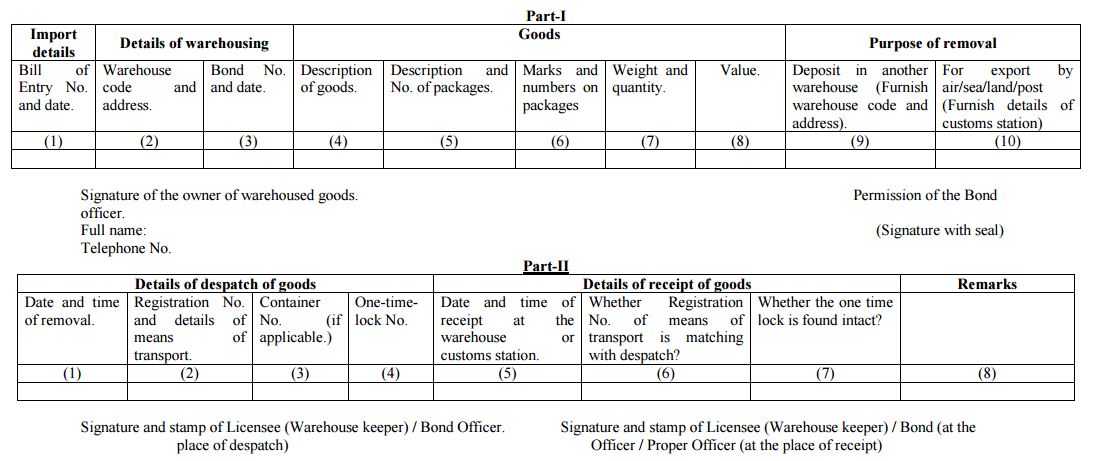

FORM

(see regulation 3 of Warehoused Goods (Removal) Regulations, 2016)

Form for transfer of goods from a warehouse (in terms of section 67 or section 69 of the Customs Act, 1962)

[F.N.484/03/2015-LC (Vol.II. Pt- I.)]

(Temsunaro Jamir)

Under Secretary to the Government of India

Related Post